FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

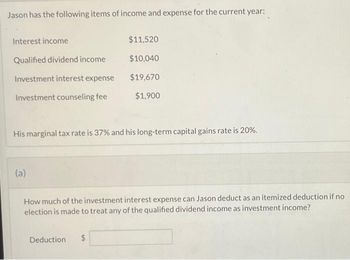

Jason has the following items of income and expense for the current year: His marginal tax rate is37%and his long-term

Transcribed Image Text:Jason has the following items of income and expense for the current year:

Interest income

Qualified dividend income

Investment interest expense

Investment counseling fee

His marginal tax rate is 37% and his long-term capital gains rate is 20%.

(a)

$11,520

$10,040

$19,670

$1,900

How much of the investment interest expense can Jason deduct as an itemized deduction if no

election is made to treat any of the qualified dividend income as investment income?

Deduction $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Henrich is a single taxpayer. In 2019, his taxable income is $456,500. What is his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates, Estates and Trusts for reference. (Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no answer blank. Enter zero if applicable.) Estates and Trusts If taxable income is over: But not over: The tax is: $ 0 $ 2,600 10% of taxable income $ 2,600 $ 9,300 $260 plus 24% of the excess over $2,600 $ 9,300 $12,750 $1,868 plus 35% of the excess over $9,300 $12,750 $3,075.50 plus 37% of the excess over $12,750 Tax Rates for Net Capital Gains and Qualified Dividends Rate* Taxable Income Married Filing Jointly Married Filing Separately Single Head of Household Trusts and Estates 0% $0 - $78,750 $0 - $39,375 $0 - $39,375 $0 - $52,750 $0 - $2,650 15% $78,751 - $488,850 $39,376…arrow_forwardMichael earns $10,000, and his tax liability for the current year is $8,000, double what it was the previous year. to avoid penalties, how much do his combined payments (withholdings and ccredits) haave to be?arrow_forwardChuck, a single taxpayer, earns $78,800 in taxable income and $14,400 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places. a. Marginal tax rate b. Marginal tax rate % %arrow_forward

- Determine the amount of the standard deduction allowed for 2021 in the following independent situations. In each case, assume that the taxpayer is claimed as another person's dependent. Amount of theStandard Deductiona. Curtis, age 18, has income as follows: $700 interest from a certificate of deposit and $12,600 from repairing cars. $fill in the blank 1b. Mattie, age 18, has income as follows: $600 cash dividends from investing in stock and $4,700 from working as a lifeguard at a local pool. $fill in the blank 2c. Jason, age 16, has income as follows: $675 interest on a bank savings account and $800 for painting a neighbor's fence. $fill in the blank 3d. Ayla, age 15, has income as follows: $400 cash dividends from a stock investment and $500 from grooming pets. $fill in the blank 4e. Sarah, age 67 and a widow, has income as follows: $500 from a bank savings account and $3,200 from babysitting.arrow_forwardGive typing answer with explanation and conclusionarrow_forwardPlease help me.....arrow_forward

- Hardevarrow_forwardChuck, a single taxpayer earns $75,600 in taxable income and $10,700 in interest from and investment in Coty of Heflin bonds. a. if chuck earns an additional $40,000 of taxable income, whats his marginal tax rate on this income? b. What is his marginal rate if instead he had $40,000 of additional deductions?arrow_forwardMr. Coleman, an unmarried individual, has the following income items: Interest income Schedule C net profit $23,200 61,640 He has $10,300 itemized deductions and no dependents. Mr. Coleman's Schedule C income is qualified business income (non service). Required: Compute Mr. Coleman's income tax. Assume the taxable year is 2020. Use Individual Tax Rate Schedules and Standard Deduction Table. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) AGI Taxable Income Income tax Amountarrow_forward

- Trudy's AGI last year was $366,000. Her Federal income tax came to $109,800, paid through both withholding and estimated payments. This year, her AGI will be $549,000, with a projected tax liability of $82,350, all to be paid through estimates. Trudy wants to pay the least amount of tax that does not incur a penalty. Note: Ignore the annualized income method. If required, round intermediate calculations to two decimal place and your final answer to the nearest dollar. a. Compute Trudy's total estimated tax payments for this year.Under the current-year method: $Under the prior-year method: $ b. Assume instead that Trudy's AGI last year was $86,000 and resulted in a Federal income tax of $17,200. Determine her total estimated tax payments for this year.Under the current-year method: $Under the prior-year method: $arrow_forwardLawyer is in the highest federal tax bracket in the current year. What is Lawyer’s net capital gain and how is it taxed if Lawyer has a $5,000 gain from a collectible, a $5,000 unrecaptured IRC Sec 1250 gain, a $5,000 gain from stock, and a $10,000 loss from stock, all held long term.arrow_forwardIn 2020, Mackenzie had employment income of $40,000, property income of $3,000, a business loss of $22,000, an allowable business investment loss of $5,000, income from an RRSP withdrawal of $2,000, and a capital loss of $40,000 on the sale of shares in a public corporation. Mackenzie hopes that the losses will result in a net income for tax purposes of $O. Required: A) Determine Mackenzie's net income for tax purposes in accordance with Section 3 of the Income Tax Act. B) Based on your answer in Part A, explain to Mackenzie why there will or will not be a tax liability this year, assuming that the taxable income will be equal to the net income for tax purposes. C) How would your answer change in Part A if Mackenzie realized a taxable capital gain of $30,000 in 2020?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education