FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

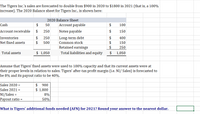

Transcribed Image Text:The Tigers Inc.'s sales are forecasted to double from $900 in 2020 to $1800 in 2021 (that is, a 100%

increase). The 2020 Balance sheet for Tigers Inc., is shown here:

2020 Balance Sheet

Cash

$

50

Account payable

$

100

Account receivable

250

Notes payable

$

150

$

$

$

$

$

Inventories

250

Long-term debt

400

Net fixed assets

500

Common stock

150

Retained earnings

250

Total assets

$ 1,050

Total liabilities and equity

2$

1,050

Assume that Tigers' fixed assets were used to 100% capacity and that its current assets were at

their proper levels in relation to sales. Tigers' after-tax profit margin (i.e. NI/ Sales) is forecasted to

be 8% and its payout ratio to be 40%.

$ 900

$ 1,800

Sales 2020 =

Sales 2021 =

NI/Sales =

Payout ratio =

8%

50%

What is Tigers' additional funds needed (AFN) for 2021? Round your answer to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Projected Spontaneous Liabilities Smiley Corporation's current sales and partial balance sheet are shown below. Sales Balance Sheet: Liabilities Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Total common equity Total liabilities & equity This year $10,000 $ 2,000 $ 1,500 $ 1,400 $ 4,900 $ 2,000 $ 6,900 $ 2,000 $3,000 $ 5,000 $11,900 Sales are expected to grow by 14% next year. Assuming no change in operations from this year to next year, what are the projected spontaneous liabilities? Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forwardThe most recent financial statements for Crosby, Incorporated, follow. Sales for 2021 are projected to grow by 25 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. Sales Costs Other expenses CROSBY, INCORPORATED 2020 Income Statement Earnings before interest and taxes Interest paid Taxable income Taxes (24%) Net income Dividends Addition to retained earnings Current assets Cash Accounts receivable Inventory Total Total assets $ 23,440 50,584 Fixed assets Net plant and equipment $ 224,000 EFN $ 25,640 35,100 71,780 $ 132,520 CROSBY, INCORPORATED Balance Sheet as of December 31, 2020 Assets $ 767,000 623,000 31,000 $ 356,520 $ 113,000 15,600 $ 97,400 23.376 $ 74,024 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock and paid-in surplus…arrow_forwardThe most recent financial statements for Crosby, Incorporated, follow. Sales for 2021 are projected to grow by 30 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. CROSBY, INCORPORATED 2020 Income Statement Sales $ 749,000 Costs 584,000 Other expenses 20,000 Earnings before interest and taxes $ 145,000 Interest paid 16,000 Taxable income $ 129,000 Taxes (21%) 27,090 Net income $ 101,910 Dividends $ 31,592 Addition to retained earnings 70,318 CROSBY, INCORPORATED Balance Sheet as of December 31, 2020 Assets Liabilities and Owners’ Equity Current assets Current liabilities Cash $ 20,840 Accounts payable $ 55,000 Accounts receivable 43,780 Notes payable 14,200 Inventory 93,960 Total $ 69,200…arrow_forward

- Sunburst Corporation's net revenues over a five year period were as follows (in millions of dollars): $28,700 (2021) $22,800 (2020) $27,000 (2019) $24,500 (2018) $21,600 (2017) Calculate trend percentages for the five-year period using 2017 as the base year. (Round your answers to the nearest whole percent.) Sunburst Trend Data (in millions) Sales revenue Trend percentage 2021 28,700 % 2020 22,800 % $ 2019 27,000 % 1 2018 24,500 $ % Base Year 2017 $ 21,600 %arrow_forwardCarlsbad Corporation's sales are expected to increase from $5 million in 2019 to $6 million in 2020, or by 20%. Its assets totaled $3 million at the end of 2019. Carlsbad is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2019, current liabilities are $1 million, consisting of $250,000 of accounts payable, $500,000 of notes payable, and $250,000 of accrued liabilities. Its profit margin is forecasted to be 6%. a. Assume that the company pays no dividends. Use the AFN equation to forecast the additional funds Carlsbad will need for the coming year. Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. b. Why is this AFN different from the one when the company pays dividends? I. Under this scenario the company would have a lower level of retained earnings, which would decrease the amount of additional funds needed. II. Under this scenario the company would have a higher…arrow_forwardAssume General Motors announced a quarterly profit of $119 million for 4th quarter 2022. Below is a portion of its balance sheet. Conduct a horizontal analysis of the following line items. Note: Negative answers should be indicated by a minus sign. Round the "percent" answers to the nearest hundredth percent. Cash and cash equivalents Marketable securities Inventories Goodwill Total liabilities and equity 2022 (dollars in millions) $ $ 2021 (dollars in millions) 15,980 9,222 13,642 0 103,249 $ $ 15,499 16,148 14,324 1,278 144,603 Difference % Changearrow_forward

- The most recent financial statements for Crosby, Incorporated, appear below. Sales for 2022 are projected to grow by 25 percent. Interest expense will remain constant; the tax rate and the dividend payout rate also will remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. Sales Costs Other expenses CROSBY, INCORPORATED 2021 Income Statement Earnings before interest and taxes Interest expense Taxable income Taxes (24%) Net income Dividends Addition to retained earnings $ 19,940 50,664 $772,000 628,000 33,500 $ 110,500 17,600 $ 92,900 22,296 $ 70,604arrow_forwardThe following forecasts were developed at the end of 2022 for Endless Sunny Days (ESD), a company that has a cost of capital for its operations of 8% and a cost of capital for its equity of 12% (amounts are in millions of dollars): Cash flow from operations 2023E 135 95 2024E 215 165 2025E 270 125 Cash investment expenditure At the end of 2022, the book value of equity was $370 and the net financing debt was $360. 1. Forecast Free Cash Flows for 2023, 2024 and 2025. 2. Calculate the present value of Forecast Free Cash Flows for 2023, 2024 and 2025. 3. Using a terminal growth rate in free cash flow after 2025 of 1%, calculate the present value of cash flows to be received in the terminal period. 4. Using your answers to previous questions, estimate the total market value of equity for the firm.arrow_forwardA company has the following items for the fiscal year 2020: Revenue =10 million EBIT = 5 million Net income = 2 million Total Equity = 20 million Total Assets = 40 million Calculate the company’s ROA and ROEarrow_forward

- The following amounts were taken from the financial statements of Bramble Company: 2020 2019 Total assets $840000 $1020000 Net sales 770000 640000 Gross profit 353000 350000 Net income 200000 111000 Weighted average number of common shares outstanding 40000 88000 Market price of common stock $145.00 $36.00 The price-earnings ratio for 2020 is 5.00 times. 7.53 times. 31.00 times. 29.00 times.arrow_forwardAssume General Motors announced a quarterly profit of $119 million for 4th quarter 2019. Below is a portion of its balance sheet. Conduct a horizontal analysis of the following line items. (Negative answers should be indicated by a minus sign. Round the "percent" answers to the nearest hundredth percent.) 2019 (dollars in millions) 2018 (dollars in millions) Difference % CHG Cash and cash equivalents $ 15,980 $ 15,499 Marketable securities 9,222 16,148 Inventories 13,642 14,324 Goodwill 1,278 Total liabilities and equity $ 103,249 $ 144,603arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education