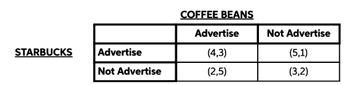

There are two competing companies: Starbucks and Coffee Bean. Both companies want to determine whether they should launch a new advertising campaign for their coffee shops. If both companies start advertising, Starbucks will attract 4 new customers, while Coffee Bean will attract 3 new customers. However, if both companies decide not to advertise, Starbucks will attract only 3 new customers and 2 new customers for Coffee Bean. If only Starbucks decides to advertise, it will attract 5 new customers, while Coffee Bean will attract only 1 new customer for not advertising. While if only Coffee Bean decides to advertise, it will attract 5 new customers, and Starbucks will only attract 2 new customers for not advertising.

What is the optimal strategy for Coffee Bean if Starbucks chooses to Advertise? Please explain in detail

In relation to that, if Coffee Bean chooses to Advertise, the Payoff is __.

In relation to that, if Coffee Bean chooses Not to Advertise, the Payoff is __.

What is the optimal strategy for Coffee Bean if Starbucks chooses not to Advertise? Please explain in detail

In relation to that, if Coffee Bean chooses to Advertise, the Payoff is __.

In relation to that, if Coffee Bean chooses Not to Advertise, the Payoff is __.

What is the Dominant Strategy for Coffee Bean regardless of what Starbucks decides to do? Explain in three paragraphs long your findings.

The Nash Equilibrium for both coffee shops is to __.

Describe this game in its payoff table form. Explain in three long paragraphs your overall findings.

Step by stepSolved in 3 steps

- Rawlding is a manufacturer in the oligopolistically competitive market for footballs. Two other manufacturers, Spaldon and Wilke, compete with Rawlding for football consumers. Rawlding faces the demand curve for footballs depicted on the graph. Initially, Rawlding charges $30 per football, producing and selling 7 million footballs per year. PRICE (Dollars per ball) 36 35 34 33 32 31 30 29 28 27 26 O 7 8 FOOTBALLS (Millions of balls) 9 10 G As an oligopolist, Rawlding is a price maker. If Rawlding raises the price of its football from $30 to $32 per ball, the quantity of Rawlding footballs demanded by million footballs per year. If Rawlding reduces the price of its football from $30 to $28 per ball, the quantity of by million footballs per year. (Hint: Click on the points on the graph to see their coordinates.) footballs demanded If Rawlding raises the price of its football above $30, the kinked demand curve model suggests that Spaldon and Wilke will respond by The portion of Rawlding's…arrow_forward. OPEC, the Organization of Petroleum Exporting Countries, was founded in 1969. Their original objective was to form a cartel to increase the price that they receive for their oil exports. Create a prisoner’s dilemma type game for two large members of OPEC (e.g. Saudi Arabia and Indonesia). Create numbers, where payoffs are total annual oil export revenues for each of these two countries. Verbally explain how you got your numbers. Find the Nash equilibrium. Based on this model, what strategy is in the oil exporters’ best interest (Nash or otherwise)? How do they make it happen? Create another prisoner’s dilemmamodel for all of OPEC on one side, and all non OPEC oil exporting nations on the other side. Create numbers, where payoffs are total annual oil export revenues for each of the two sides. Verbally explain how you created your numbers. Also create your numbers applying the fact that OPEC’s total production capacity is greater than total non OPEC exports…arrow_forwardPart 2: First Long Question There are two French bakeries in a small town: Le Meilleur Croissant (C), owned by Camille, and Le Meilleur Pain Au Chocolat (P), owned by Paul. In each period of an infinitely repeated game, they compete a la Bertrand, with market demand given by Q(pmin) = 10 - Pmin- Even though they sell identical goods, they have different marginal costs: cc = 2 and %3D Cp = 4 (Paul bakes just as well but is bad at business decisions). There are no fixed costs. Question 6 Turns out that Camille and Paul are married, and so they choose prices to maximize the joint profits of the two firms. Because both love baking and love each other, they also jointly decide that both firms should be selling positive amounts in their optimal plan. What prices do they choose? Pc = 6, pp = 11 Pc = 6.5, pp = 6.5 Pc = 6, pp = 6 Pc = 7, pp = 7 %3D O pc = 6, pp = 7arrow_forward

- Hand written solutions are strictly prohibitedarrow_forwardDuopoly: 1. Consider a duopoly game with 2 firms. The market inverse demand curve is given by P(Q) = 120-Q, where Q = 9₁ +9₂ and q; is the quantity produced by firm i. The firm's long run total costs are given by C₁(9₁)=2q₁ and C₂(92)=92, respectively. a. Determine the Nash Equilibrium for Cournot competition, in which firms compete based on quantity. What is each firm's best response as a function of the other firm's output? Graph these best response functions in on the same graph. Compute the associated payoffs for each firm. b. Determine the Nash Equilibrium for Bertrand competition, in which firms compete based on price and stand ready to meet market demand at that price. What is each firm's best response as a function of the other firm's price? Graph these best response functions in on the same graph. Compute the associated payoffs for each firm. Game Tharrow_forwardTwo firms X and Y compete with each other. Firm X can produce one of three products X1, X2, or X3. Similarly, firm Y can produce one of three products Y1, Y1, and Y3. Each firm's profit depends on its own and its competitor's decision about which product to produce. These profits are given in the table below where each cell presents profits corresponding to a pair of chosen strategies with the first number being the profit of firm X and the second being the profit of firm Y. For example, if X chooses to produce X3 and Y chooses to produce Y1, the profit of X will be $15 and the profit of Y will be $20. The firms make their product choice decisions simultaneously and independently of each other. Y1 Y2 Y3 X1 0, 0 12, 8 16, 16 15, 20 18, 9 20, 15 8, 12 18, 18 9, 18 X2 X3 11) Does this game have any equilibrium in dominant strategies? If yes, find all of them. 12) In addition to the equilibria (if any) you found in the previous question, does this game have any other equilibria? If yes,…arrow_forward

- While there is a degree of differentiation between major grocery chains like Albertsons and Kroger, the regular offering of sale prices by both firms for many of their products provides evidence that these firms engage in price competition. For markets where Albertsons and Kroger are the dominant grocers, this suggests that these two stores simultaneously announce one of two prices for a given product: a regular price or a sale price. Suppose that when one firm announces the sale price and the other announces the regular price for a particular product, the firm announcing the sale price attracts 1,000 extra customers to earn a profit of $5,000, compared to the $3,000 earned by the firm announcing the regular price. When both firms announce the sale price, the two firms split the market equally (each getting an extra 500 customers) to earn profits of $2,000 each. When both firms announce the regular price, each company attracts only its 1,500 loyal customers and the firms each earn…arrow_forwardSuppose that two mining companies, Australian Minerals Company (AMC) and South African Mines, Inc. (SAMI), control the only sources of a rare mineral used in making certain electronic components. The companies have agreed to form a cartel to set the (profit-maximizing) price of the mineral. Each company must decide whether to abide by the agreement (i.e., not offer secret price cuts to customers) or not abide (i.e., offer secret price cuts to customers). If both companies abide by the agreement, AMC will earn an annual profit of $36 million and SAMI will earn an annual profit of $24 million from sales of the mineral. If AMC does not abide and SAMI abides by the agreement, then AMC earns $48 million and SAMI earns $6 million. If SAMI does not abide and AMC abides by the agreement, then AMC earns $12 million and SAMI earns $36 million. If both companies do not abide by the agreement, then AMC earns $18 million and SAMI earns $12 million. Complete the following payoff matrix using the…arrow_forwardSpace 1 options: less than or equal to, equal to, greater than or equal to Space 2 options: 0 0.5 1 8 16arrow_forward

- Two duopolists are sharing a market in which they are contemplating whether to compete or to cooperate. If they cooperate and behave like a monopolist they will share the monopolist profit of $1800. If they compete each will get a profit of $800 but if one them cooperates while the other chooses to compete the one who cooperates gets $700 while the one who competes will end up with $1000. Set-up the game, explain the process and show the Nash-equilibrium reached when the game is played.arrow_forwardFill in the blanks: Consider the department store market that has two rivals, DJs and Myer. Each firm can choose to either Advertise or Not Advertise. These choices are made simultaneously. The payoffs are given below in the following figure.arrow_forwardConsider an oligopolistic industry with N competing firms. Suppose that these firms have no fixed costs and that they all have the same marginal costs. Each firm must choose what quantity to produce independently of each other, and all firms must choose at the same time. If we decrease the number of firms in this industry (to, for example N−1), the market price Group of answer choices A. increases B. decreases C. remains unchanged D. becomes nil E. none of the abovearrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education