FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

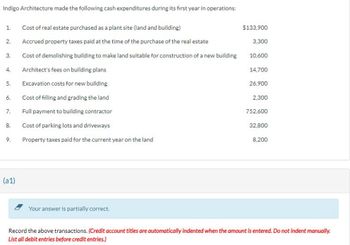

Transcribed Image Text:Indigo Architecture made the following cash expenditures during its first year in operations:

1.

2.

3.

4.

5.

6.

7.

8.

9.

(a1)

Cost of real estate purchased as a plant site (land and building)

Accrued property taxes paid at the time of the purchase of the real estate

Cost of demolishing building to make land suitable for construction of a new building

Architect's fees on building plans

Excavation costs for new building

Cost of filling and grading the land

Full payment to building contractor

Cost of parking lots and driveways

Property taxes paid for the current year on the land

Your answer is partially correct.

$133,900

3,300

10,600

14,700

26,900

2.300

752,600

32,800

8,200

Record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.

List all debit entries before credit entries.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- China Express purchased land for $140,000. Prior to construction on the new building, the land had to be cleared of trees and brush. Construction costs incurred during the first year are listed below: Land clearing costs $ 5,000 Architect fees (for new building) 30,000 Legal fees for title investigation of land 1,000 Property taxes on land (for the first year) 2,500 Building construction costs 440,000 Required:Determine the amounts that should be recorded in the land and the new building accounts.arrow_forwardFor each of the following items, indicate if it is a Capital Expenditures (CE) or Revenue Expenditure (RE). 1. Constructed an addition to an existing building. 2. Repainted the president’s office. 3. Paid cash for improvements that will increase the number of products that the machine can produce per hour. 4. Replaced the tires on a company delivery vehicle. 5. Replaced a component of a machine that will increase the economic life of that machine.arrow_forwardBased on the following data, determine the cost of the land to be reported on the balance sheet. Land purchase price $177,668 Broker's commission 17,098 Payment for demolition and removal of existing building 5,376 Cash received from sale of materials salvaged from demolished building 1,031arrow_forward

- Determining cost of land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $41,000 in cash and giving a short-term note for $276,000. Legal fees paid were $1,330, delinquent taxes assumed were $12,400, and fees paid to remove an old building from the land were $17,000. Materials salvaged from the demolition of the building were sold for $4,800. A contractor was paid $963,700 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet.arrow_forwardZabinski Co. paid $150,000 for a purchase that included land, building, and office furniture. An appraiser provided the following estimates of the market values of the assets if they had been purchased separately: Land, $20,000, Building, $150,000, and Office furniture, $30,000. Based on this information the cost that would be allocated to the land is: a. $17,500 b. $20,000 c. $25,000 d. $15,000arrow_forwardasv.1arrow_forward

- Determining cost of land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $28,000 in cash and giving a short-term note for $258,000. Legal fees paid were $1,565, delinquent taxes assumed were $10,000, and fees paid to remove an old building from the land were $20,000. Materials salvaged from the demolition of the building were sold for $4,300. A contractor was paid $869,400 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet.fill in the blank 1 of 1$arrow_forwardA company purchased new equipment for $40,000. The company paid cash for the equipment. Other costs associated with the equipment were: transportation costs, $2,300; sales tax paid, $2,400; and installation cost, $2,300. The total capitalized cost reported for the equipment was: Multiple Choice $44,700. $47,000. $40,000. $42,300.arrow_forwardWhich of the following are the capitalized coats of the land and the new building, respectively?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education