Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

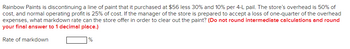

Transcribed Image Text:Rainbow Paints is discontinuing a line of paint that it purchased at $56 less 30% and 10% per 4-L pail. The store's overhead is 50% of

cost, and normal operating profit is 25% of cost. If the manager of the store is prepared to accept a loss of one-quarter of the overhead

expenses, what markdown rate can the store offer in order to clear out the paint? (Do not round intermediate calculations and round

your final answer to 1 decimal place.)

Rate of markdown

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- NUBD Co. currently sells 1,000 units of product M for P2 each. Variable costs are P1.50. A discount store has offered P1.70 per unit for 400 units of product M. The managers believe that if they accept the special order, they will lose some sales at the regular price. Determine the number of units they could lose before the order become unprofitablearrow_forwardEaton Tool Company has fixed costs of $435,600, sells its units for $94, and has variable costs of $50 per unit. a. Compute the break-even point. Break-even point b. Ms. Eaton comes up with a new plan to cut fixed costs to $340,000. However, more labor will now be required, which will increas variable costs per unit to $53. The sales price will remain at $94. What is the new break-even point? Note: Round your answer to the nearest whole number. New break-even point units Profitability will be less Profitability will be more units c. Under the new plan, what is likely to happen to profitability at very high volume levels (compared to the old plan)?arrow_forwardRolf's Golf store sells golf balls for 27 per dozen. The store's overhead expenses are 28% of cost and the owners require a profit of 22% of cost. a. How much does Rolf's Golf store buy the golf balls for? b. What is the price needed to cover all the costs and expenses? c. What is the highest rate of markdown at which the store will still break even?arrow_forward

- Ross has received a special order for 16,000 units of its product at a special price of $23. The product normally sells for $31 and has the following manufacturing costs: Per unit Direct materials $ 7 Direct labor 6 Variable manufacturing overhead 3 Fixed manufacturing overhead 10 Unit cost $ 26 Assume that Ross has sufficient capacity to fill the order. If Ross accepts the order, what effect will the order have on the company’s short-term profit? Multiple Choice $48,000 decrease $112,000 increase $80,000 decrease $240,000 increasearrow_forwardFutura Company purchases 75,000 starters from a supplier at $11.10 per unit that it installs in farm tractors. Due to a reduction in output, the company now has enough idle capacity to produce the starters rather than buying them from the supplier. However, the company's chief engineer is opposed to making the starters because the production cost per unit is $12.20, as shown below: Direct materials Direct labor Supervision Depreciation Variable manufacturing overhead Rent Total product cost Per Unit $ 5.00 3.00 1.80 1.46 2.66 2.40 $ 12. 26 Total $ 135,000 $ 185,000 $ 30,000 If Futura decides to make the starters, a supervisor would be hired (at a salary of $135,000) to oversee production. However, the company has sufficient idle tools and machinery such that no new equipment would have to be purchased. The rent charge above is based on space utilized in the plant. The total rent on the plant is $83.000 per period. Required: What is the financial advantage (disadvantage) of making the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education