ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

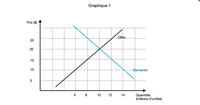

Chart 1 below illustrates the tennis shoe market in Canada.

5-1- If Canada did not trade with other countries in this market, then what would be the

The price of tennis shoes in the world market is $ 15.

Suppose Canada opens up to free trade with other countries.

5-2- What would then be the quantity

5-3- Calculate and graphically represent the variation in social surplus brought about by opening up to free trade.

Transcribed Image Text:Graphique 1

Prix ($)

.Qffre

25

20

15

10

Demande

5

Quantités

(millions d'unités)

6

10

12

14

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The following table shows the demand, supply, and price of tulips in the Netherlands. If the world price of tulips is $1 and there are no trade restrictions, the Netherlands will: Table 19.2 Domestic Supply and Demand for Tulips in the Netherlands Demand Supply Q P($) Q P(S) 12,000 6,000 10,000 1 7,000 1 8,000 2 8,000 6,000 3 9,000 3. 4,000 4 10,000 O produce 9,000, consume 6,000, and export 6,000 tulips. O produce 7,000, consume 10,000, and export 3,000 tulips. O produce 10,000 and consume 10,000 tulips. hparrow_forward4. Effects of a tariff on international trade The following graph shows the domestic demand for and supply of limes in Zambia. The world price (Pw) of limes is $810 per ton and is displayed as a horizontal black line. Throughout the question, assume that all countries under consideration are small, that is, the amount demanded by any one country does not affect the world price of limes and that there are no transportation or transaction costs associated with international trade in limes. Also, assume that domestic suppliers will satisfy domestic demand as much as possible before any exporting or importing takes place. PRICE (Dollars per ton) 1305 1250 1195 1140 1065 1030 975 9.20 865 810 755 Domestic Demand Domestic Supplyarrow_forwardThe following figure illustrates the tomato market for Mexico, assumed to be a "small" country that is unable t to affect the world price. Suppose the world price of tomato is given and constant at $100 per ton. SM is the domestic supply and DM is the domestic demand for Mexico. Now suppose the Mexican government provides production subsidy of $200 per ton to its tomato producers. SM (with subsidy) is Mexico's supply schedule with production subsidy. Price ($) 800 300 100 0 2 8 SM 20 SM (with subsidy) World price DM Tons of Tomatoes Refer to the figure above. As a result of the production subsidy, the deadweight loss to Mexico equals [Select]arrow_forward

- The following graph shows the domestic supply of and demand for soybeans in Guatemala. The world price (Pw ) of soybeans is $540 per ton and is represented by the horizontal black line. Throughout the question, assume that the amount demanded by any one country doès not affect the world price of soybeans and that there are no transportation or transaction costs associated with international trade in soybeans. Also, assume that domestic suppliers will satisfy domestic demand as much as possible before any exporting or importing takes place. 900 Domestic Demand Domestic Supply 855 810 765 720 675 630 585 Pw 540 495 450 40 80 120 160 200 240 280 320 360 400 QUANTITY (Tons of soybeans) PRICE (Dollars per ton)arrow_forwardThe graph above is the U.S. market for some imported good. Supply is a flat curve. The U.S. can import the Chinese good for $40 and the Mexican good for $48. Assume the U.S. imposes $10 tariffs on each unit of the imported good. What will be the quantity imported? From which country? How your answer will change if the U.S. keep the $10 tariffs but join a trade bloc with Mexico? Will the country’s wellbeing increase or decrease? By how much (hint find the change in consumer surplus and the change in government revenue)? Explain your answers.arrow_forwardNonearrow_forward

- Price P1 P3 Y V P2 U D Quantity Q1 Q4 Qs Q3 Figure 4 Domestic market for a good Figure 4 shows a country's domestic market for a good. There is perfect competition. The supply curve, S, is the domestic producers' supply curve for the good. D is the domestic consumers' demand curve. With free trade, the price in the domestic economy equals the world price, P2. However the domestic government has imposed a tariff on imports that has raised the price of the good in the domestic economy from P2 to P3. Which area or areas of the diagram show the government's tariff revenue? Select one answer. Select one: O Z O w plus Y ох O X plus Z Narrow_forwardNonearrow_forward2. Welfare effects of a tariff in a small country Suppose Guatemala is open to free trade in the world market for oranges. Since Guatemala is small relative to the international market, the demand for and supply of oranges in Guatemala have no impact on the world price. The following graph shows the domestic market for oranges in Guatemala. The world price of a ton of oranges is Pw = $350. On the following graph, use the green triangle (triangle symbols) to shade the area representing consumer surplus (CS) when the economy is at the free-trade equilibrium. Then, use the purple triangle (diamond symbols) to shade the area representing producer surplus (PS). PRICE (Dollars per ton) 710 Domestic Demand Domestic Supply 670 630 590 550 510 470 430 28 8 8 8 8 8 8 8 390 350 P. 310 0 15 30 45 60 75 90 105 120 135 150 QUANTITY (Tons of oranges) CS PS Because Guatemala participates in international trade in the market for oranges, it will import tons of oranges. Now suppose the Guatemalan…arrow_forward

- 3. Welfare effects of a tariff in a small country Suppose Ronduras is open to free trade in the world market for soybeans. Because of Honduras's small size, the demand for and supply of soybeans in Honduras do not affect the world price. The following graph shows the domestic soybeans market in Honduras. The world price of soybeans is Pw = $400 per ton. On the following graph, use the green triangle (triangle symbols) to shade the area representing consumer surplus (CS) when the economy is at the free-trade equilibrium. Then, use the purple triangle (diamond symbols) to shade the area representing producer surplus (PS). 1200 Domestic Demand Domestic Supply 1100 CS 1000 900 PS 800 700 600 500 400 300 200 100 120 140 160 180 200 20 40 60 80 QUANTITY (Tons of soybeans) PRICE (Dollars pe: ton)arrow_forwardTopic 3 Assignment The following graph shows the domestic supply of and demand for maize in Bangladesh. Bangladesh is open to international trade of maize without any restrictions. The world price (Pw) of maize is $245 per ton and is represented by the horizontal black line. Throughout this problem, assume that the amount demanded by any one country does not affect the world price of maize and that there are no transportation or transaction costs associated with international trade in maize. Also, assume that domestic suppliers will satisfy domestic demand as much as possible before any exporting or importing takes place. Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. 470 Supply 420 305 X I I Demand I PRICE (Dollars perton) 445 245 720 D P W 40 80 120 150 200 240 280 320 350…arrow_forwardSuppose you have the following for white t-shirts market:Market demand is P=125-(3/8)QMarket supply is P=5+(1/8)Q. there is now a global supply that is horizontal at $15. But the government now imposes a tariff of $5 per unit of t-shirt.a. Obviously the world price and domestic price will now be $20. Calculate the quantityproduced and demanded domestically? b. Using graphs show the changes in CS (Consumer Surplus) and PS (Producer Surplus) comparedto Free Trade. Show also the government revenue, which is tariff per t-shirt times the new level of imports. Who gains in comparison to Free Trade scenario? Who loses? What is the welfare gain or loss? Show by using graphs.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education