FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please do not give image formaT

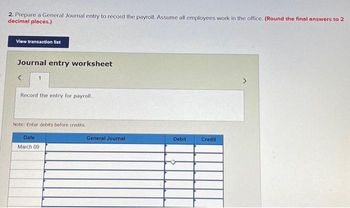

Transcribed Image Text:2. Prepare a General Journal entry to record the payroll. Assume all employees work in the office. (Round the final answers to 2

decimal places.)

View transaction list

Journal entry worksheet

Record the entry for payroll.

Note: Enter debits before credits.

Date

March 09

General Journal

Debit

Credit

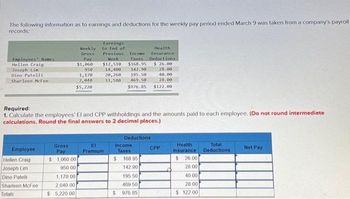

Transcribed Image Text:The following information as to earnings and deductions for the weekly pay period ended March 9 was taken from a company's payroll

records:

Employees Names

Hellen Craig

Joseph Lin

Dino Patelli

Sharleen McFee

Employee

Hellen Craig

Joseph Lim

Dino Patelli

Sharloon McFee

Totals

Gross

Pay

Weekly

Gross

$ 1,060.00

950.00

1,170.00

2,040 00

$ 5,220.00

Pay

$1,060

950

1,170

2,040

$5,220

Earnings

to End of

Previous Income

Week Taxes

$12,510 $168.95

14,400

142.90

20,260

195.50

33,580 469.50

Required:

1. Calculate the employees' El and CPP withholdings and the amounts paid to each employee. (Do not round intermediate

calculations. Round the final answers to 2 decimal places.)

EI

Premium

$976.85 $122.00

Income

Taxes

$

Health

Insurance.

Deductions

$26.00

Deductions

$ 168.95

142.90

28.00

40.00

28.00

195.50

469.50

976.85

CPP

Health

Insurance

$26.00

28:00

40.00

28.00

$122.00

Total

Deductions

Net Pay

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Select the letter of the item below that best matches the definitions that follow. a. Data Files CD ________ b. Lists ________ c. Forms ________ d. Registers ________ e. Reports and graphs ________ f. Restoring a backup ________ g. Icon bar ________ h. Home page ________ i. Backing up a file ________ 1. One click access to QuickBooks Accountant Centers and Home page. 2. The process of rebuilding a backup file to a full QuickBooks Accountant file ready for additional input. 3. Electronic representations of paper documents used to record business activities such as customer invoices, vendor bills, and checks. 4. A big-picture approach of how your essential business tasks fit together organized by logical groups such as customers, vendors, and employees. 5. Groups of names such as customers, vendors, employees, items, and accounts. 6. Contains backups of all the practice files needed for chapter work and completion of assignments. 7. The process of creating a copy of a…arrow_forwardExplain an example of source documents.arrow_forwardHow can forwardrates be used for hedging purposes?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education