Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

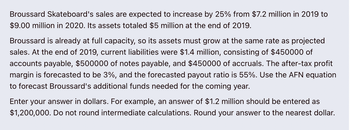

Transcribed Image Text:Broussard Skateboard's sales are expected to increase by 25% from $7.2 million in 2019 to

$9.00 million in 2020. Its assets totaled $5 million at the end of 2019.

Broussard is already at full capacity, so its assets must grow at the same rate as projected

sales. At the end of 2019, current liabilities were $1.4 million, consisting of $450000 of

accounts payable, $500000 of notes payable, and $450000 of accruals. The after-tax profit

margin is forecasted to be 3%, and the forecasted payout ratio is 55%. Use the AFN equation

to forecast Broussard's additional funds needed for the coming year.

Enter your answer in dollars. For example, an answer of $1.2 million should be entered as

$1,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Visanoarrow_forwardLong-Term Financing Needed At year-end 2021, Wallace Landscaping's total assets, all of which are used in operations, were $1.97 million, and its accounts payable were $435,000. Sales, which in 2021 were $3.4 million, are expected to increase by 30% in 2022. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Wallace typically uses no current liabilities other than accounts payable. Common stock amounted to $465,000 in 2021, and retained earnings were $270,000. Wallace has arranged to sell $190,000 of new common stock in 2022 to meet some of its financing needs. The remainder of its financing needs will be met by issuing new long-term debt at the end of 2022. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales is 3%, and 45% of earnings will be paid out as dividends. a. What was Wallace's total long-term debt in 2021? Do not round…arrow_forwardOn January 1, 2020, Oceanic Bank made a P1,000,000 8% loan. The P80,000 interest is receivable at the end of each year, with the principal amount to be received at the end of five years. At the end of 2020, the first year's interest of P80,000 has not ye been received because the borrower is experiencing financial difficulties. The borrower negotiate a restructuring of the loan. The payment of all the interest for 5 years will be delayed until the end of the 5-year loan term. In addition, the amount of principal repayment will be dropped from P1,000,000 to P500,000. The PV of 1 at 8% for 4 periods is .735. No interest revenue has been recognized in 2020 in connection with the loan. What amount should be reported as interest income for 2021? * a.80,000 b.52,920 c.48,960 d.0arrow_forward

- Clementi Corporation provided the following information for the current year 2022: Accounting income (pre-tax) in 2022 is $400 million. Installment Receivable at the end of 2022 equaled $20 million. and is expected to be collected equally in 2023 and 2024. Warranty Liability balance at the end of 2022 equaled $16 million and is expected to be paid equally in 2023 and 2024. The income tax rate is 20%. Clementi Corporation records income tax payable equal to: O $79.2 million O $72.8 million O $87.2 million O $80.8 million.arrow_forwardJPX's decides to value a property based on its expected net after-tax monthly cash flow of $7,400, as if it were a perpetuity. Assuming the next cash flow is received one-month from today, what is the property value given a discount rate of 11.52% APR, compounded monthly? A) 770808 B) 770833 C) 770865 D) 770912arrow_forwardABC Insurance has paid losses of $50M during calendar year 2019 and case reserves at the end of the year totaling $60M. Management estimates ultimate losses on these open reserves will be $200M. What are bulk loss reserves at the end of the year?arrow_forward

- Sales are $2.45 million in 2020, $2.55 million in 2021, and $2.35 million in 2022.What is the percentage change from 2020 to 2021? What is the percentage change from 2021 to 2022? Be sure to indicate whether the percentage change is an increase or a decrease. (Round your answers to 1 decimal place.)arrow_forwardIn 2019, Beta had an annual effective tax rate of 20%. In the 2020 first quarter, the company would pay tax at 25% just for that quarter alone. Beta management estimates that the 2020 full year effective tax rate will be 15%. Based on a first quarter 2020 income before tax of $200,000 what amount of provision for income taxes should be accrued under the integral method. a. $50,000 b. $40,000 c. $60,000 d. $0 e. $30,000arrow_forwardFor a present sum of $620,000, determine the annual worth (in then-current dollars) in years 1 through 7 if the market interest rate is 12% per year and the inflation rate is 5% per year.The annual worth is $?arrow_forward

- If $90,000 is invested in a fund on December 31, 2019, and 5 equal annual withdrawals of $23,138.32 are made starting on December 31, 2020, that will deplete the fund, what is the interest rate being earned if interest is compounded annually?arrow_forwardOn April 1, 2021, the Electronic Superstore borrows $21 million of which $7 million is due in 2022. Show how the company would report the $21 million debt on its December 31, 2021 balance sheet. (Enter your answers in dollars not in millions. For example, $7,000,000 rather than $7 million.) Electronic Superstore Partial Balance sheet December 31st 2021 Current liabilities: Long-term liabilities: Total liabilitiesarrow_forwardsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education