FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Subject :- Accounting

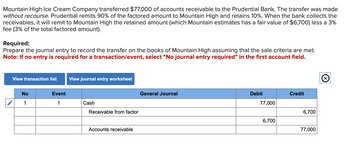

Transcribed Image Text:Mountain High Ice Cream Company transferred $77,000 of accounts receivable to the Prudential Bank. The transfer was made

without recourse. Prudential remits 90% of the factored amount to Mountain High and retains 10%. When the bank collects the

receivables, it will remit to Mountain High the retained amount (which Mountain estimates has a fair value of $6,700) less a 3%

fee (3% of the total factored amount).

Required:

Prepare the journal entry to record the transfer on the books of Mountain High assuming that the sale criteria are met.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list View journal entry worksheet

No

1

Event

1

Cash

Receivable from factor

Accounts receivable

General Journal

Debit

77,000

6,700

Credit

6,700

77,000

x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mountain High Ice Cream Company transferred $66,000 of accounts receivable to the Prudential Bank. The transfer was made with recourse. Prudential remits 90% of the factored amount to Mountain High and retains 10% to cover sales returns and allowances. When the bank collects the receivables, it will remit to Mountain High the retained amount (which Mountain estimates has a fair value of $5,600). Mountain High anticipates a $3,600 recourse obligation. The bank charges a 2% fee (2% of $66,000), and requires that amount to be paid at the start of the factoring arrangement. Required: Prepare the journal entry to record the transfer on the books of Mountain High assuming that the sale criteria are met. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 Record the transfer of accounts receivable. Note: Enter debits before credits. General Journal Debit Credit Event 1 Cash Loss…arrow_forwardMountain High Ice Cream Company transferred $64,000 of accounts receivable to the Prudential Bank. The transfer was made with recourse. Prudential remits 90% of the factored amount to Mountain High and retains 10% to cover sales returns and allowances. When the bank collects the receivables, It will remit to Mountain High the retained amount (which Mountain estimates has a fair value of $5,400). Mountain High anticipates a $3,400 recourse obligation. The bank charges a 2% fee (2% of $64,000), and requires that amount to be paid at the start of the factoring arrangement. Required: Prepare the journal entry to record the transfer on the books of Mountain High assuming that the sale criteria are met. Note: If no entry is required for a transaction/event, select "No Journal entry required" In the first account field. No 1 Event 1 Answer is not complete. General Journal Cash Loss on sale of receivables Receivable from factor Accounts receivable > Debit 56,320 Credit 64,000arrow_forwardVikramarrow_forward

- Mountain High Ice Cream Company reports under IFRS. Mountain High transferred $70,000 of accounts receivable to the Prudential Bank. The transfer was made with recourse. Prudential remits 80% of the factored amount to Mountain High and retains 20% to cover sales returns and allowances. When the bank collects the receivables, it will remit to Mountain High the retained amount (which Mountain estimates has a fair value of $6,000). Mountain High anticipates a $4,000 recourse obligation. The bank charges a 1% fee (1% of $70,000), and requires that amount to be paid at the start of the factoring arrangement. Mountain High has transferred control over the receivables, but determines that it still retains substantially all risks and rewards associated with them. Required: Prepare the journal entry to record the transfer on the books of Mountain High, considering whether the sale criteria under IFRS have been met. Note: If no entry is required for a transaction/event, select "No journal entry…arrow_forwardMountain High Ice Cream Company transferred $68,000 of accounts receivable to the Prudential Bank. The transfer was made without recourse. Prudential remits 90% of the factored amount to Mountain High and retains 10%. When the bank collects the receivables, it will remit to Mountain High the retained amount (which Mountain estimates has a fair value of $5,800) less a 2% fee (2% of the total factored amount). Required: Prepare the journal entry to record the transfer on the books of Mountain High assuming that the sale criteria are met. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet i No 1 Event 1 General Journal Cash Loss on sale of receivables Receivable from factor Accounts receivable Debit 61,200 Credit 68,000 ******** X .….…….arrow_forwardLogitech Corporation transferred $100,000 of accounts receivable to a local bank. The transfer was made without recourse. The local bank remits 85% of the factored amount to Logitech and retains the remaining 15%. When the bank collects the receivables, it will remit to Logitech the retained amount less a fee equal to 3% of the total amount factored. Logitech estimates a fair value of its 15% interest in the receivables of $11,000 (not including the 3% fee). What is the effect of this transaction on the company’s assets, liabilities, and income before income taxes?arrow_forward

- Mountain High Ice Cream Company transferred $60,000 of accounts receivable to the Prudential Bank. The transfer was made without recourse. Prudential remits 90% of the factored amount to Mountain High and retains 10%.When the bank collects the receivables, it will remit to Mountain High the retained amount (which Mountainestimates has a fair value of $5,000) less a 2% fee (2% of the total factored amount).Required:Prepare the journal entry to record the transfer on the books of Mountain High assuming that the sale criteria aremet.arrow_forwardMountain High Ice Cream Company transferred $60,000 of accounts receivable to the Prudential Bank. The transfer was made without recourse. Prudential remits 90% of the factored amount to Mountain High and retains 10%. When the bank collects the receivables, it will remit to Mountain High the retained amount (which Mountain estimates has a fair value of $5,000) less a 2% fee (2% of the total factored amount).Required:Prepare the journal entry to record the transfer on the books of Mountain High assuming that the sale criteria are met. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardVinu Bhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education