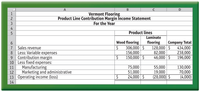

Top managers of Vermont Flooring are alarmed by their operating losses. They are considering dropping the laminate flooring product line. Company accountants have prepared the following analysis to help make this decision in the chart below:

Total fixed costs will not change if the company stops selling laminate flooring.

Requirements

1. Prepare an incremental analysis to show whether Vermont Flooring should discontinue the laminate flooring product line. Will discontinuing laminate flooring add $28,000 to operating income? Explain.

2. Assume that the company can avoid $32,000 of fixed expenses by discontinuing the laminate flooring product line (these costs are direct fixed costs of the laminate flooring product line). Prepare an incremental analysis to show whether the company should stop selling laminate flooring.

3. Now, assume that all of the fixed costs assigned to laminate flooring are direct fixed costs and can be avoided if the company stops selling laminate flooring. However, marketing has concluded that wood flooring sales would be adversely affected by discontinuing the laminate flooring line (retailers want to buy both from the same supplier). Wood flooring production and sales would decline 10%. What should the company do?

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- Rainbow Paints is discontinuing a line of paint that it purchased at $56 less 30% and 10% per 4-L pail. The store's overhead is 50% of cost, and normal operating profit is 25% of cost. If the manager of the store is prepared to accept a loss of one-quarter of the overhead expenses, what markdown rate can the store offer in order to clear out the paint? (Do not round intermediate calculations and round your final answer to 1 decimal place.) Rate of markdown %arrow_forwardJuice WORLD Company makes and sells gourmet juices and is looking to purchase a new, more efficient fruit peeler system. Which of the following would not be relevant in making the decision? The per-year power cost of the new system The installation cost of the new system The per year power cost of the current system The original price of the current system O The capacity of the current freezer systemarrow_forwardMohave Corp. is considering eliminating a product from its Sand Trap line of beach umbrellas. This collection is aimed at people who spend time on the beach or have an outdoor patio near the beach. Two products, the Indigo and Verde umbrellas, have impressive sales. However, sales for the Azul model have been dismal. Mohave’s information related to the Sand Trap line is shown below. Segmented Income Statement for Mohave’s Sand Trap Beach Umbrella Products Indigo Verde Azul Total Sales revenue $ 60,000 $ 60,000 $ 30,000 $ 150,000 Variable costs 34,000 31,000 26,000 91,000 Contribution margin $ 26,000 $ 29,000 $ 4,000 $ 59,000 Less: Direct fixed costs 1,900 2,500 2,000 6,400 Segment margin $ 24,100 $ 26,500 $ 2,000 $ 52,600 Common fixed costs* 17,840 17,840 8,920 44,600 Net operating income (loss) $ 6,260 $ 8,660 $ (6,920 ) $ 8,000 *Allocated based on total…arrow_forward

- Meditation Haven has three product lines. Its only unprofitable line is yoga blocks. The results of the yoga blocks line for 2020 is below:Sales 350000 Variable expenses 230000 Fixed expenses 180000 Net loss (60000) If this product line is eliminated, 70% of the fixed expenses can be eliminated. Using incremental analysis, would you recommend the company drop the yoga block line and why?arrow_forwardExercise E Analysis of Hair Care Company's citrus hair conditioner reveals that it is losing $5,000 annually. The company sells 5,000 units of citrus hair conditioner each year at $10 per unit. Variable costs are $6 per unit. None of the company's fixed costs would be saved if the citrus hair conditioner were eliminated. What would be the increase or decrease in company net income if citrus hair condition were eliminated?arrow_forwardMallory’s Video Supply has changed its focus tremendously and as a result has dropped the selling price of DVD players from $45 to $38. Some units in the work-in-process inventory have costs of $30 per unit associated with them, but Mallory can only sell these units in their current state for $22 each. Otherwise, it will cost Mallory $11 per unit to rework these units so that they can be sold for $38 each. How much is the financial impact if the units are processed further? a. $5 per unit profit b. $3 per unit loss c. $16 per unit profit d. $12 per unit lossarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education