FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

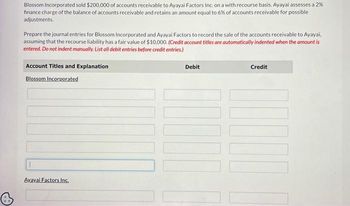

Transcribed Image Text:Blossom Incorporated sold $200,000 of accounts receivable to Ayayai Factors Inc. on a with recourse basis. Ayayai assesses a 2%

finance charge of the balance of accounts receivable and retains an amount equal to 6% of accounts receivable for possible

adjustments.

Prepare the journal entries for Blossom Incorporated and Ayayai Factors to record the sale of the accounts receivable to Ayayai,

assuming that the recourse liability has a fair value of $10,000. (Credit account titles are automatically indented when the amount is

entered. Do not indent manually. List all debit entries before credit entries.)

Account Titles and Explanation

Blossom Incorporated

Avayai Factors Inc.

Debit

LI

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- 13. In 2023, a corporation sells its business in an arm's length transaction for proceeds equal to FMV. At the time of the sale the business has accounts receivable of $123,000. The corporate vendor of the business and the purchaser agree that the realizable value of the receivables is $118,500. In 2022, the vendor had deducted a reserve for doubtful debts of $6,800. Which of the following statements is correct? A. If no joint election is filed under ITA 22, the vendor will have an addition to business income of $2,300. B. If no joint election is filed under ITA 22, the vendor will have an addition to business income of $6,800 and an allowable capital loss of $2,250. C. If a joint election is filed under ITA 22, the vendor will have a business deduction of $2,300. D. If a joint election is filed under ITA 22, the vendor will have a business deduction of $4,500. 14. During the current year, Denos Corporation incurred costs of $45,000 for leasehold improvements to its newly rented…arrow_forwardWhite Corporation has entered into an agreement to transfer accounts receivable to Murphy Company. Under the terms of this agreement, White receives 80% of the value of all the transferred accounts receivable (to reflect credit risk) and is charged a 1% service charge, which is based upon the dollar amount of transferred receivables. Interest is charged at an annual interest rate of 12% of any outstanding loan balance. The transferred receivables will continue to be collected by White with any cash flows being remitted to Murphy at the end of each month. White is not allowed to transfer the receivables to anyone else. White normally transfers its accounts receivable. The following selected 2019 transactions relate to this agreement: Dec 1 Accounts receivable of $160,000 are transferred. 11 A sales return of $1,000 on a transferred account is made. 31 Collections are made on $82,000 of the transferred accounts receivable plus interest for the month of December. This amount is…arrow_forwardVaughn Manufacturing assigns $7300000 of its accounts receivables as collateral for a $2.64 million 9% loan with a bank. Vaughn Manufacturing also pays a finance fee of 2% on the transaction upfront. What would be recorded as a gain (loss) on the transfer of receivables?arrow_forward

- ll.arrow_forwardOn February 1, 2023 MANGOSTEN Company factored receivable with a carrying amount of ₱ 300,000 to ACKEE Company. ACKEE Company assesses a finance charge of 3% of the receivables and retains 5% of the receivables. Relative to this transaction, assume MANGOSTEEN factors receivables on a without recourse basis. Using the same information on the previous number, what amount of cash was received? A. ₱ 276,000 B. ₱ 285,000 C. ₱ 291,000 D. ₱ 300,000arrow_forwardWinkler Company borrows $92,000 and pledges its receivables as security. The journal entry to record this transaction would be:arrow_forward

- 5. Packwood, Inc. factors $250,000 of its accounts receivable to M&B Finance with recourse. M&B charges a fee of 1% and withholds 10% of the face amount of the receivables to cover possible uncollectible accounts and sales returns. The bank deducts the fee from the cash given to Packwood at the outset of the arrangement. Packwood estimates the fair value of the recourse obligation is equal to $6,000. Packwood estimates the fair value of the 10% of the face amount of receivables equals $22,500. Packwood does not retain control over the factored receivables. Prepare any journal entries Packwood, Inc. would make to record the factoring.arrow_forwardBrooks Company purchases debt investments as trading securities at a cost of $71,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $90,000. Brooks sells a portion of its trading securities (costing $35,500) for $40,250 cash. Analyze each transaction above by showing its effects on the accounting equation-specifically, identify the accounts and amounts (including + or -) for each transaction.arrow_forwardSheldon factored $200,000 of accounts receivable with Penny Factors on a with recourse basis. Penny assesses a 5% finance charge. Sheldon estimates the fair value of the recourse obligation to be $1,500. Penny Factors pays Sheldon 90% of the factored receivables. Sheldon estimates that the value of the final 10% of receivables is $16,000. Journalize the sale of the receivables.arrow_forward

- Subject :- Accountingarrow_forward2arrow_forwardSale of Receivables Hunt Incorporated sold $300,000 of accounts receivable to Gannon Factors Inc. on a with recourse basis. Gannon assesses a 2% finance charge of the amount of accounts receivable and retains an amount equal to 6% of accounts receivable for possible adjustments. Hunt estimates a recourse liability to cover bad debts of $15,000. Subsequently, the factor collected $283,000 in cash from the accounts receivable Required: Part A: Prepare the journal entry for Hunt to record the sale of the receivables to Gannon. (hint: you may or may not need all the debits and credits) 1 2 3 41 A LO 5 6 7 8 9 Ref Account Titles Adjusting Entries Debit Credit 1 2 13 4 +56 ∞ O 17 18 19arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education