FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

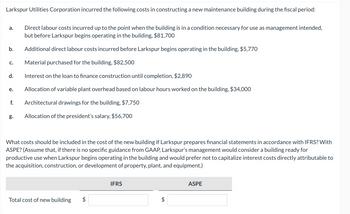

Transcribed Image Text:Larkspur Utilities Corporation incurred the following costs in constructing a new maintenance building during the fiscal period:

Direct labour costs incurred up to the point when the building is in a condition necessary for use as management intended,

but before Larkspur begins operating in the building, $81,700

Additional direct labour costs incurred before Larkspur begins operating in the building, $5,770

Material purchased for the building, $82,500

Interest on the loan to finance construction until completion, $2,890

Allocation of variable plant overhead based on labour hours worked on the building, $34,000

f. Architectural drawings for the building, $7,750

Allocation of the president's salary, $56,700

a.

b.

C.

d.

e.

g.

What costs should be included in the cost of the new building if Larkspur prepares financial statements in accordance with IFRS? With

ASPE? (Assume that, if there is no specific guidance from GAAP, Larkspur's management would consider a building ready for

productive use when Larkspur begins operating in the building and would prefer not to capitalize interest costs directly attributable to

the acquisition, construction, or development of property, plant, and equipment.)

Total cost of new building

$

IFRS

ASPE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please Do not Give image format And solve With Explanationarrow_forwardNeed help with this practice problemarrow_forwardSchedule of Activity Costs Quality Control Activities Product testing Assessing vendor quality Recalls Rework Scrap disposal Product design Training machine operators Warranty work Process audits From the provided schedule of activity costs, determine the (a) value-added and (b) non-value-added costs. 2 a. Value-added costs $ Activity Cost $55,000 26,000 18,000 29,000 8,000 30,000 46,000 12,000 22,000 b. Non-value-added costs $arrow_forward

- Martini Hotel & Casino is situated on beautiful Lake Tahoe in Nevada. The complex includes a 300-room hotel, a casino, and a restaurant. As Martini's new controller, your manager asks you to recommend the basis the hotel should use for allocating fixed overhead costs to the three divisions in 2020. You are presented with the following income statement information for 2019: (Click the icon to view the data.) Requirement 1. Calculate division margins in percentage terms prior to allocating fixed overhead costs. (Round your answers to two decimal places, X.XX.) Restaurant Casino Hotel 42.69 % Allocated fixed overhead costs Operating margin Operating margin % Data table Revenues Direct costs Segment margin Division margin Requirement 2. Allocate indirect costs to the three divisions using each of the three allocation bases suggested. For each allocation base, calculate division operating margins after allocations, in dollars and as a percentage of revenues Allocate the indirect costs, then…arrow_forwardPlease do not give solution in image format and explain proper steps by Step and Fast Answering Please ?arrow_forwardReplace Equipment A machine with a book value of $251,700 has an estimated six-year life. A proposal is offered to sell the old machine for $214,200 and replace it with a new machine at a cost of $281,500. The new machine has a six-year life with no residual value. The new machine would reduce annual direct labor costs from $50,400 to $40,300. a. Prepare a differential analysis dated April 11 on whether to continue with the old machine (Alternative 1) or replace the old machine (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential Analysis Continue Old Machine (Alt. 1) or Replace Old Machine (Alt. 2) April 11 Continue Replace Differential with Old Old Effects Machine Machine (Alternative 1) (Alternative 2) (Alternative 2) Revenues: Proceeds from sale of old machine $ Costs: Purchase price Direct labor (6 years) Profit (Loss) b. Should the company continue with the old machine (Alternative 1) or replace the old machine…arrow_forward

- Organic Laboratories allocates research and development costs to its three research facilities based on each facility's total annual revenue from new product developments: Total Facility locatión Kentucky Arizona Illinois New product $ 62,587,200 $ 100,360,000 $ 77,772,800 $ 240,720,000 revenue Research & $ 60,360,000 Development Using revenue as an allocation base, the amount of costs allocated to the Kentucky research facility is calculated to be: Multiple Choice $24,072,000. $15,693,600. $244,504,000. $9,018,000. $18,036,000.arrow_forwardSodlnoarrow_forwardReplace Equipment A machine with a book value of $247,100 has an estimated six-year life. A proposal is offered to sell the old machine for $216,800 and replace it with a new machine at a cost of $280,700. The new machine has a six-year life with no residual value. The new machine would reduce annual direct labor costs from $50,700 to $40,600. a. Prepare a differential analysis dated April 11 on whether to continue with the old machine (Alternative 1) or replace the old machine (Alternative 2). If an amount is zero, enter "0". Use a minus sign to indicate subtracted or negative numbers or a loss. Differential Analysis Continue with Old Machine (Alt. 1) or Replace Old Machine (Alt. 2) April 11 Continue with Old Machine (Alternative 1) Replace Old Machine (Alternative 2) Differential Effect on Income (Alternative 2) Revenues: Proceeds from sale of old machine $fill in the blank 1d230a036f95fc2_1 $fill in the blank 1d230a036f95fc2_2 $fill in the blank…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education