FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

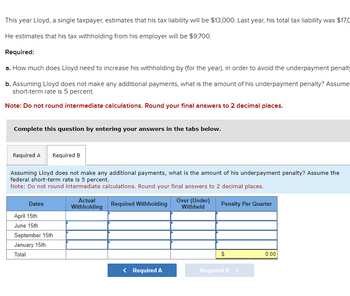

Transcribed Image Text:This year Lloyd, a single taxpayer, estimates that his tax liability will be $13,000. Last year, his total tax liability was $17,0

He estimates that his tax withholding from his employer will be $9,700.

Required:

a. How much does Lloyd need to increase his withholding by (for the year), in order to avoid the underpayment penalty

b. Assuming Lloyd does not make any additional payments, what is the amount of his underpayment penalty? Assume

short-term rate is 5 percent.

Note: Do not round intermediate calculations. Round your final answers to 2 decimal places.

Complete this question by entering your answers in the tabs below.

Required A Required B

Assuming Lloyd does not make any additional payments, what is the amount of his underpayment penalty? Assume the

federal short-term rate is 5 percent.

Note: Do not round intermediate calculations. Round your final answers to 2 decimal places.

Required Withholding

Penalty Per Quarter

Dates

April 15th

June 15th

September 15th

January 15th

Total

Actual

Withholding

< Required A

Over (Under)

Withheld

Required B >

0.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Adelaide is self-employed and must submit estimated quarterly tax payments. Her predicted total tax liability for the current year will be $36,000, and her current withholdings are $18,283. She is advised to determine her quarterly payments by subtracting her current withholdings from her predicted total tax liability and dividing by four. What is a good estimate for Adelaide to use for her quarterly payments?arrow_forwardGive typing answer with explanation and conclusionarrow_forwardChuck, a single taxpayer earns $75,600 in taxable income and $10,700 in interest from and investment in Coty of Heflin bonds. a. if chuck earns an additional $40,000 of taxable income, whats his marginal tax rate on this income? b. What is his marginal rate if instead he had $40,000 of additional deductions?arrow_forward

- How does the tax benefit rule apply in the following cases? a. In 2019, the Orange Furniture Store, an accrual method sole proprietorship, sold furniture on credit for $1,000 to Sammy. The cost of the furniture was $600. In 2020, Orange took a bad debt deduction for the $1,000. In 2021, Sammy inherited some money and paid Orange the $1,000 he owed. Orange's owner was in the 35% marginal tax bracket in 2019, the 12% marginal tax bracket in 2020, and the 35% marginal tax bracket in 2021. Orange Furniture must include $fill in the blank 102a7e000ffcfe0_1 in gross income as the recovery of a prior deduction. The timing of the income and deductions cost Orange $fill in the blank 102a7e000ffcfe0_2. b. In 2020, Marvin, a cash basis taxpayer, took a $2,000 itemized deduction for state income taxes paid; the deduction was not limited by the SALT cap. This increased his itemized deductions to a total that was $800 more than the standard deduction. In 2021, Marvin received a…arrow_forwardToby and Nancy are engaged and plan to get married. During 2023, Toby is a full-time student and earns $7,600 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Nancy is employed and has wages of $59,400. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar. a. Compute the following: Gross income and AGI Standard deduction (single) Taxable income Income tax Gross income and AGI Toby Filing Single b. Assume that Toby and Nancy get married in 2023 and file a joint return. What is their taxable income and income tax? Round your final answer to the nearest whole dollar. Standard deduction (married, filing jointly) Taxable income Income tax Nancy Filing Single Married Filing Jointly c. How much income tax can Toby and Nancy save if…arrow_forwardPROBLEM: Jose Diaz has a federal tax levy of $4,119.90 against him. If Diaz is single with three personal exemptions and had a take home pay of $1020.00 this week, how much would his employer take from his pay to satisfy part of the tax levy? Federal tax levy amount _________arrow_forward

- Trudy's AGI last year was $366,000. Her Federal income tax came to $109,800, paid through both withholding and estimated payments. This year, her AGI will be $549,000, with a projected tax liability of $82,350, all to be paid through estimates. Trudy wants to pay the least amount of tax that does not incur a penalty. Note: Ignore the annualized income method. If required, round intermediate calculations to two decimal place and your final answer to the nearest dollar. a. Compute Trudy's total estimated tax payments for this year.Under the current-year method: $Under the prior-year method: $ b. Assume instead that Trudy's AGI last year was $86,000 and resulted in a Federal income tax of $17,200. Determine her total estimated tax payments for this year.Under the current-year method: $Under the prior-year method: $arrow_forwardAmy is a single taxpayer. Her income tax liability in the prior year was $3,803. Amy earns $50,000 of income ratably during the current year and her tax liability is $4,315. In order to avoid penalty, Amy's smallest amount of required annual withholding and estimated payments is: a.$4,747 b.$4,315 c.$3,423 d.$3,884 ( Incorrect) e.$3,803arrow_forwardSubject -account Please help me. Thankyou.arrow_forward

- sabel, a calendar-year taxpayer, uses the cash method of accounting for her sole proprietorship. In late December she received a $41,000 bill from her accountant for consulting services related to her small business. Isabel can pay the $41,000 bill anytime before January 30 of next year without penalty. Assume her marginal tax rate is 37 percent this year and next year, and that she can earn an after-tax rate of return of 6 percent on her investments. Required: What is the after-tax cost if Isabel pays the $41,000 bill in December? What is the after-tax cost if Isabel pays the $41,000 bill in January? Use Exhibit 3.1. Note: Round your answer to the nearest whole dollar amount. Based on requirements a and b, should Isabel pay the $41,000 bill in December or January?arrow_forwardMichael has the following items of income and expense for the current year: Interest income Qualified dividend income Investment interest expense Investment counseling fee His marginal tax rate is 37% and his long-term capital gains rate is 20%. (a) $12,850 $10,570 $19,220 $2,160 How much of the investment interest expense can Michael deduct as an itemized deduction if no election is made to treat any of the qualified dividend income as investment income? Deduction $arrow_forwardn each of the following cases, discuss how the taxpayers might respond to a tax rate increase in a manner consistent with the income effect. a. Mr. Edwards earns $32,000 a year as an employee, and Mrs. Edwards doesn’t work.b. Mr. Frank earns $22,000 a year as an employee, and Mrs. Frank earns $10,000 a year as a self-employed worker.c. Mr. George earns $22,000 a year as an employee, and Mrs. George earns $10,000 a year as an employee.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education