FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

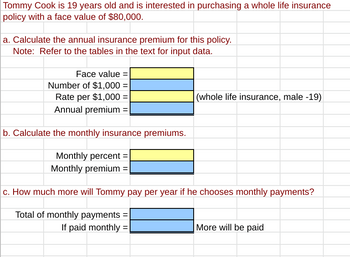

Transcribed Image Text:Tommy Cook is 19 years old and is interested in purchasing a whole life insurance

policy with a face value of $80,000.

a. Calculate the annual insurance premium for this policy.

Note: Refer to the tables in the text for input data.

Face value=

Number of $1,000 =

Rate per $1,000 =

(whole life insurance, male -19)

Annual premium =

b. Calculate the monthly insurance premiums.

Monthly percent

Monthly premium =

c. How much more will Tommy pay per year if he chooses monthly payments?

Total of monthly payments =

If paid monthly =

More will be paid

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- To prepare for retirement, you are going to deposit money into a pension plan account every month for the next 25 years. The pension plan has a 6.96% annual rate that compounds monthly. How much money will be in the account after 25 years if for the next 25 years you deposit $465.86 into the pension plan every month? First find the interest rate per period to four decimal places: i = Next find the total number of deposits: n = Finally, find the total amount of money in the account after 25 years: FV =arrow_forwardUsing Table 19-1 and Table 19-2, calculate the annual, semiannual, quarterly, and monthly premiums (in $) for the life insurance policy. Round your answers to the nearest cent. Face Valueof Policy Sex and Ageof Insured Type of Policy AnnualPremium SemiannualPremium QuarterlyPremium MonthlyPremium $70,000 male—40 whole life $ $ $ $arrow_forwardAssume that you have calculated: (a) premiums for life insurance policies and (b) payments to annuitants based upon an assumption that everybody dies before attaining age 101. Now you discover that a significant number of your policy owners are likely to live beyond age 101 and some will live to age 121. How will that affect your business?arrow_forward

- At age 24, someone sets up an IRA (individual retirement account) with an APR of 4%. At the end of each month he deposits $100 in the account. How much will the IRA contain when he retires at age 65? Compare that amount to the total deposits made over the time period. After retirement the IRA will contain $ ??arrow_forwardUsing the "Human Life Value" method, how much life insurance should you purchase if you have 45 years until retirement, an annual income of $65,100 received at the start of each years, and a time value of money of 9%? (Assume 80% income replacement, ignore taxes and inflation.)arrow_forwardNorm and Tanya earn about the same salary and are undertaking a life insurance needs analysis for one of them passing away. If the nominal projected investment return is an average of 8% per annum, inflation is projected at 3% per annum, then find the amount of additional insurance they should purchase, given the following data: Number of years insurance money should last 30 Net Worth $33,257 CPP Survivor Benefit $400 per month Salary $45,000 Lifestyle Expenses (after mortgage) will continue at full amount $5,000 per month Additional funds for emergency, vacation & taxes $35,000 Funeral expenses $20,000 Current group insurance coverage from employer 1 x Salary Enter your answer rounded to 2 decimal places, and do not enter any symbols such as $, % or commas.arrow_forward

- Calculate the annual premium for a 20 year old male seeking 5 year term insurance valued at $120,000.arrow_forwardYou are the wage earner in a "typical family," with $60,000 gross annual income. Use the easy method to determine how much life insurance you should carry. O 60,000 O 120,000 294,000 420,000arrow_forwardYou begin working at age 25, and your employer deposits $310 each month into a retirement account that pays an APR of 6% compounded monthly. Make a table that shows the size of your nest egg in terms of the age at which you retire for the retirement ages of 60, 65 and 70. (Round your answers to the nearest cent.) Age Nest egg 60 $ 65 $ 70 $arrow_forward

- The summarized balance sheets of Pharoah Company and Sheridan Company as of December 31, 2025 are as follows: Assets Liabilities Capital stock Retained earnings Total equities Assets Liabilities Capital stock Retained earnings Total equities Pharoah Company Balance Sheet December 31, 2025 O $444000. O $297000. O $345000. O $350000. Sheridan Company Balance Sheet December 31, 2025 $2000000 $220000 1000000 780000 $2000000 $1480000 $330000 990000 160000 $1480000 If Pharoah Company acquired a 30% interest in Sheridan Company on December 31, 2025 for $350000 and the equity method of accounting for the investment was used, the amount of the debit to Equity Investments (Sheridan) to record the purchase would have beenarrow_forwardYou are the wage earner in a "typical family," with $28,000 gross annual income. Use the easy method to determine how much life insurance you should carry. (Do not round intermediate calculations.) Life insurance needarrow_forwardNikularrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education