Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

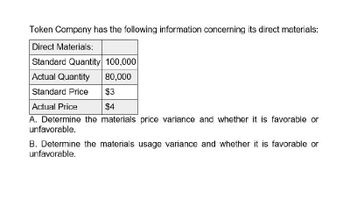

Tokan company has the following information concerning it's direct material need answer this question

Transcribed Image Text:Token Company has the following information concerning its direct materials:

Direct Materials:

Standard Quantity 100,000

Actual Quantity

80,000

Standard Price

$3

$4

Actual Price

A. Determine the materials price variance and whether it is favorable or

unfavorable.

B. Determine the materials usage variance and whether it is favorable or

unfavorable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Longman, Inc. is a manufacturer of lead crystal glasses. The standard direct materials quantity is 0.9 pound per glass at a cost of $0.50 per pound. The actual result for one month's production of 7,100 glasses was 1.4 pounds per glass, at a cost of $0.40 per pound. Calculate the direct materials cost variance and the direct materials efficiency variance. .....arrow_forwardPerfect Pet Collar Company makes custom leather pet collars. The company expects each collar to require 2.35 feet of leather and predicts leather will cost $4.20 per foot. Suppose Perfect Ret made 85 collars during February. For these 85 collars, the company actually averaged 2.50 feet of leather per collar and paid $3.80 per foot. Required: 1. Calculate the standard direct materials cost per unit. 2. Without performing any calculations, determine whether the direct materials price variance will be favorable or unfavorable. 3. Without performing any calculations, determine whether the direct materials quantity variance will be favorable or unfavorable. 6. Calculate the direct materials price and quantity variances. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Req 6 Calculate the standard direct materials cost per unit. Note: Round your answer to 2 decimal places. Standard Direct Materials per Collar Reg 2 and 3>arrow_forwardDeluxe, Inc. produced 1,000 units of the company's product in 2018. The standard quantity of direct materials was three yards of cloth per unit at a standard cost of $1.05 per yard. The accounting records showed that 2,600 yards of cloth were used and the company paid $1.10 per yard. Standard time was two direct labor hours per unit at a standard rate of $10.75 per direct labor hour. Employees worked 1,400 hours and were paid $10.25 per hour. Read the requirements. Requirement 1. What are the benefits of setting cost standards? Standard costing helps managers do the following: Requirement 2. Calculate the direct materials cost variance and the direct materials efficiency variance as well as the direct labor cost and efficiency variances. Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC actual cost; AQ = actual…arrow_forward

- H1. Answer b pleasearrow_forwardWhich of the following is the correct formula for the direct materials quantity variance? O a. (Actual Quantity - Actual Price) - (Standard Quantity Standard Price) O b. (Actual Quantity- Standard Quantity) * Actual Price O c. (Actual Price - Standard Price) × Actual Quantity O d. (Actual Quantity - Standard Quantity) x Standard Pricearrow_forwardPlease Do not Give image formatarrow_forward

- Please do not give solution in image format thankuarrow_forward1. The price variance for materials is the difference between the actual quantity of materials at the standard price and the standard quantity of materials at the standard price. A. True B. False 2. Standards are determined after the accounting period has ended, so comparisons can be made between standard costs (budgeted costs) and actual total costs and actual unit costs. A. True B. Falsearrow_forwarda. Compute the direct material price and efficiency variances. b. (Appendix) Prepare the journal entries to record the purchase and use of the direct materials using standard costing. Complete this question by entering your answers in the tabs below. Required A Required B (Appendix) Prepare the journal entries to record the purchase and use of the direct materials using standard costing. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < A Record the purchase and use of the direct materials using standard costing. Note: Enter debits before credits. Event 1 General Journal Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning