FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

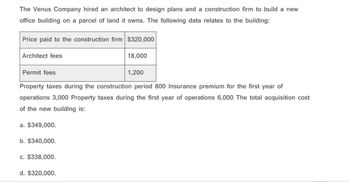

Transcribed Image Text:The Venus Company hired an architect to design plans and a construction firm to build a new

office building on a parcel of land it owns. The following data relates to the building:

Price paid to the construction firm $320,000

Architect fees

18,000

1,200

Permit fees

Property taxes during the construction period 800 Insurance premium for the first year of

operations 3,000 Property taxes during the first year of operations 6,000 The total acquisition cost

of the new building is:

a. $349,000.

b. $340,000.

c. $338,000.

d. $320,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Moby Co. purchased land costing $2,550,000 as a future factory site. Moby paid $240,000 to tear down two buildings on the land. Some Amish folks came along and paid them from the scrap lumber. They paid $2,450 cash for it. Moby paid the lawyer $4,555 in fees for the title investigation and for making the purchase. The architect's fees were $85,600. The cost for the title insurance was $4,600, and liability insurance costs during the construction phase for the factory was $12,640. The excavation cost to clear the ground for the new building was $19,450. They paid the building contractor $8,200,000. The interest costs during the construction phase of the building was $465,000. What should Moby record as cost of the land? Question options: 2,796,705 2,882,305 2,799,155 2,550,000arrow_forwardWindsor, Inc. purchased land adjacent to its plant to improve access for trucks making deliveries. Expenditures incurred in purchasing the land were as follows: purchase price, $59,200; broker's fees, $6,460; title search and other fees, $5,190; demolition of an old building on the property, $6,170; grading, $1,450; digging foundation for the road, $3,230; laying and paving driveway, $27,800; lighting $7,910; signs, $1,980. List the items and amounts that should be included in the Land account. $ Aarrow_forwardThe Madison Sign Company purchased land as a factory site for $72,000. Prior to construction of the new building, the land had to be cleared of trees and brush. Construction costs incurred during the first year are listed below: Land clearing costs $3,200 Sale of firewood to a worker (580) Architect fees (for new building) 12,000 Title investigation of land 1,700 Property taxes on land (for the first year) 1,200 220,000 Building construction costs Required: Determine the amounts that the company should record in the Land and the Building accounts. (Amounts to be deducted should be indicated by a minus sign.) Totals $ Land Buildingarrow_forward

- Peace Co. purchased land as a factory site for P300,000. Peace paid P30,000 to tear down two building on the land. Salvage was sold for P2,700. Legal fees of P1,740 were paid for title investigation and making the purchase. Architect's fees were P15,600. Land Title insurance cost P1,200. Liability insurance during construction cost, P1300. Excavation cost P5,220. The contractor was paid P1,100,000. An assessment made by the city for pavement was P3,200. Interest costs during construction were P85,000. The cost of the land is a. 330,240b. 333,440c. 306,140d. none of thesearrow_forwardAnchor Company purchased a manufacturing machine with a list price of $88,000 and received a 2% cash discount on the purchase. The machine was delivered under terms free on board (FOB) shipping point, and transportation costs amounted to $2,800. Anchor paid $3,900 to have the machine installed and tested. Insurance costs to protect the asset from fire and theft amounted to $5,000 for the first year of operations. What is the cost of the machine? Multiple Choice O O O O $92,940 $97,940 $89,040 $86,240arrow_forwardA company purchased property for a building site. The costs associated with the property were: Purchase price $175,000 Real estate commissions 15,000 Legal fees. Expenses of clearing the land Expenses to remove old building 800 2,000 1,000 What portion of these costs should be allocated to the cost of the land and what portion should be alloca the cost of the new building? $175,800 to Land; $18,800 to Building O $190,000 to Land; $3,800 to Building $190,800 to Land; $1,000 to Building O $192,800 to Land; $0 to Building O $193,800 to Land; $0 to Buildingarrow_forward

- Laramie Company has acquired a property that included both land and a building for $600,000. The company hired an appraiser who has determined that the market value of the land is $370,000 and that of the building is $400,000. At what amount should the company record the cost of the building? (Round any intermediate calculations to two decimal places and your final answer to the nearest dollar.)arrow_forwardA tax- and duty-free importation of a 30-horsepower sand mill for paint manufacturing costs P400,000 CIF Manila. Bank charges, arrester and brokerage cost P6,000. Foundation and installation costs were P30,000. Other incidental expenses amount to P25,000. Salvage value of the mill is estimated to be P65,000 after 20 years. Find the appraisal value of the mill using straight-line depreciation at the end of 12 vears.arrow_forwardCrane Corp. purchased land as a factory site for $280000. They paid $12200 to tear down two buildings on the land, and the salvage from these old buildings was sold for $1310. Legal fees of $830 were paid for title investigation and making the purchase. Architect's fees were $10370. Title insurance cost $610, and liability insurance during construction cost $650. Excavation costs were $2970. A contractor was paid $677000 to construct the new building. An assessment made by the city for pavement was $1740. Interest costs during construction were $43300. The cost of the land should be recorded at $292330. O $294770. O $296510. O $294070.arrow_forward

- Carla Vista Corp. purchased land as a factory site for $330000. They paid $10400 to tear down two buildings on the land, and the salvage from these old buildings was sold for $1330. Legal fees of $840 were paid for title investigation and making the purchase. Architect's fees were $10490. Title insurance cost $620, and liability insurance during construction cost $650. Excavation costs were $3430. A contractor was paid $657000 to construct the new building. An assessment made by the city for pavement was $1690. Interest costs during construction were $43000. The cost of the land should be recorded at Select answer from the options below $342930. $344620. $340530. $342220.arrow_forwardFarley Corporation purchased land adjacent to its plant to improve access for trucks making deliveries. Expenditures incurred in purchasing the land were as follows: purchase price, $70,000; broker's fees, $6,000; title search and other fees, $5,000; demolition of an old building on the property, $5,700; grading $1,200; digging foundation for the road, $3,000; laying and paving driveway. $25,000; lighting $7,500; signs, $1,500. List the items and amounts that should be included in the Land account. $ $arrow_forwardDetermining cost of land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $36,000 in cash and giving a short-term note for $273,000. Legal fees paid were $1,850, delinquent taxes assumed were $11,300, and fees paid to remove an old building from the land were $22,300. Materials salvaged from the demolition of the building were sold for $4,600. A contractor was paid $939,400 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education