FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

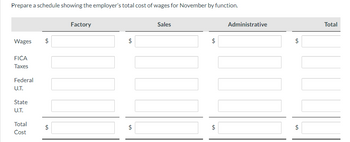

Transcribed Image Text:Prepare a schedule showing the employer's total cost of wages for November by function.

Wages

FICA

Taxes

Federal

U.T.

State

U.T.

Total

Cost

$

tA

$

Factory

$

LA

$

+A

Sales

$

$

Administrative

$

LA

$

CA

Total

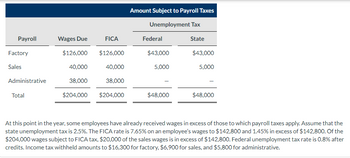

Transcribed Image Text:Payroll

Factory

Sales

Administrative

Total

Wages Due

$126,000

40,000

38,000

$204,000

FICA

$126,000

40,000

38,000

$204,000

Amount Subject to Payroll Taxes

Unemployment Tax

State

Federal

$43,000

5,000

$48,000

$43,000

5,000

$48,000

At this point in the year, some employees have already received wages in excess of those to which payroll taxes apply. Assume that the

state unemployment tax is 2.5%. The FICA rate is 7.65% on an employee's wages to $142,800 and 1.45% in excess of $142,800. Of the

$204,000 wages subject to FICA tax, $20,000 of the sales wages is in excess of $142,800. Federal unemployment tax rate is 0.8% after

credits. Income tax withheld amounts to $16,300 for factory, $6,900 for sales, and $5,800 for administrative.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

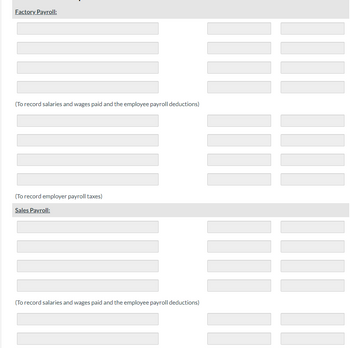

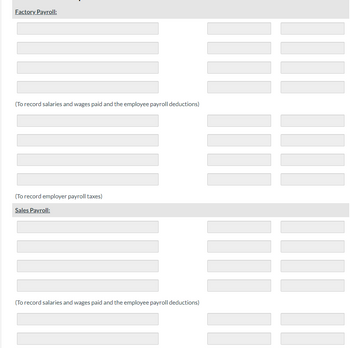

Transcribed Image Text:Factory Payroll:

(To record salaries and wages paid and the employee payroll deductions)

(To record employer payroll taxes)

Sales Payroll:

(To record salaries and wages paid and the employee payroll deductions)

|| |

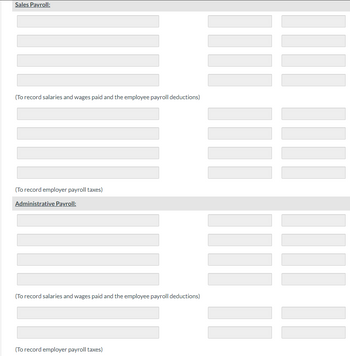

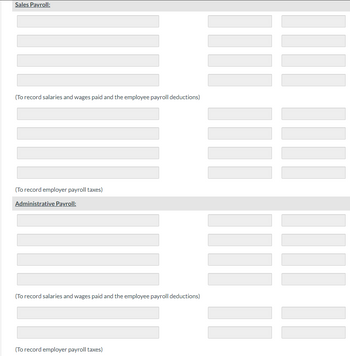

Transcribed Image Text:Sales Payroll:

(To record salaries and wages paid and the employee payroll deductions)

(To record employer payroll taxes)

Administrative Payroll:

(To record salaries and wages paid and the employee payroll deductions)

(To record employer payroll taxes)

||||

II

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:Factory Payroll:

(To record salaries and wages paid and the employee payroll deductions)

(To record employer payroll taxes)

Sales Payroll:

(To record salaries and wages paid and the employee payroll deductions)

|| |

Transcribed Image Text:Sales Payroll:

(To record salaries and wages paid and the employee payroll deductions)

(To record employer payroll taxes)

Administrative Payroll:

(To record salaries and wages paid and the employee payroll deductions)

(To record employer payroll taxes)

||||

II

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- provide correct answer otherwise i give unhelpfull ratesarrow_forwarda. Incurred $105,000 of direct labor in its Mixing department and $90,000 of direct labor in its Shaping department. Hint. Credit Factory Wages Payable. b. Incurred indirect labor of $23,000. Hint. Credit Factory Wages Payable. View transaction list Journal entry worksheetarrow_forwardUse the combined wage bracket tables, Exhibit 9-3 and Exhibit 9-4, to solve. Employee MaritalStatus WithholdingAllowances Pay Period GrossEarnings CombinedWithholding Reese, S. M 4 Weekly $1,211 $arrow_forward

- McBride and Associates employs two professional appraisers, each having a different specialty. Debbie specializes in commercial appraisals and Tara specializes in residential appraisals. The company expects to incur total overhead costs of $299,610 during the year and applies overhead based on annual salary costs. The salaries and billable hours of the two appraisers are estimated to be as follows: Annual Salary Billable Hours Debbie $ 126,480 1,700 Tara $ 73,260 1,650 The accountant for McBride and Associates is computing the hourly rate that should be used to charge clients for Debbie's and Tara's services. The hourly billing rate should be set to cover the total cost of services (salary plus overhead) plus a 25 percent markup. Required: 1. Compute the predetermined overhead rate.. 2. Compute the hourly billing rates for Debbie and Tara.arrow_forwardcalculating gross earnings THe lw pay its employees on a hourly wage. Fing gross earings for each employee. Hours worked hours wage gross earnings pat 38 5.96 steve 23 5.50 mary 32 6.19arrow_forwardCompute commission and gross payarrow_forward

- Analyze and review the following items and determine the appropriate journal entry. Record the journal entryarrow_forwardExercise 8-3 (Algo) Direct Materials Budget [LO8-4] Three grams of musk oil are required for each bottle of Mink Caress, a popular perfume made by a company in western Siberia. The cost of the musk oil is $2.20 per gram. Budgeted quarterly production of Mink Caress is given below for Year 2 and the first quarter of Year 3: Units of raw materials needed per unit of finished goods Units of raw materials needed to meet production First 72,000 Total units of raw materials needed Year 2 Units of raw materials to be purchased Unit cost of raw materials Cost of raw materials to purchased Second 102,000 Required: Prepare a direct materials budget for musk oil, by quarter and in total, for Year 2. Budgeted production, in bottles The inventory of musk oil at the end of a quarter must equal 20% of the following quarter's production needs. A total of 43,200 grams of musk oil will be on hand to start the first quarter of Year 2. Third 162,000 Mink Caress Direct Materials Budget - Year 2 First…arrow_forwardP3-10 Summary of payroll procedures Megerle Custom Cabinet Co. uses the job order cost system. In recording payroll transactions, the following accounts are used: Cash Wages Payable FICA Tax Payable Federal Unemployment Tax Payable State Unemployment Tax Payable Employees Income Tax Payable Payroll Administrative Salaries Miscellaneous Administrative Expense Sales Salaries Miscellaneous Selling Expense Factory Overhead Work in Process Factory employees are paid weekly, while all other employees are paid semimonthly on the fifteenth and the last day of each month. All salaries and wages are subject to all taxes. The income tax withheld amounts to 10% of gross wages. Following is a narrative of transactions completed during January: Jan.7 Recorded total earnings of factory employees amounting to $68,200, less deductions for employees’ income taxes and FICA taxes. 7 Issued check for payment of the payroll. 14 Recorded total earnings of factory employees amounting to $66,300, less…arrow_forward

- 2 ts eBook Mc Graw Hill The following information is for Punta Company for July: a. Factory overhead costs were applied to jobs at the predetermined rate of $50.00 per labor hour. Job Sincurred 6,250 labor hours; Job T used 4,350 labor hours. b. Job S was shipped to customers during July. c. Job T was still in process at the end of July. d. The overapplied or underapplied overhead to the Cost of Goods Sold account was closed at the end of July. e. Factory utilities, factory depreciation, and factory insurance incurred are summarized as follows: " Utilities Depreciation Insurance Total f. Direct materials and indirect materials used are as follows: $ 16,500 48,750 Job Job T Indirect labor Total $ 19,500 84,750 Job S $ 32,250 Job T $75,000 37,250 14,250 $46,500 $ 112,250 Total 107,250 $ 51,500 158,750 214,750 $373,500 Material A Material B Subtotal Indirect materials Total g. Direct labor incurred for the two jobs and indirect labor are as follows: $ 63,000 52,500 148,000 $263,500…arrow_forwardCustom Hot Rods, Inc. provided you the January 31, 2021 account balances listed below: Finished Goods Inventory, January 1st Factory Supervisory Salaries Income Tax Expense Raw Materials Inventory, January 1st Work In Process Inventory, January 1st Sales Salaries Expense Factory Depreciation Expense Finished Goods Inventory, January 31st Raw Materials Purchases Work In Process Inventory, January 31st Factory Utilities Expense Direct Labor Raw Materials Inventory, January 31st Sales Returns and Allowances Indirect Labor Account Balances $41,365 14,855 6,440 16,375 14,605 24,224 8,400 65,615 163,520 24,390 16,763 117,915 32,510 21,850 39,140 Instructions Using a proper heading and format, prepare a Schedule of Cost of Goods Manufactured for Custom Hot Rods, Inc. for the month ended January 31, 2021.arrow_forwardRequired information [The following information applies to the questions displayed below.] Marco Company shows the following costs for three jobs worked on in April. Balances on March 31 Direct materials used (in March) Direct labor used (in March) Overhead applied (March) Costs during April Direct materials used Direct labor used Overhead applied Status on April 30 a. Materials purchases (on credit). b. Direct materials used. View transaction list Journal entry worksheetarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education