FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

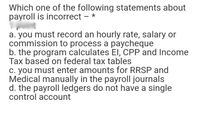

Transcribed Image Text:Which one of the following statements about

payroll is incorrect – *

a. you must record an hourly rate, salary or

commission to process a paycheque

b. the program calculates EI, CPP and Income

Tax based on federal tax tables

C. you must enter amounts for RRSP and

Medical manually in the payroll journals

d. the payroll ledgers do not have a single

control account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Describe a minimum of three ways Accounting Iinformation System can help minimize or eliminate inaccurate time and attendance data in a typical company's payroll activity.arrow_forward518 2. Payroll Controls Refer to the Problem 2 flowchart in the next column. Required: a. What risks are associated with the payroll procedures depicted in the flowchart? b. Discuss two control techniques that will reduce or eliminate the risks. Problem 2: Payroll Controls Employee Timecard D Paycheck Rec Pept Chapter 10: Auditing the Expenditure Cycle Supplier Invoice A B Supervisor Timecard Supervisor Approves and Signs Timecards Paycheck Supervisor Distributes Paychecks to Employees Problem 3: System Flowchart Analysis Accounts Payable Rec Pept C Supplier Invoice Payroll Department A Timecard Prepare Paychecks Paycheck Rec Pept Rec Pept Supplier Invoice A Dept X Supplier Invoice E A 3. System Flowchart Analysis Using the Flowchart labeled Problem 3, answer the follow- K P ing questions: a. What are the names of Departments X and Y? b. What are the names of the documents that are iden- tified by letters in the system? Use the following format: Doc A = (Name of document here), etc. c.…arrow_forwardQuestion 8 If Automated taxes and form setting is on, can you change the date of payment for automated taxes? No. If the client needs to select the payment date, they need to turn off Automated taxes and forms Yes. You can change the submission date up to 10 days before submitting the tax payment No. There is no option to change the date of payment in QuickBooks Online Payroll Yes. Automated taxes gives you total control over the date of the tax paymentsarrow_forward

- i am missing a transaction for number 4 "Record the employers payroll expenses"arrow_forwardPrepare a general journal entry to record the payroll. The firm's general ledger contains a Wages Expense account and a Wages Payable account. Then assuming that the firm has transferred funds from its regular bank account to its special payroll bank account and that this entry has been made, prepare a general journal entry to record the payment of wages. When necessary, round your intermediate calculations and the final answers to the nearest cent. If an amount box does not require an entry, leave it blank. GENERAL JOURNAL PAGE DATE DESCRIPTION POST. REF. DEBIT CREDIT 20-- Feb. 21 fill in the blank ee29ee01603501e_2 fill in the blank ee29ee01603501e_3 fill in the blank ee29ee01603501e_5 fill in the blank ee29ee01603501e_6 fill in the blank ee29ee01603501e_8 fill in the blank ee29ee01603501e_9 fill in the blank ee29ee01603501e_11 fill in the blank ee29ee01603501e_12 fill in the blank…arrow_forwardCompleting the Payroll Register The Employee Payroll Register presents all the computations previously performed as it applies to this payroll period. Complete the following steps (if a field should be blank, leave it blank): Record the amount to be withheld for group insurance. Record the amount to be withheld for health insurance. Each worker is to be paid by check. Assign check numbers provided to the correct employee. Compute the net pay for each employee. Total the input columns. KIPLEY COMPANY, INC.Payroll RegisterFor Period Ending January 8, 20-- EARNINGS DEDUCTIONS NET PAY Name Gross OASDI HI FIT SIT SUTA CIT SIMPLE Grp. Ins. Health Ins. Ck. No. Amount Carson, F. $700.00 $43.40 $10.15 $48.00 $21.49 $0.42 $21.00 $20.00 Wilson, W. 897.04 55.62 13.01 68.00 27.54 0.54 26.91 50.00 Utley, H. 678.75 42.08 9.84 14.00 20.84 0.41 20.36 40.00 Fife, L. 877.10 54.38 12.72 33.00 26.93 0.53 26.31 50.00 Smith, L. 790.00 48.98 11.46 59.00…arrow_forward

- How might a business use a payroll register?arrow_forwardAccording to the accountant of Ulster Inc., its payroll taxes for the week were as follows: $137.68 for FICA taxes, $13.77 for federal unemployment taxes, and $92.93 for state unemployment taxes.Journalize the entry to record the accrual of the payroll taxes. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 10.50.)arrow_forwardJournalize the February payroll and the payment of the payroll. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Feb. 28 (To record payroll.) (To record payment of payroll.) Feb. 28arrow_forward

- Exercise 5-9A (Static) What are the two methods payroll accountants use to determine federal income tax withholding amounts? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) F2 # 3 ? Wage-salary method ?Wage-bracket method ? Percentage method ?Salary-bracket method E 80 F3 $ 4 R Q F4 % 5 * 00 8 DII F8 ( 9 A DD F9 0 F10 J K L P 4 F11arrow_forwardWhen an employer does not have a sophisticated time-keeping system, it is valid to accrue a percentage of wages at end-of-period based on:a. it is never valid to estimate an end-of-period adjustment.b. a percentage based on the previous period's payroll (for example. 4 out of 5 days = 80% x prior payroll).c. a percentage that external auditors provide the payroll clerk.d. a percentage suggested by the IRS.arrow_forwardwhat are the examples of independent verification controls in a payroll accounting systemarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education