ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

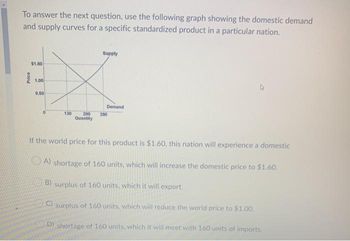

Transcribed Image Text:To answer the next question, use the following graph showing the domestic demand

and supply curves for a specific standardized product in a particular nation.

Price

$1.60

1.00

0.50

0

130

200

Quantity

Supply

Demand

290

If the world price for this product is $1.60, this nation will experience a domestic

A) shortage of 160 units, which will increase the domestic price to $1.60.

B) surplus of 160 units, which it will export.

C) surplus of 160 units, which will reduce the world price to $1.00.

D) shortage of 160 units, which it will meet with 160 units of imports.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Use the graph below and the following information to answer the next question(s). The world price of soybeans is $2.00 per bushel, and the importing country is small enough not to affect the world price. 2.25 2.00 Figure 6.1 60 70 130 140 Q/millions bushels World price Based on Figure 6.1, given a tariff of $0.25 per bushel on soybean imports, how much will domestic production increase?arrow_forwardHow do tariffs impact domestic industries and international trade relationships?arrow_forwardPrice of Carnations $14 $400 $100 $500 $200 12- 10- 8 6 4 2 Domestic Supply Tariff World Price Domestic Demand 100 200 300 400 500 600 Quantity of Carnations (in dozens) Refer to the figure above. What is the amount of deadweight loss caused by the tariff?arrow_forward

- 4. A graphical comparison of tariffs and quotas Alagir and Ertil are small countries that protect their economic growth from rapidly advancing globalization by limiting the import of rugs to 20 million. To this end, each country imposes a different type of trade barrier when the world price (Pw) is $3,000. In Alagir, the government decides to impose a tariff of $2,000 per rug; in Ertil, the government implements a quota of 20 million rugs. Assume that Alagir and Ertil have identical domestic demand (Do) and supply (S) curves for rugs as shown on the following graph. Under these conditions, the price of rugs is $5,000 per rug in each country. PRICE (Dolars per rug) 10000 9000 8000 7000 8000 5000 4000 3000 2000 1000 D 0 P.. 10 D₂ * 20 D₁ XX ☆ XX 40 30 50 60 70 QUANTITY (Millions of rugs) S 80 90 100 (?)arrow_forwardLesson 12 Question 1arrow_forwardPrice $36 $30 $26 I I Home market S D 20 40 80 100 Quantity Price 40 World market I 80 X* + t ·X* Imports The graphs show the case for a tariff imposed by a large country. According to these graphs, if the world price of the product is given as $30 and a $10 tariff is imposed, then the new price after the tariff is $36. So the terms-of-trade gain is 40 80 10 160arrow_forward

- Predict what happen to the international price and quantity traded of the manufactured good in Figure 1.4 with an improvement in technology in the domestic market.arrow_forwardThe following graph shows the domestic supply of and demand for maize in Burundi. The world price (Pw) of maize is $270 per ton and is represented by the horizontal black line. Throughout the question, assume that the amount demanded by any one country does not affect the world price of maize and that there are no transportation or transaction costs associated with international trade in maize. Also, assume that domestic suppliers will satisfy domestic demand as much as possible before any exporting or importing takes place. 450 Domestic Demand Domestic Supply 430 410 390 370 350 330 310 290 P 270 250 40 80 120 180 200 240 280 320 360 400 QUANTITY (Tons of maize) If Burundi is open to international trade in maize without any restrictions, it will import tons of maize. Suppose the Burundian government wants to reduce imports to exactly 160 tons of maize to help domestic producers. A tariff of per ton will achieve this. A tariff set at this level would raise $ in revenue for the…arrow_forwardQuestion 7 Consider again this same graph: Price 40 8 7 6 5 4 3 2 0 Tariff Domestic supply Domestic demand 10 20 30 40 50 60 70 80 World price Quantity Tell me the amount of gains from trade, carefully following all numeric instructions.arrow_forward

- The following graph shows the domestic market for oil in the United States, where SDSD is the domestic supply curve, and DDDD is the domestic demand curve. Assume the United States is considered a large nation, meaning that changes in the quantity of its imports due to a tariff influence the world price of oil. Under free trade, the United States faced a total supply schedule of SD+WSD+W, which shows the quantity of oil that both domestic and foreign producers together offer domestic consumers. In this case, the free-trade equilibrium (black plus) occurs at a price of $240 per barrel of oil and a quantity of 9 million barrels. At this price, the United States imports 6 million barrels of oil. Suppose the U.S. government imposes a $60-per-barrel tariff on oil imports.arrow_forwardAssume that Canada is an importer of televisions and that there are no trade restrictions. Canadian consumers buy 1.2 million televisions per year, of which 600,000 are produced domestically and 600,000 are imported. Suppose that a technological advance among Japanese television manufacturers causes the world price to fall $800 to $700. Draw a graph to show how this change affects the welfare of Canadian consumers and Canadian producers and how it affects total surplus in Canada. Label the diagram carefully to show all the areas using letters of alphabets. (Do not shade the areas). After the fall in price, consumers buy 1.4 million televisions, of which 400,000 are produced domestically and 1 million are imported. Calculate the change (this will be only the area either gained or lost by consumers and producers) in consumer surplus, producer surplus and total surplus due to price reduction. Provide numerical answers by calculating the area of change in surplus due to fall in…arrow_forwardDiscuss the implications of a large country model with import quota. Use the below graph to support your analysis.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education