FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

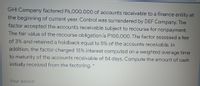

GHI Company factored P6,000,000 of

Transcribed Image Text:GHI Company factored P6,000,000 of accounts receivable to a finance entity at

the beginning of current year. Control was surrendered by DEF Company. The

factor accepted the accounts receivable subject to recourse for nonpayment.

The fair value of the recourse obligation is P100,000. The factor assessed a fee

of 3% and retained a holdback equal to 5% of the accounts receivable. In

addition, the factor charged 15% interest computed on a weighted average time

to maturity of the accounts receivable of 54 days. Compute the amount of cash

initially received from the factoring. *

Your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wood Incorporated factored €150,000 of accounts receivable with Engram Factors Inc., Without guarantee. Engram assesses a 2% finance charge of the amount of accounts receivable Retains an amount equal to 6% of accounts receivable for possible adjustments. Prepare the journal entry for Wood Incorporated and Engram Factors to record the factoring of the accounts receivable to Engram.arrow_forwardThe controller for Bramble Corporation has reached an agreement with Sheffield Financing Ltd. to sell a large portion of Bramble's past-due accounts receivable. Bramble agrees to sell $1,820,000 of accounts receivable to Sheffield with recourse. Bramble's controller estimates that the fair value of Bramble's liability to pay Sheffield for uncollectible accounts is $163.000. Sheffield will charge Bramble 9% of the total receivables balance as a financing fee, and will withhold an initial amount of 10% (a) Calculate the net proceeds and the gain or loss on the disposal of receivables to Sheffield Financing Ltd. Net proceeds ✓on disposal of receivables S $arrow_forwardSubject :- Accountingarrow_forward

- On December 1, 2020, RB Company assigned on a non-notification basis accounts receivable of Php6,000,000 to a bank in consideration for a loan of 80% of the accounts less a 5% service fee on the accounts assigned. The entity signed a note for the bank loan. On December 31, 2020, the entity collected assigned accounts of Php2,000,000 less discount of Php200,000. The entity remitted the collections to the bank in partial payment for the loan. The bank applied first the collection to the interest and the balance to the principal. The agreed interest is 1% per month on the loan balance. The entity accepted sales returns of Php100,000 on the assigned accounts and wrote off assigned accounts totaling Php300,000. What is the equity of the assignor in assigned accounts on December 31, 2020?arrow_forwardManjiarrow_forwardJ Hotheads Unlimited sold $440,000 of accounts receivable to Frozen Factors Inc. on a with recourse basis. Frozen assesses an 11% finance charge of the amount of accounts receivable and retains an amount equal to 8% of accounts receivable to cover probable adjustments. Prepare the journal entry for Hotheads to record the sale of the accounts receivable to Frozen assuming that the recourse liability has a fair value of $26,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education