FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

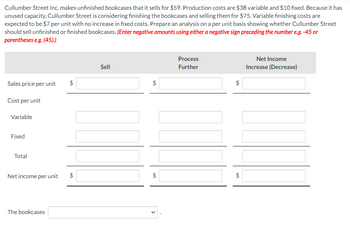

Transcribed Image Text:Cullumber Street Inc. makes unfinished bookcases that it sells for $59. Production costs are $38 variable and $10 fixed. Because it has

unused capacity, Cullumber Street is considering finishing the bookcases and selling them for $75. Variable finishing costs are

expected to be $7 per unit with no increase in fixed costs. Prepare an analysis on a per unit basis showing whether Cullumber Street

should sell unfinished or finished bookcases. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or

parentheses e.g. (45).)

Sales price per unit

Cost per unit

Variable

Fixed

Total

Net income per unit

The bookcases

+A

Sell

+A

$

$

$

Process

Further

+A

$

Net Income

Increase (Decrease)

+A

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Cullumber Street Inc. makes unfinished bookcases that it sells for $59. Production costs are $38 variable and $10 fixed. Because it has unused capacity, Cullumber Street is considering finishing the bookcases and selling them for $71. Variable finishing costs are expected to be $6 per unit with no increase in fixed costs. Prepare an analysis on a per unit basis showing whether Cullumber Street should sell unfinished or finished bookcases. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45).) Sales price per unit $ Cost per unit Variable Fixed Total Sell Process Further $ $ Net Income Increase (Decrease) Net income per unit SUPPORT $ $ $arrow_forwardInitially, the contribution margin for a good is 74.94. If fixed costs are $1191 and an anticipated 588 units are being sold, how much can the price of the good drop before this business should shut down in the short run (assuming costs stay the same)? Answer:arrow_forwardRoboGarden sells a robot lawn aerator. At the current price, RoboGarden's contribution margin is $129.84 per unit. Because of a shortage of silicon chips, RoboGarden expects variable cost to increase by $10.17. In response, RoboGarden is thinking about raising its selling price by $36.36. Calculate the percent profit breakeven metric for this situation. Report the correct sign for the result. Report your answer as a percent. Report -25.5%, for example, as "-25.5". Rounding: tenth of a percent.arrow_forward

- Sammy Co. currently sells 1,000 units of product M for P2 each. Variable costs are P1.50. A discount store has offered P1.70 per unit for 400 units of product M. The managers believe that if they accept the special order, they will lose some sales at the regular price. Determine the number of units they could lose before the order become unprofitablearrow_forwardI need help with requirement 2 please.arrow_forwardGarrow_forward

- Sweet Acacia Inc. makes unfinished bookcases that it sells for $58. Production costs are $38 variable and $9 fixed. Because it has unused capacity, Sweet Acacia is considering finishing the bookcases and selling them for $72. Variable finishing costs are expected to be $7 per unit with no increase in fixed costs. Prepare an analysis on a per-unit basis that shows whether Sweet Acacia should sell unfinished or finished bookcases. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Sales per unit Variable cost per unit Fixed cost per unit Total per unit cost Net income per unit The bookcases 69 $ Sell ✓processed further. LA GA Process Further $ $ Net Income Increase (Decrease)arrow_forwardCarmen Co. can further process Product J to produce Product D. Product J is currently selling for $20.60 per pound and costs $15.40 per pound to produce. Product D would sell for $36.90 per pound and would require an additional cost of $10.10 per pound to produce. What is the differential cost of producing Product D?arrow_forwardMarigold Corp. is unsure of whether to sell its product assembled or unassembled. The unit cost of the unassembled product is $27 and Marigold would sell it for $60. The cost to assemble the product is estimated at $13 per unit and the company believes the market would support a price of $64 on the assembled unit. What decision should Marigold make and why? Sell before assembly because the company will be better off by $9 per unit. Sell before assembly because the company will be better off by $4 per unit. Process further because the company will be better off by $18 per unit. Process further because the company will be better off by $20 per unit.arrow_forward

- Please help me to solve this problemarrow_forwardEaton Tool Company has fixed costs of $435,600, sells its units for $94, and has variable costs of $50 per unit. a. Compute the break-even point. Break-even point b. Ms. Eaton comes up with a new plan to cut fixed costs to $340,000. However, more labor will now be required, which will increas variable costs per unit to $53. The sales price will remain at $94. What is the new break-even point? Note: Round your answer to the nearest whole number. New break-even point units Profitability will be less Profitability will be more units c. Under the new plan, what is likely to happen to profitability at very high volume levels (compared to the old plan)?arrow_forwardSnow Company pays a production company to produce phones for them at a cost of $200 each. Variable costs total $120 per phone, and fixed expenses are $1,998,000. Snow Company currently sells the phones for $500. 1. Snow Company found a new company to produce phones at a lower cost of $185. Calculate breakeven point in units. 2. Predicted demand for its phones is 12,000 units. What is the lowest price that can be charged in order to earn a $198,000 profit? 3. Snow Company can sell 14,000 units, but has to increase advertising costs in order to stimulate the extra demand. Snow Company still wants to earn a $198,000 profit, by how much can Snow Co. increase advertising costs to help achieve its goal?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education