Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Business 123 Introduction to Investments

May I please have the solution for the following assigment?

Thank you so much!

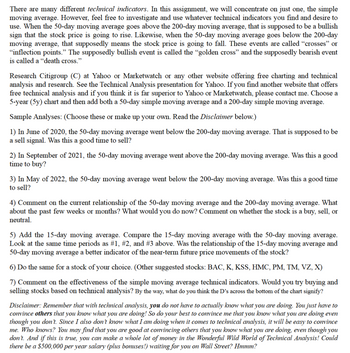

Transcribed Image Text:There are many different technical indicators. In this assignment, we will concentrate on just one, the simple

moving average. However, feel free to investigate and use whatever technical indicators you find and desire to

use. When the 50-day moving average goes above the 200-day moving average, that is supposed to be a bullish

sign that the stock price is going to rise. Likewise, when the 50-day moving average goes below the 200-day

moving average, that supposedly means the stock price is going to fall. These events are called "crosses" or

"inflection points." The supposedly bullish event is called the "golden cross" and the supposedly bearish event

is called a "death cross."

Research Citigroup (C) at Yahoo or Marketwatch or any other website offering free charting and technical

analysis and research. See the Technical Analysis presentation for Yahoo. If you find another website that offers

free technical analysis and if you think it is far superior to Yahoo or Marketwatch, please contact me. Choose a

5-year (5y) chart and then add both a 50-day simple moving average and a 200-day simple moving average.

Sample Analyses: (Choose these or make up your own. Read the Disclaimer below.)

1) In June of 2020, the 50-day moving average went below the 200-day moving average. That is supposed to be

a sell signal. Was this a good time to sell?

2) In September of 2021, the 50-day moving average went above the 200-day moving average. Was this a good

time to buy?

3) In May of 2022, the 50-day moving average went below the 200-day moving average. Was this a good time

to sell?

4) Comment on the current relationship of the 50-day moving average and the 200-day moving average. What

about the past few weeks or months? What would you do now? Comment on whether the stock is a buy, sell, or

neutral.

5) Add the 15-day moving average. Compare the 15-day moving average with the 50-day moving average.

Look at the same time periods as #1, #2, and #3 above. Was the relationship of the 15-day moving average and

50-day moving average a better indicator of the near-term future price movements of the stock?

6) Do the same for a stock of your choice. (Other suggested stocks: BAC, K, KSS, HMC, PM, TM, VZ, X)

7) Comment on the effectiveness of the simple moving average technical indicators. Would you try buying and

selling stocks based on technical analysis? By the way, what do you think the D's across the bottom of the chart signify?

Disclaimer: Remember that with technical analysis, you do not have to actually know what you are doing. You just have to

convince others that you know what you are doing! So do your best to convince me that you know what you are doing even

though you don't. Since I also don't know what I am doing when it comes to technical analysis, it will be easy to convince

me. Who knows? You may find that you are good at convincing others that you know what you are doing, even though you

don't. And if this is true, you can make a whole lot of money in the Wonderful Wild World of Technical Analysis! Could

there be a $500,000 per year salary (plus bonuses!) waiting for you on Wall Street? Hmmm?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- PLEASE SHOW MANUAL WORKINGS ONLY. No spreadsheet computation is allowed! Please fill in the parts as follows: 1. Covariance with MP 2. Correlation with Market Index 3. Beta 4. CAPM Req. Return 5. Valuation 6. Nature of stockarrow_forwardYou estimated the single index (market) model for stocks P and Q with the following results: Return on Stock P: Rp = 0.04 +0.6RM + ep Return on Stock Q: RQ = 0.04 + 1.4RM + еQ Where RM is return on the single index and ep and eq are error terms which are not correlated with anything and have zero means. In addition, the following statistics are known for RM and the error terms: Mean Risk-free rate 3% Single index return, RM 8% Error term for Stock P return, ep 0% Error term for Stock Q return, eq 0% Standard Deviation 15% 20% 10% Based on the information above, calculate the smallest possible portfolio return standard deviation one can get by forming a two-asset portfolio of Stock P and Q. Hint: Recall the formula for the weight of the minimum variance portfolio. (6 marks) b. Suppose you intend to hold a combined portfolio by allocating 50% in the risk-free asset and the remaining in the minimum variance portfolio (i.e., the risky portfolio you constructed in part a). What is the…arrow_forwardIf a stock's expected return plots on or above the SML, then the stock's return is SML, the stock's return is to compensate the investor for risk. cent to compensate the investor for risk. If a stock's expected return plots below the The SML line can change due to expected Inflation and risk aversion. If inflation changes, then the SML plotted on a graph will shift up or down parallel to the old SML. If risk aversion changes, then the SML plotted on a graph will rotate up or down becoming more or less steep if investors become more or less risk averse. A firm can influence market risk (hence its beta coefficient) through changes in the composition of its assets and through changes in the amount of debt it uses. Quantitative Problem: You are given the following information for Wine and Cork Enterprises (WCE): Tar 4%; 10 % ; RPM 6%, and beta - 1.1 What is WCE's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. -75 % If inflation…arrow_forward

- (Expected rate of return and risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Common Stock A Probability 0.20 0.60 0.20 Probability 0.15 0.35 0.35 0.15 (Click on the icon in order to copy its contents into a spreadsheet.) ew an example Get more help. T 3 a. Given the information in the table, the expected rate of retum for stock A is 15.6 %. (Round to two decimal places.) The standard deviation of stock A is %. (Round to two decimal places.) E D 80 73 Return. 12% 16% 18% U с $ 4 R F 288 F4 V Common Stock B % 5 T FS G 6 Return -7% 7% 13% 21% B MacBook Air 2 F& Y H & 7 N 44 F? U J ** 8 M | MOSISO ( 9 K DD O . Clear all : ; y 4 FIX { option [ + = ? 1 Check answer . FV2 } ◄ 1 delete 1 return shiftarrow_forwardHelp me get the solution pleasearrow_forwardA support level is the price range at which a technical analyst would expect the A) supply of a stock to increase dramatically. B) supply of a stock to decrease substantially. C) demand for a stock to increase substantially. D) demand for a stock to decrease substantially. E) price of a stock to fall. 8) A market decline of 23% on a day when there is no significant macroeconomic event ______ consistent with the EMH because ________. Please provide an accurate justification for the chosen answer.arrow_forward

- Consider the two stocks below. Which has a positive beta (i.e., tends to move in the same direction as the market)? Which has a higher R2 (1.e., market returns explain more of its return patterns)? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. Stock 1 has a positive beta and a higher R² a b C d Stock 2 has a positive beta and a higher R² Stock 1 has a positive beta, but Stock 2 has a higher R Stock 2 has a positive beta, but Stock 1 has a higher R² ft RM Stock 2 Stock 1 Pararrow_forwardYou have collected the following NH-NL indicator data: . If you are an technician following a momentum-based strategy, are you buying or selling today? A momentum-based trader would be selling because the NH-NL indicator indicates that new lows are now outpacing new lows, with a continuing strong upward trend. (Select from the drop-down menus.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Day NH-NL Indicator 1 (yesterday) 104 2 99 3 61 10 4567806 42 -18 -43 -80 -84 9 -91 -69 - ☑arrow_forward(Expected rate of return and risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Common Stock A Probability 0.20 0.60 0.20 Probability 0.15 0.35 0.35 0.15 (Click on the icon in order to copy its contents into a spreadsheet.) Common Stock B Return 13% 14% 18% Return - 6% 7% 15% 21% a. Given the information in the table, the expected rate of return for stock A is 14.6 %. (Round to two decimal places.) The standard deviation of stock A is %. (Round to two decimal places.)arrow_forward

- Please solve step by step for clarity, thank you!arrow_forwardSolve this practice problem in the 2 pictures belowarrow_forwardConsider the following information: Rate of Return If State Occurs State of Probability of State of Economy Stock A Economy Stock B Recession .15 .06 - 10 Normal .56 .09 .19 Вoom .29 .14 .36 . Calculate the expected return for Stocks A and B. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) . Calculate the standard deviation for Stocks A and B. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Stock A expected return % Stock B expected return % Stock A standard deviation % Stock B standard deviation %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you