Income Tax Fundamentals 2020

38th Edition

ISBN: 9780357391129

Author: WHITTENBURG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Give me all options solution which option is correct and which option is incorrect with response.

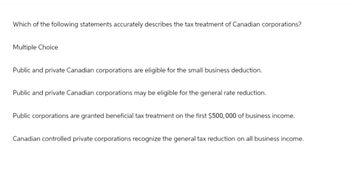

Transcribed Image Text:Which of the following statements accurately describes the tax treatment of Canadian corporations?

Multiple Choice

Public and private Canadian corporations are eligible for the small business deduction.

Public and private Canadian corporations may be eligible for the general rate reduction.

Public corporations are granted beneficial tax treatment on the first $500,000 of business income.

Canadian controlled private corporations recognize the general tax reduction on all business income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- With respect to provincial income taxes, other than those assessed in Quebec, which of the following statements is not correct? a) Each province can apply different rates to add many brackets for individuals as it wishes. b) the federal government collects the provincial income tax for individuals for every province except Quebec. c) Each province can establish its own tax credits to apply against tax payable for individuals. d) Each province can establish rules for determining the taxable income of individuals.arrow_forwardIndividuals and firms pay out a significant portion of their income as taxes, so taxes are important in both personal and corporate decisions. Our tax system is progressive. Individual Individuals pay taxes on wages, on investment income, and on the profits of proprietorships and partnerships. Taxable income is defined as gross income less a set of deductions. In 2018, the personal exemption is for taxpayers and their dependents is zero. A capital gain (loss) is the profit (loss) from the sale of a capital asset for more (less) than its purchase price. In 2018, for most taxpayers a -Select- ✓ capital gain is taxed at a maximum rate of 15%, while a -Select- capital gain is taxed as ordinary income [for high-income taxpayers the tax rate on long-term capital gains is 20% ]. -Select- ✓income consists of dividend and interest income. Interest income (except interest on state and local government debt which is exempt from federal taxes) is taxed as -Select- while dividends are taxed at the…arrow_forwardU.S. corporations are eligible for a foreign tax credit for withholding taxes imposed on dividends received from 100 percent owned foreign corporations, even if the dividend qualifies for the 100 percent dividends received deduction. True or Falsearrow_forward

- For both individuals and corporations, the tax code in the United States is ___________: in general, the higher the income, the greater percentage of that income is paid in taxes.arrow_forwardWhich of the following statements concerning the tax treatment of interest income is true? a. Individuals must accrue interest on a daily basis. b. The anniversary day accrual method of recognizing interest income requires that interest income received by a corporation be recognized for tax purposes for every twelve-month period from the date the investment is made. c. Foreign interest income is exempt from taxes in Canada. d. The anniversary day accrual method of recognizing interest income requires that interest income received by an individual be recognized for tax purposes for every twelve-month period from the date the investments is made.arrow_forwardStarfax Ltd. is a Canadian controlled private corporation that is not associated with any other corporation and is not involved in manufacturing or processing activities. In the current year, Starfax Ltd. has net income for tax purposes of $635,000. This income is comprised of the following amounts: Active business income $590,000 Dividend income from taxable Canadian corporations $ 30,000 • Canadian source interest income $ 15,000 Which of the following is the correct General Rate Reduction for Starfax Ltd. in the current year? O A. $11,700 O B. $1,950 O C. $78,650 O D. $82,550arrow_forward

- The small business deduction is only available on: Multiple Choice The first $500,000 in manufacturing and processing income earned by a Canadian controlled private corporation. None of the above. All of the income earned in Canada by a Canadian controlled private corporation. Income earned in Canada by a resident corporation.arrow_forwardWhat are the 5 income items generated by domestic and resident foreign corporations which are subject to final tax?arrow_forwardWhich of the following taxes is allowed to be deducted from gross income derived from the exercise of profession, trade or business? Group of answer choices Import duties Philippine income tax Estate and donor's tax Tax on sale of shares of stock traded through the local stock exchangearrow_forward

- Compute the income tax due if Sandbox Corporation which is an MSME domestic corporation reported the following gross income and expenses in 2021: A.Using the same data in the previous question, what is the income tax due if Sandbox is a resident foreign corporation? B.Using the same data in the previous question, what is the income tax due if Sandbox is a non-resident foreign corporation? C.Using the same data in the previous question, what is the income tax due if Sandbox is a private proprietary educational institution?arrow_forwardg. A municipal property tax on real estate is regressive, and the incident is on the consumer if the property is used in business. average, and the incident is on the consumer if one owns or rents. progressive, and the incident is on the taxpayer if the property is rented. proportional, and the incident is on the consumer if it is an owner-occupied residence or land. h. The federal corporate income tax is proportional, if the incidence is on shareholders. average, if the incidence is on shareholders. progressive, if the incidence is on consumers. O regressive, if the incidence is on producers.arrow_forwardWhich of the following statements are correct? i. A tax resident is normally liable to tax on their worldwide, profits, income, and gains, whether received. ii. Non-residents are generally liable to tax on certain income and profits generated from sources within the country. iii. A domiciled taxpayer is normally liable to tax on their worldwide, profits, income, and gains, whether received. iv. Tax is imposed on certain sources of income, such as interest, dividends, royalties, and fees, by way of withholding tax. a. i, ii and iv b. i only c. All of the above d. i, iii and ivarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you