Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

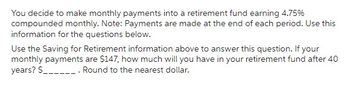

Transcribed Image Text:You decide to make monthly payments into a retirement fund earning 4.75%

compounded monthly. Note: Payments are made at the end of each period. Use this

information for the questions below.

Use the Saving for Retirement information above to answer this question. If your

monthly payments are $147, how much will you have in your retirement fund after 40

years? $_________. Round to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- How much will a registered retirement savings deposit of $23 700.00 be worth in 8 years at 6.54% compounded semiannually? How much of the amount is interest?arrow_forwardAssume that you contribute $300 per month to a retirement plan for 15 years. Then you are able to increase the contribution to $500 per month for the next 25 years. Given a 9.0 percent interest rate, what is the value of your retirement plan after the 40 years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Future value of multiple annuities $ 51,158 72arrow_forwardAssume that you contribute $280 per month to a retirement plan for 25 years. Then you are able to increase the contribution to $480 per month for the next 25 years. Given a 7.2 percent interest rate, what is the value of your retirement plan after the 50 years? Note: Do not round intermediate calculations and round your final answer to 2 decimal places.arrow_forward

- You plan to place $1,200 per year into a Roth IRA. You expect to earn 6% APR and you will place this amount into the account for 35 years. How much will you have in the account in 35 years? Round to the nearest $1,000.arrow_forwardYou would like to have enough money saved to receive a $90,000 per year perpetuity after retirement. The annual interest rate is 8 percent. Required: How much would you need to have saved in your retirement fund to achieve this goal? a) Assume that the perpetuity payments start on the day of your retirement. b) Assume that the perpetuity payments start one year from the date of your retirement.arrow_forwardAt age 30, to save for retirement, you decide to deposit $300 into an IRA at the end of each month at an interest rate of 6% per year compounded monthly. How much will you have from the IRA when you retire at age 65? Use this formula: Find how much of the total amount is from interest.arrow_forward

- You are planning to make monthly deposits of $500 into a retirement account that pays 7.7 percent interest compounded monthly. If your first deposit will be made one month from now, how large will your retirement account be in 30 years?arrow_forwardAt the age of 30, to save for retirement, you decide to deposit $70 at the end of each month in an IRA that pays 4% compounded monthly. a. Use the following formula to determine how much you will have in the IRA when you retire at age 65. P[(1+r)²-1] A = A: or (7) b. Find the interest. ID a. You will have approximately $ in the IRA when you retire. (Do not round until the final answer. Then round to the nearest dollar as needed.) b. The interest is approximately $ (Use the answer from part a to find this answer. Round to the nearest dollar as needed.)arrow_forwardIn 2012 the maximum Social Security deposit by an individual was $8,386.75. Suppose you are 27 and make a deposit of this amount into an account at the end of each year. How much would you have (to the nearest dollar) when you retire if the account pays 2% compounded annually and you retire at age 65?_____$arrow_forward

- Windswept, Inc.2017 Income Statement($ in millions) Net sales $ 11,000 Cost of goods sold 8,200 Depreciation 395 Earnings before interest and taxes $ 2,405 Interest paid 110 Taxable income $ 2,295 Taxes 689 Net income $ 1,606 Windswept, Inc.2016 and 2017 Balance Sheets($ in millions) 2016 2017 2016 2017 Cash $ 420 $ 445 Accounts payable $ 2,060 $ 2,005 Accounts rec. 1,210 1,110 Long-term debt 1,120 1,580 Inventory 1,980 1,820 Common stock 3,460 3,190 Total $ 3,610 $ 3,375 Retained earnings 700 950 Net fixed assets 3,730 4,350 Total assets $ 7,340 $ 7,725 Total liab. & equity $ 7,340 $ 7,725 What were the total dividends paid for 2017?arrow_forwardplease show all work and state answer clearlyarrow_forwardUse the excel and follow the step Like you did last question and please use excelarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education