FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

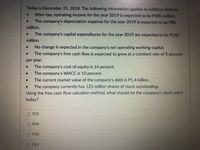

Transcribed Image Text:Today is December 31, 2018. The following information applies to Addison Airlines:

After-tax, operating income for the year 2019 is expected to be P400 million.

The company's depreciation expense for the year 2019 is expected to be P80

million.

The company's capital expenditures for the year 2019 are expected to be P160

million.

No change is expected in the company's net operating working capital.

The company's free cash flow is expected to grow at a constant rate of 5 percent

per year.

The company's cost of equity is 14 percent.

The company's WACC is 10 percent.

The current market value of the company's debt is P1.4 billion.

The company currently has 125 million shares of stock outstanding.

Using the free cash flow valuation method, what should be the company's stock price

today?

O P25

O P40

O P50

O P85

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Given the forecast below, estimate the fair market value per share of Kenmore Air's equity at the end of 2017 if the company has 50 million shares outstanding and the market value of its interest-bearing liabilities on the valuation date equals $300 million. Assume that after 2021, earnings before interest and tax will remain constant at $220 million, depreciation will equal capital expenditures in each year, and working capital will not change. Kenmore Air's weighted- average cost of capital is 11 percent and its tax rate is 40 percent. Forecast for Kenmore Air, Inc. Year 2018 2019 2020 2021 -40 85 97 112 Free cash flow ($ millions)arrow_forwardGiven the most recent financial statements for FY2023. Sales for FY2024 are expected to grow by 10 percent. The following assumption must be held in the pro forma financial statements. The tax rate (percentage), the interest expense ($ amount), and the dividend payout ratio (percentage) will remain constant. COGS, SGA, Depreciation, all current asset accounts, Net PPE, intangibles, other assets, and accounts payable increase spontaneously with sales. Calculate the internal growth rate if the firm operates at full capacity and no new debt or equity is issued. (Enter percentages as decimals and round to 4 decimals) MSFT ($ in millions, shares in millions) Income Statement Sales COGS Gross Profit Research and Dev. SGA FY2023 211,915 65,863 146,052 27,195 16653 Depreciation 13681 Operating Income, EBIT 88,523 Interest Expense 1968 Pretax income, EBT 86,555 Taxes 16950 Net income 69,605 32,902 36,703 Retained Earnings Dividends Price per share Shares outstanding 330.24 7,430 Balance Sheet…arrow_forwardOn December 2020, the company Psi SA is financed with debt and equity. This company has a cost of capital (WACC) equal to 12%. Also on December 2020, the company presented an EBIT equal to 1,500€, 350€ of amortization and 150€ of depreciation, and 300€ of corporate taxes. The company invested in fixed assets for 500€, and its working capital increased in 50€. After a decade of rapid growth, the cash flows in the last two years increased only at a constant rate of 2%, and it is expected that the cash flows will remain growing at this level in the future. Determine the value of the firm on December 2020.arrow_forward

- Quantitative Problem 1: Assume today is December 31, 2019. Barrington Industries expects that its 2020 after-tax operating income [EBIT(1-T)] will be $400 million and its 2020 depreciation expense will be $60 million. Barrington's 2020 gross capital expenditures are expected to be $120 million and the change in its net operating working capital for 2020 will be $25 million. The firm's free cash flow is expected to grow at a constant rate of 5.5% annually. Assume that its free cash flow occurs at the end of each year. The firm's weighted average cost of capital is 8.1%; the market value of the company's debt is $2.85 billion; and the company has 190 million shares of common stock outstanding. The firm has no preferred stock on its balance sheet and has no plans to use it for future capital budgeting projects. Also, the firm has zero non-operating assets. Using the corporate valuation model, what should be the company's stock price today (December 31, 2019)? Do not round intermediate…arrow_forwardBroussard Skateboard's sales are expected to increase by 20% from $8.6 million in 2019 to $10.32 million in 2020. Its assets totaled $3 million at the end of 2019. Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2019, current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. The after-tax profit margin is forecasted to be 6%, and the forecasted payout ratio is 60%. Use the AFN equation to forecast Broussard's additional funds needed for the coming year. $______arrow_forwardPlease correctly with stepsarrow_forward

- A company has the following items for the fiscal year 2020: Revenue =10 million EBIT = 5 million Net income = 2 million Total Equity = 20 million Total Assets = 40 million Calculate the company’s ROA and ROEarrow_forwardBroussard Skateboard's sales are expected to increase by 25% from $7.2 million in 2019 to $9.00 million in 2020. Its assets totaled $5 million at the end of 2019. Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2019, current liabilities were $1.4 million, consisting of $450000 of accounts payable, $500000 of notes payable, and $450000 of accruals. The after-tax profit margin is forecasted to be 3%, and the forecasted payout ratio is 55%. Use the AFN equation to forecast Broussard's additional funds needed for the coming year. Enter your answer in dollars. For example, an answer of $1.2 million should be entered as $1,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forwardYou are considering an investment in Fields and Struthers, Inc., and want to evaluate the firm's free cash flow. From the income statement, you see that Fields and Struthers earned an EBIT of $70 million, had a tax rate of 21 percent, and its depreciation expense was $7 million. Fields and Struthers's NOPAT gross fixed assets increased by $36 million from 2020 and 2021. The firm's current assets increased by $32 million and spontaneous current liabilities increased by $18 million. Calculate Fields and Struthers's NOPAT operating cash flow for 2021. Calculate Fields and Struthers's NOPAT investment in operating capital for 2021. Calculate Fields and Struthers's NOPAT free cash flow for 2021.arrow_forward

- For the year ending December 31, 2017, sales for Company Y were $62.91 billion. Beginning January 1, 2018 Company Y plans to invest 8.5% of their sales amount each year and they expect their sales to increase by 5% each year over the next three years. Company Y invests into an account earning an APR of 2.0% compounded continuously. Assume a continuous income stream How much money will be in the investment account on December 31, 2020? Round your answer to three decimal places. 17.306 x billion dollars How much money did Company Y invest in the account between January 1, 2018 and December 31, 20207 Round your answer to three decimal places. 16.858 x billion dollars How much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020? Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer 447 x billion dollarsarrow_forwardFor 2022, You're Doing Great Corporation reported $22 million in sales and $19 million In operating costs Cincluding depreciation). The company has $15 million of total invested capital. Its after-tax cost of Capital is 10%, and its tax rate is 25%. What was the firm's economic value added (EVA) during 2022?arrow_forwardCarlsbad Corporation's sales are expected to increase from $5 million in 2021 to $6 million in 2022, or by 20%. Its assets totaled $3 million at the end of 2021. Carlsbad is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2021, current liabilities are $1 million, consisting of $250,000 of accounts payable, $500,000 of notes payable, and $ 250,000 of accrued liabilities. Its profit margin is forecasted to be 7%, and the forecasted retention ratio is 45%. Use the AFN equation to forecast the additional funds Carlsbad will need for the coming year. Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. $ What additional funds would be needed if the company's year - end 2021 assets had been $4 million? Assume that all other numbers are the same. Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. $…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education