Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

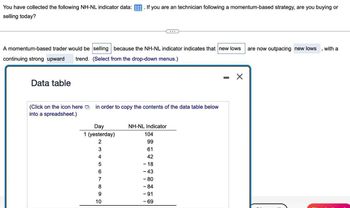

Transcribed Image Text:You have collected the following NH-NL indicator data: . If you are an technician following a momentum-based strategy, are you buying or

selling today?

A momentum-based trader would be selling because the NH-NL indicator indicates that new lows are now outpacing new lows, with a

continuing strong upward trend. (Select from the drop-down menus.)

Data table

(Click on the icon here in order to copy the contents of the data table below

into a spreadsheet.)

Day

NH-NL Indicator

1 (yesterday)

104

2

99

3

61

10

4567806

42

-18

-43

-80

-84

9

-91

-69

-

☑

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (a) A financial analyst would like to study the stock market in Hong Kong. It is believed that the stock market will become overvalue when one of the indicato Time left 1:5 price/earning (P/E) ratio is over 33.9. On this basis, he finds out 30 companies and records their P/E ratio as below: Round the data down to an integer (e.g., 29.7 will be 29) and then prepare a stem-and-leaf display for the rounded data. [Do not put space between digits (e.g., put 1123 instead of 1 1 2 3).] Stem Leaf 0 1 2 3 4 51.7 46.5 40.9 4.2 56.8 38.9 46.7 2.5 49.9 44.6 46.5 12.3 23.8 44.0 47.2 47.2 58.2 17.1 56.4 52.7 43.0 48.7 38.1 54.5 43.8 40.9 41.9 52.5 32.9 13.142.7 33.1 5arrow_forwardWhen modeling the expected return of an income producing property, why should it be defined, for example, a correlation of -0.60 between the NOI growth and the vacancy rate? a. To increase the probability that the computer draws higher values of NOI growth when it draws higher values of vacancy, from their respective distributions, and vice versa. b. To increase the probability that the computer draws lower values of NOI growth when it draws lower values of vacancy, from their respective distributions, and vice versa. c. To increase the probability that the computer draws lower values of NOI growth when it draws higher values of vacancy, from their respective distributions, and vice versa. d. Both “b” and “c” e. To increase the probability that the computer draws NOI growth values that are 60% as large as the vacancy values.arrow_forwardGo to Yahoo! Finance and download the monthly stock prices for Apple (AAPL) from 1/1/2016 to 12/31/2021. (1) Sort the data in increasing order by date. (2) Calculate monthly returns using Adj. Close prices. Align the returns well with the dates. (3) Calculate the average monthly return and standard deviation of the monthly returns. (Hint: use either STDEV.S or STDEV to calculate the standard deviation.) On Excel Formulas includedarrow_forward

- You ran a regression of the excess return on Walmart's stock on the excess return on the market. You found the following: alpha=1.5%, beta-2.818, R^2=0.623. If Walmart's total volatility was 0.310 in that same period, what must have been the markets volatility in that same period.arrow_forwardThe Beta coefficients of TSLA and JPM are 1.99 and 1.18 respectively. What does Beta measure and how is it interpreted? Explain the beta values of TSLA and JPM by providing a calculated example of how they relate to market returns.arrow_forwardConsider the following returns and states of the economy for TZ.Com.: Economy Probability Return Weak 40% 1% Normal 50% 8% Strong 10% 39% What is the standard deviation of TZ's returns? SET YOUR CALCULATOR TO FOUR DECIMAL PLACES AND ROUND TO 2 DECIMAL PLACES AT THE END. DO NOT ENTER THE %. FOR EXAMPLE, IF YOUR ANSWER IS 7.70% ENTER IT AS 7.70.arrow_forward

- You are given the following returns on "the market" and Stock F during the last three years. We could calculate beta using data for Years 1 and 2 and then, after Year 3, calculate a new beta for Years 2 and 3. How different are those two betas, i.e., what's the value of beta 2 - beta 1? (Hint: You can find betas using the Rise-Over-Run method, or using your calculator's regression function.) Year Market Stock F 1 6.10% 19.50% 2 12.90% −3.70% 3 16.20% 21.71% A. 10.96 B. 10.91 C. 11.06 D. 11.01 E. 11.11 Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwarda. Fill in the missing values in the table. (Leave no cells blank - be certain to enter O wherever required. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Security Firm A Expected Return Standard Deviation Correlation Beta 0.119 0.22 0.95 Firm B 0.131 0.41 1.50 Firm C 0.112 0.75 0.26 The market portfolio 0.12 0.19 The risk-free asset 0.05 * With the market portfolio b-1. What is the expected return of Firm A? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return %arrow_forwardYou are building out your 1 x 3 point and figure chart that is currently in a column of X's with the last X at $17. When you look at the high, low, close data for today you see that the high was $17.99 and the low was $14.01. The stock closed at $15.01. What do you add to the chart for today? O a. A new trend line b. You add noting to the chart c. A new column of O's to the $15 level d. A new X at $18arrow_forward

- Pls help me with the question and all parts or skip. All parts mandatoryarrow_forwardThank you. It's all done.arrow_forwardCan you please see attached and help me solve for part one and part two using the income statements and balance sheets. Looking to calculate the following risk ratios for 2024 and 2025 (assuming all sales were on accounr) as well as calcuate the following profitibility ratios for 2024 and 2025arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education