Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

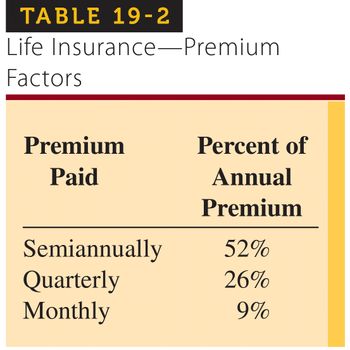

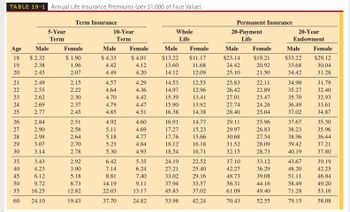

Using Table 19-1 and Table 19-2, calculate the annual, semiannual, quarterly, and monthly premiums (in $) for the life insurance policy. Round your answers to the nearest cent.

| Face Value of Policy |

Sex and Age of Insured |

Type of Policy | Annual Premium |

Semiannual Premium |

Quarterly Premium |

Monthly Premium |

|---|---|---|---|---|---|---|

| $70,000 | male—40 | whole life | $ | $ | $ | $ |

Transcribed Image Text:TABLE 19-2

Life Insurance-Premium

Factors

Premium

Paid

Semiannually

Quarterly

Monthly

Percent of

Annual

Premium

52%

26%

9%

Transcribed Image Text:TABLE 19-1 Annual Life Insurance Premiums (per $1,000 of Face Value)

Age

18 $2.32

19

2.38

20

2.43

TERE878

21

22

23

24

25

26

27

28

29

30

Male

2.49

2.55

2.62

2.69

2.77

2.84

2.90

2.98

3.07

3.14

5-Year

Term

35

3.43

40

4.23

45

6.12

50

9.72

55

16.25

60 24.10

Term Insurance

Female

$ 1.90

1.96

2.07

2.15

2.22

2.30

2.37

2.45

2.51

2.58

2.64

2.70

2.78

2.92

3.90

5.18

8.73

12.82

19.43

10-Year

Term

Male

$ 4.33

4.42

4.49

4.57

4.64

4.70

4.79

4.85

4.92

5.11

5.18

5.23

5.30

6.42

7.14

8.81

14.19

22.03

37.70

Female

$4.01

4.12

4.20

4.29

4.36

4.42

4.47

4.51

4.60

4.69

4.77

4.84

4.93

5.35

6.24

7.40

9.11

13.17

24.82

Whole

Life

Male

Female

$13.22 $11.17

13.60

11.68

14.12

12.09

14.53

14.97

15.39

15.90

16.38

16.91

17.27

17.76

18.12

18.54

24.19

27.21

33.02

37.94

45.83

53.98

12.53

12.96

13.41

13.92

14.38

14.77

15.23

15.66

16.18

16.71

22.52

25.40

29.16

33.57

37.02

42.24

Permanent Insurance

20-Payment

Life

Male

$23.14

24.42

25.10

25.83

26.42

27.01

27.74

28.40

29.11

29.97

30.68

31.52

32.15

37.10

42.27

48.73

56.31

61.09

70.43

Female

$19.21

20.92

21.50

22.11

22.89

23.47

24.26

25.04

25.96

26.83

27.54

28.09

28.73

33.12

36.29

39.08

44.16

49.40

52.55

20-Year

Endowment

Male

$33.22

33.68

34.42

34.90

35.27

35.70

36.49

37.02

37.67

38.23

38.96

39.42

40.19

43.67

48.20

51.11

58.49

71.28

79.15

Female

$29.12

30.04

31.28

31.79

32.40

32.93

33.61

34.87

35.30

35.96

36.44

37.21

37.80

39.19

42.25

46.04

49.20

53.16

58.08

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Find the installment price of a recliner bought on the installment plan with a down payment of $70 and six payments of S107.88. The installment price is $arrow_forwardbased on the table answer: Explain why the 30-year old in the first year of coverage has a lower mortality expectation than a 30-year old in the 6th year of coverage.arrow_forward9. Define out of pocket maximum. a. A flat-rate fee you must pay when receiving any kind of health care service. b. The maximum amount of money your insurance will cover of a certain health care service. c. The maximum amount you will have to pay out of pocket in one year for the benefits your insurance covers. d. The maximum amount of money the insured party will pay toward prescription medications.arrow_forward

- Subject- accountarrow_forwardExercise 17-25 (Algo) Postretirement benefits; determine APBO, service cost, interest cost; prepare journal entry [LO17-10, 17-11] The following data are available pertaining to Household Appliance Company's retiree health care plan for 2024: Number of employees covered Years employed as of January 1, 2024 Attribution period 2 2 [each] 25 years Expected postretirement benefit obligation, January 1 Expected postretirement benefit obligation, December 31 Interest rate Funding Required: 1. What is the accumulated postretirement benefit obligation at the beginning of 2024? $ 56,000 $ 58,800 5% nonearrow_forwardCalculate the housing expense ratio and the total obligation ratio (in %) for the following mortgage applications. (Round your answers to two decimal places.) Applicant MonthlyGrossIncome MonthlyPITIExpense Other MonthlyFinancialObligations HousingExpenseRatio (%) TotalObligationsRatio (%) Emerson $2,700 $633 $270 % %arrow_forward

- Find the installment price of a recliner bought on the installment plan with a down payment of $100 and six payments of $102.34.arrow_forwardUsing Table 19-1 and Table 19-2 find the following premiums for a 10-year term life insurance policy with a face value of $30,000 for a 28-year-old male. A. Annual premium B. Semiannual premium C. Quarterly premium D. Monthly premium Life Insurance—Premium FactorsPremium Paid Percent of Annual PremiumSemiannually 52%Quarterly 26%Monthly 9%arrow_forwardThe following data are available pertaining to Household Appliance Company's retiree health care plan for 2021: Number of employees covered 2 Years employed as of January 1, 2021 3 [each] Attribution period 20 years Expected postretirement benefit obligation, Jan. 1 $ 60,000 Expected postretirement benefit obligation, Dec. 31 $ 63,000 Interest rate 5 % Funding none Required:1. What is the accumulated postretirement benefit obligation at the beginning of 2021?2. What is interest cost to be included in 2021 postretirement benefit expense?3. What is service cost to be included in 2021 postretirement benefit expense?4. Prepare the journal entry to record the postretirement benefit expense for 2021.arrow_forward

- 7. A net premium of $41 payable for life will provide (x) with either $5,000 n-year term insurance followed by $1,000 whole life insurance after age x + n, or $3,000 n-year term insurance followed by $2,000 whole life insurance after age x + n. What is 1000 · Px ? A) 17.37 B) 17.47 C) 17.57 D) 17.67 E) 17.77arrow_forwardCalculate the housing expense ratio and the total obligation ratio (in %) for the following mortgage applications. (Round your answers to two decimal places.) Applicant Emerson Monthly Monthly Gross PITI Income Expense $2,700 $633 Other Monthly Financial Obligations $270 Housing Expense Ratio (%) % Total Obligations Ratio (%) %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education