Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

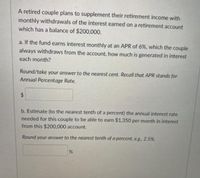

Transcribed Image Text:A retired couple plans to supplement their retirement income with

monthly withdrawals of the interest earned on a retirement account

which has a balance of $200,000.

a. If the fund earns interest monthly at an APR of 6%, which the couple

always withdraws from the account, how much is generated in interest

each month?

Round/take your answer to the nearest cent. Recall that APR stands for

Annual Percentage Rate.

24

b. Estimate (to the nearest tenth of a percent) the annual interest rate

needed for this couple to be able to earn $1,350 per month in interest

from this $200,000 account.

Round your answer to the nearest tenth of a percent, eg., 2.5%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What should be the balance in a Registered Retirement Income Fund (RRIF) that will provide $2,500 at the beginning of each month for 6 years, if the RRIF earns 3.50% compounded quarterly? $0.00 Round to the nearest centarrow_forwardHow is this wrongarrow_forwardA retired couple plans to supplement their Social Security with interest earned by a $210,000 retirement fund. a. If the fund compounds interest monthly at an APR of 4.9%, which the couple takes out at the end of the year for spending in the next year, how much average interest is generated each month? b. Suppose the APR drops to 2.3%. What is the resulting average interest payment each month? c. Estimate the APR needed to generate $1100 each month in average interest. ret le ith?arrow_forward

- What should be the balance in a Registered Retirement Income Fund (RRIF) that will provide $3,000 at the beginning of each half-year for 4 years, if the RRIF earns 5.25% compounded monthly?arrow_forwardThe value of a retirement savings account with an annual contribution of $600 (contributions made at the end of each year, including the last year), and an APR of 5.4% after 40 years is $79,960.27. Find the value of this retirement savings account after 52 years. Round your answer to the nearest cent. OA. $151,304.82 OB. $165,660.72 OC. $160,075.29 OD. $154,695.52 OE. $169,319.35arrow_forwardThomas's retirement fund has an accumulated amount of $55,000. If it has been earning interest at 2.44% compounded monthly for the past 25 years, calculate the size of the equal payments that she deposited at the beginning of every 3 months. $0.00 Round to the nearest cent SUBMIT QUESTION SAVE PROGRESS K 00 40arrow_forward

- On January 1, 2018, you deposited $5,500 in a savings account. The account will earn 8 percent annual compound interest, which will be added to the fund balance at the end of each year. Required: 1. What will be the balance in the savings account at the end of 7 years? 2. What is the total interest for the 7 years? 3. How much interest revenue did the fund earn in 2018 and in 2019? Show Transcribed Textarrow_forwardYou decide to make monthly payments into a retirement fund earning 4.75% compounded monthly. Note: Payments are made at the end of each period. Use this information for the questions below. Use the Saving for Retirement information above to answer this question. If your monthly payments are $147, how much will you have in your retirement fund after 40 years? $_________. Round to the nearest dollar.arrow_forwardMany persons prepare for retirement by making monthly contributions to a savings program. Suppose that $2,500 is set aside each year and invested in a savings account that pays 8% interest per year, compounded continuously. a. Determine the accumulated savings in this account at the end of 29 years. b. In Part (a), suppose that an annuity will be withdrawn from savings that have been accumulated at the EOY 29. The annuity will extend from the EOY 30 to the EOY 36. What is the value of this annuity if the interest rate and compounding frequency in Part (a) do not change? Click the icon to view the interest and annuity table for continuous compounding when i=8% per year. a. The accumulated savings amount at the end of 29 years will be $275384. (Round to the nearest dollar.) b. The value of the annuity will be $41655. (Round to the nearest dollar.)arrow_forward

- You estimate you need to supplement your social security payments with monthly withdrawals of $1,400.00 per month from a private investment account during the first 23 years of your retirement. Assuming you can earn annual returns of 5.2% in your investment account during your retirement years, how much money do you need to have accumulated in your investment account by the day you retire in order to fund the aforementioned monthly withdrawals?arrow_forwardNOTE: Provide a format and show your work (example: N = 6, PV = XXX, I = X%, etc.) 1. Sam decides to start saving for retirement and she starts making $165 monthly contributions today and continue them for four years. What will Sam have at the end of the period if the compounding rate is 11.00 percent APR? (Do not round intermediate calculations and round your final answer to 2 decimal places.) 2.What annual rate of return is earned on a $5,000 investment made in year 4 when it grows to $11,000 by the end of year 10? (Hint. Construct a timeline. Do not round intermediate calculations and round your final answer to 2 decimal places.) 3. Given an 8 percent interest rate, compute the present value of payments made in years 0, 1, 2, 3, and 4 of $1,500, $1,600, $1,200, and $1,600, respectively. Compute using NPV.arrow_forward8. Jane Evans receives payments of $900 at the beginning of each month from a pension fund of $72 500. Interest earned by the fund is 6.3% compounded monthly. a. What is the number of payments Jane will receive? b. What is the size of the final payment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education