FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

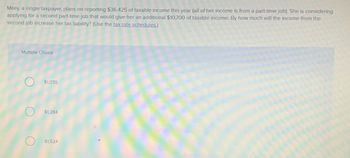

Transcribed Image Text:Miley, a single taxpayer, plans on reporting $36,425 of taxable income this year (all of her income is from a part-time job). She is considering

applying for a second part-time job that would give her an additional $10,700 of taxable income. By how much will the income from the

second job increase her tax liability? (Use the tax rate schedules.)

Multiple Choice

O

$1,070

$1,284

$1,524

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Use the following information Molly has collect to help her determine her taxable income for the year: Salary from her job 115,100 Interest earn from 1,280 savings Interest paid on student loans Your Answer: Answer 905 Standard deduction 12,950 Itemized deductions 842 Child tax credit 2000arrow_forwardLorna Hall’s real estate tax of $2,010.88 was due on December 14, 2019. Lorna lost her job and could not pay her tax bill until February 27, 2020. The penalty for late payment is 612%612% ordinary interest. (Use Days in a year table.)a. What is the penalty Lorna must pay? (Round your answer to the nearest cent.) Penalty Pay b. What is the total amount Lorna must pay on February 27? (Round your answer to the nearest cent.) Total Amountarrow_forwardKole earns $170,000 in 2023 in his job as a sales manager. What is his FICA tax? (Employee portion of Social Security and Medicare Tax) O $10,063 $12.255 O $13,005 O $12,397arrow_forward

- Erica has the following: Salary = $30,000; RPP contribution = $2,000; mortgage interest = $1,000; Union dues = $800; Basic Personal Amount = $11,635. Her federal income tax rate = 15%. What amount of federal income tax does Erica owe? A) $2,335 B) $4,200 C) $2,259 D) $2,829arrow_forwardManny, a single taxpayer, earns $65,600 per year in taxable income and an additional $12,060 per year in city of Boston bonds. What is Manny's current marginal tax rate for 2021? (Use tax rate schedule.) Multiple Choice 11.23 percent 12.00 percent 12.93 percent 15.34 percent None of the choices are correct.arrow_forwardPROBLEM: Jose Diaz has a federal tax levy of $4,119.90 against him. If Diaz is single with three personal exemptions and had a take home pay of $1020.00 this week, how much would his employer take from his pay to satisfy part of the tax levy? Federal tax levy amount _________arrow_forward

- If Susie earns $750,000 in taxable income, how much tax will she pay as a single taxpayer for 2023? (Use tax rate schedule.) Multiple Choice $207,414 $277,500 $237,832 $189,625 None of the choices are correct.arrow_forwardMark's gross annual salary is $78,082 with biweekly paychecks. If he is married and has 3 dependent children, compute the biweekly withholding his employer will send to the IRS. Use the following information: • Biweekly allowance: $165.38 per person. 2022 Married Person Biweekly Withholding Table Taxable Wages 50-$498 $498-$893 $893-$2,105 $2,105-$3,924 $3,924-$7,038 $7,038-$8,804 $8,804-$12,957 $12,957 or more Wages Withholding $0.00 50.00 plus 10% of amount exceeding $498 $39.50 plus 12% of amount exceeding $893 $184.94 plus 22% of amount exceeding $2,105 $585.12 plus 24% of amount exceeding $3,924 $1,332.48 plus 32% of amount exceeding $7,038 $1,897.60 plus 35% of amount exceeding $8,804 $3,351.15 plus 37% of amount exceeding $12,957 Round your answer to the nearest dollar.arrow_forwardSuppose you made $70,390 of income from wages and $178 of taxable interest. You also made contributions of $6400 to a tax deferred retirement account. You have 2 dependents and file as single. The standard deduction is 3900 and the exemption is 5900 per exemption. What is your Taxable Income? Answer to the nearest dollar.arrow_forward

- Clayton received a $140,000 distribution from his 401(k) account this year. Assuming Clayton's marginal tax rate is 25 percent, what is the total amount of tax and penalty Shauna will be required to pay if she receives the distribution on her 62nd birthday and she has not yet retired? Group of answer choices $0 $14,000 $35,000 $49,000 None of the choices is correct.arrow_forwardUse the marginal tax rates in the table below to compute the tax owed in the following situation. The tax owed is S (Simplify your answer. Round to the nearest dollar as needed.) Marco is married filing separately with a taxable income of $67,900. Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Married Filing Separately up to $9325 up to $37,950 up to $76,550 up to $116,675 up to $208,350 up to $235,350 above $235,350 $6350 $4050arrow_forwardBrooke, a single taxpayer, works for Company A for all of 2022, earning a salary of $57,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education