Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

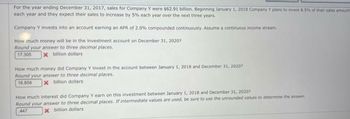

Transcribed Image Text:For the year ending December 31, 2017, sales for Company Y were $62.91 billion. Beginning January 1, 2018 Company Y plans to invest 8.5% of their sales amount

each year and they expect their sales to increase by 5% each year over the next three years.

Company Y invests into an account earning an APR of 2.0% compounded continuously. Assume a continuous income stream

How much money will be in the investment account on December 31, 2020?

Round your answer to three decimal places.

17.306 x billion dollars

How much money did Company Y invest in the account between January 1, 2018 and December 31, 20207

Round your answer to three decimal places.

16.858

x billion dollars

How much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020?

Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer

447

x billion dollars

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Catten, Inc., invests $163,170 today earning 7% per year for nine years. Use Table B.2 to compute the future value of the investment nine years from now. (Round the amount to the nearest dollar.)arrow_forwardA company has profits of $38,982 this year and expects profits to decrease by $1,728 dollars per year over the next 12 years. If the profits will be continuously invested in an account bearing 6.2% APR compounded continuously, what is the 12-year present value of this income stream?arrow_forwardIf you invest $56,000 today in an account that pays 8.3% a year, how much will you have in 31 years?Formula?Excel Function?arrow_forward

- Broussard Skateboard's sales are expected to increase by 20% from $8.6 million in 2019 to $10.32 million in 2020. Its assets totaled $3 million at the end of 2019. Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2019, current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. The after-tax profit margin is forecasted to be 6%, and the forecasted payout ratio is 60%. Use the AFN equation to forecast Broussard's additional funds needed for the coming year. $______arrow_forwardyou wish to receive incresing quater-end payments with 3.7% growth -rate quater for the next 3 years.if your first quartely payment was $540,how much you invest now ?assume that money is worth 2.4% compounded monthly.arrow_forwardplease helparrow_forward

- Broussard Skateboard's sales are expected to increase by 25% from $7.2 million in 2019 to $9.00 million in 2020. Its assets totaled $5 million at the end of 2019. Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2019, current liabilities were $1.4 million, consisting of $450000 of accounts payable, $500000 of notes payable, and $450000 of accruals. The after-tax profit margin is forecasted to be 3%, and the forecasted payout ratio is 55%. Use the AFN equation to forecast Broussard's additional funds needed for the coming year. Enter your answer in dollars. For example, an answer of $1.2 million should be entered as $1,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forwardYour have $15,000 that you want to invest. You expect your investment to yield 5% annual growth compounding annually over the long term. How much will your investment be worth in 15 years? $29,487 $31,184 $31,706 $32,546arrow_forwardTallinn Financial forecasts €200,000 in net income next fiscal year and ending total assets for €600,000. Tallinn pays 60% of its net income out in dividends. Tallinn’s current shareholder equity €240,000 and current liabilities are €100,000. Current liabilities are forecast to increase by €20,000 and debt (long-term) is expected to remain constant. What is Tallinn’s net new financing needed next year?arrow_forward

- Mindblowers Inc. introduced a new video game in 2022. Sales were $50, 000 per quarter in each of the first three quarters of 2022 and increased by 20% per quarter starting in the fourth quarter of that year through the last quarter of last year. What the 2-year income cash flows are worth for Mindblowers Inc. at the end of 2023? The interest rate is 12% per year compounded monthly.arrow_forwardThe returns from an investment are 5% in Year 18% in Year 2, and 15.8% in the first half of Year 3. Calculate the annualized return for the entire period. (Round your intermediate calculations to at least 4 decimal places and final answer to 2 decimal places.)arrow_forwardJenBritt Incorporated had a free cash flow (FCF) of $76 million in 2019. The firm projects FCF of $255 million in 2020 and $640 million in 2021. FCF is expected to grow at a constant rate of 4% in 2022 and thereafter. The weighted average cost of capital is 10%. What is the current (i.e., beginning of 2020) value of operations? Do not round intermediate calculations. Enter your answer in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answer to two decimal places. $ millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education