FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

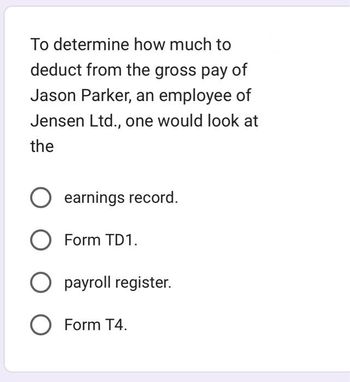

Transcribed Image Text:To determine how much to

deduct from the gross pay of

Jason Parker, an employee of

Jensen Ltd., one would look at

the

earnings record.

O Form TD1.

O payroll register.

O Form T4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the February payroll and the payment of the payroll. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Feb. 28 (To record payroll.) (To record payment of payroll.) Feb. 28arrow_forwardExercise 5-9A (Static) What are the two methods payroll accountants use to determine federal income tax withholding amounts? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) F2 # 3 ? Wage-salary method ?Wage-bracket method ? Percentage method ?Salary-bracket method E 80 F3 $ 4 R Q F4 % 5 * 00 8 DII F8 ( 9 A DD F9 0 F10 J K L P 4 F11arrow_forward2. Prepare a general journal entry to record the payroll. The firm's general ledger contains a Wages Expense account and a Wages Payable account. Then assuming that the firm has transferred funds from its regular bank account to its special payroll bank account and that this entry has been made, prepare a general journal entry to record the payment of wages. If required, round your intermediate calculations and the final answers to the nearest cent and use the rounded answers in subsequent computations. If an amount box does not require an entry, leave it blank. GENERAL JOURNAL PAGE DATE DESCRIPTION POST. REF. DEBIT CREDIT 20-- Oct. 14 fill in the blank 177445fc1f8a014_2 fill in the blank 177445fc1f8a014_3 fill in the blank 177445fc1f8a014_5 fill in the blank 177445fc1f8a014_6 fill in the blank 177445fc1f8a014_8 fill in the blank 177445fc1f8a014_9 fill in the blank 177445fc1f8a014_11 fill in the blank…arrow_forward

- Calculation and Journal Entry for Employer Payroll Taxes 1. Calculate the employer's payroll taxes expense. Round your answer to the nearest cent. 2. Prepare the journal entry to record the employer's payroll taxes expense for the week ended July 15 of the current year. Round your answers to the nearest cent, if required. If an amount box does not require an entry, leave it blank. Portions of the payroll register for Barney’s Bagels for the week ended July 15 are shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both of which are levied on the first $7,000 of earnings. The Social Security tax rate is 6.2% on the first $118,500 of earnings. The Medicare rate is 1.45% on gross earnings. Barney’s BagelsPayroll Register Total Taxable Earnings of All Employees Total Earnings Unemployment Compensation Social Security $12,200 $10,500 $12,200arrow_forwardQuestion 1: What should an employer use to complete Form W-3? Answer: А. Employee earnings records В. O Payroll registers C. Form 1096 D. O Form W-2s Question 2: How is self-employment income calculated? Answer: А. O Self-employment income = Revenue В. Self-employment income = Revenue + Expenses С. Self-employment income = Revenue - Expenses D. Self-employment income = Expenses Question 3: A flexible spending account is a common type of Answer: А. cafeteria plan В. medical plan С. retirement plan D. mandatory deductionarrow_forwardTotal payroll was $946,000, of which $222,000 is exempt from Social Security tax because it represented amounts paid in excess of $128,400 to certain employees. The amount paid to employees in excess of $7,000 was $806,000. Income taxes in the amount of $173,700 were withheld, as was $19,500 in union dues. The state unemployment tax is 3.5%, but Waterway Company is allowed a credit of 2.3% by the state for its unemployment experience. Also, assume that the current F.I.C.A. tax is 7.65% on an employee's wages to $128,400 and 1.45% in excess of $128,400. No employee for Waterway makes more than $250,000. The federal unemployment tax rate is 0.8% after state credit. Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all…arrow_forward

- Do not give image format Record the transactions for July 10 and 31.arrow_forwardWhat is the difference between: Salaries and wages expense on the income statement And Salaries and wages payable in the balance sheet? Thank you!arrow_forwardI already did part b and c and I am struggling to do part a. Help please !!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education