FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

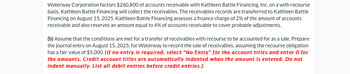

Transcribed Image Text:Waterway Corporation factors $260,800 of accounts receivable with Kathleen Battle Financing, Inc. on a with recourse

basis. Kathleen Battle Financing will collect the receivables. The receivables records are transferred to Kathleen Battle

Financing on August 15, 2025. Kathleen Battle Financing assesses a finance charge of 2% of the amount of accounts

receivable and also reserves an amount equal to 4% of accounts receivable to cover probable adjustments.

(b) Assume that the conditions are met for a transfer of receivables with recourse to be accounted for as a sale. Prepare

the journal entry on August 15, 2025, for Waterway to record the sale of receivables, assuming the recourse obligation

has a fair value of $5,000. (If no entry is required, select "No Entry" for the account titles and enter O for

the amounts. Credit account titles are automatically indented when the amount is entered. Do not

indent manually. List all debit entries before credit entries.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following transactions of Dunn Miles occurred during 2024: i (Click the icon to view the transactions.) Requirements 1. Journalize required transactions, if any, in Miles's general journal. Explanations are not required. What is the balance in Estimated Warranty Payable assuming a beginning balance of $0? 2. Requirement 1. Journalize required transactions, if any, in Miles's general journal. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. For transactions that do not require an entry, make sure to select "No entry required" in the first cell in the "Accounts" column and leave all other cells blank.) Apr. 30: Miles is party to a patent infringement lawsuit of $210,000. Miles's attorney is certain it is remote that Miles will lose this lawsuit. Date Accounts Debit Credit Apr. 30 More info Apr. 30 Jun. 30 Jul. 28 Sep. 30 Dec. 31 Miles is party to a patent infringement lawsuit of $210,000. Miles's attorney is certain it is…arrow_forwardIvanhoe Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning December 31, 2020. Annual rental payments of $53,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in setting the payment schedule is 7%; Ivanhoe's incremental borrowing rate is 9%. Ivanhoe is unaware of the rate being used by the lessor. At the end of the lease, Ivanhoe has the option to buy the equipment for $5,000, considerably below its estimated fair value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Ivanhoe uses the straight-line method of depreciation on similar owned equipment. (a) Your answer is correct. Prepare the journal entries, that Ivanhoe should record on December 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round…arrow_forwardPrepare all necessary journal entries for Sheridan for 2025. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places e.g. 5,275. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation (To record the lease) (To record the first lease payment) Debit 110 Creditarrow_forward

- 21. The A/R subledger is updated in each of the following situations EXCEPT when we: a. Record a sale on account b. Record the receipt of a customer's payment on account c. Authorize a customer to return items from a previous sale on account d. Write off a customers outstanding account balance because they have filed bankruptcy and will not be able to payarrow_forwardAt the end of 2023, Novak Corporation owns a licence with a carrying amount of $508,000. Novak expects undiscounted future cash flows from this licence to total $512,500. The licence's fair value is $404,000 and disposal costs are estimated to be nil. The licence's discounted cash flows (that is, value in use) are estimated to be $458,000. Assume that the licence was granted in perpetuity and has an indefinite life, and that Novak prepares financial statements in accordance with ASPE. Assume that the licence was granted in perpetuity and has an indefinite life. Determine if the licence is impaired at the end of 2023. The licence Prepare any related entry that is necessary. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) at the end of 2023. Account Titles and Explanation eTextbook and Media List of…arrow_forwardBlue Spruce Corporation purchased $64,800 of 4-year, 7% bonds of Hu Inc. for $60,526 to yield an 9% return. It classified the purchase as an amortized cost method investment. The bonds pay interest semi-annually.arrow_forward

- Nonearrow_forwardWhispering Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning December 31, 2020. Annual rental payments of $54,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in setting the payment schedule is 6%; Whispering's incremental borrowing rate is 8%. Whispering is unaware of the rate being used by the lessor. At the end of the lease, Whispering has the option to buy the equipment for $5,000, considerably below its estimated fair value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Whispering uses the straight-line method of depreciation on similar owned equipment. Click here to view factor tables.arrow_forwardOn January 1, 2022, Sandhill Co. had a balance of $411,000 of goodwill on its balance sheet that resulted from the purchase of a small business in a prior year. The goodwill had an indefinite life. During 2022, the company had the following additional transactions. Jan. 2 Purchased a patent (7-year life) $307,650. July 1 Sept. 1 Acquired a 9-year franchise; expiration date July 1, 2,031, $576,000. Research and development costs $178,500.arrow_forward

- (b) Prepare the entry to record the accrued interest and the amortization of premium on December 31, 2025, using the straight-line method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 1,225.) Date Dec. 31, 2025 Account Titles and Explanation Debit Creditarrow_forwardDogarrow_forward3)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education