Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

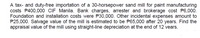

Transcribed Image Text:A tax- and duty-free importation of a 30-horsepower sand mill for paint manufacturing

costs P400,000 CIF Manila. Bank charges, arrester and brokerage cost P6,000.

Foundation and installation costs were P30,000. Other incidental expenses amount to

P25,000. Salvage value of the mill is estimated to be P65,000 after 20 years. Find the

appraisal value of the mill using straight-line depreciation at the end of 12 vears.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one the company expects the truck to be driven for 26,000 miles; in year two, 30,000 miles; and in year three, 40,000 miles. Consider how the purchase of the truck will impact Montellos depreciation expense each year and what the trucks book value will be each year after depreciation expense is recorded.arrow_forwardA tax and duty free importation of a 30-horsepower sand mill for paint manufacturing costs P360,000, CIF Manila. Bank charges, arrester and brokerage cost P5,000. Foundation and installationcosts were P25,000. Other incidental expenses amount to P20,000. Salvage value of the mill isestimated to be P60,000 after 20 years. Find the appraisal value of the mill using straight-line depreciation at the end of a.) 10 years, b.) 15 yearsarrow_forwardA tax and duty free importation of a 30 hp sandmill for paint manufacturing cost P 360,000. Bank charges arrastre and brokerage cost P 5,000. Foundation and installation cost were P 25,000. Other incidental expenses amount to P 20,000. Salvage value of the mill is estimated to be 60,000 after 20 years. Find the appraisal value of the mill, using straight-line depreciation at the end of 15 years. 17,500.00 235,000.00 147,500.00 135,000.00 60,000.00 174,500.00arrow_forward

- A tax and duty free importation of a 30 HP sandmill (for paint manufacturing) cost ₱360,000, CIF Manila. Bank charges, arrastre ₱25,000. Other incidental expenses amounted to ₱20,000. Salvage value of the mill is estimated to be ₱60,000 after 20 years. Find the appraisal value of the mill, using straight-line depreciation, at the end of (a) 10 years and (b) 15 years? : (a) ₱235,000 (b) ₱147,500arrow_forwardThe annual depreciation of Php20,000 has been reserved for a machine using straight line for 8 years. If the first cost is Php200,000, determine the salvage value of the machine. help me with this one plsarrow_forwardAn assembly line conveyor system with a 5-year life is to be depreciated by the DDB method. The conveyor units had a first cost of $30,000 with a$9000 salvage value. The annual operating cost allocated to the conveyor is $7000 per year. The book value at the end of year 2 is closest to:a. $6,480b. $10,800c. $12,400d. $18,000arrow_forward

- can you please check my workarrow_forwardAlbertus Natural Stone Quarry purchased a computer-controlled face-cutter saw for $80,000. The unit has an anticipated life of 5 years and a salvage value of $10,000. (a) Compare the schedules for annual depreciation and book value using two methods: DB at 150% of the straight line rate and at the DDB rate. (b) How is the estimated $10,000 salvage value used?arrow_forwardScreen Gem Movie Theater purchased a new projector for $155,000 with a salvage value of $2,000. Delivery and installation amounted to $580. The projector is expected to have a useful life of 15,000 hours. Using the the units-of-production method calculate the depreciation per unit?arrow_forward

- A concrete and rock crusher for demolition work has been purchased for $60,000, and it has an estimated sv of $10,000 at the end of its five-year life. Engineers have estimated that the following units of production (in m3 of crushed material) will be contracted over the next five years. EOY 12 4 m3 16,000 24,000 36,000 16,000 8,000 Using the units of production depreciation method, what is the BV at the end of year two? Select one: O a $38,650 O b. $45,165 OC $42,500 Od $40,000arrow_forwardSonic Corporation purchased and installed electronic payment equipment at its drive-in restaurants in San Marcos, TX, at a cost of $21,600. The equipment has an estimated residual value of $1,200. The equipment is expected to process 256,000 payments over its three-year useful life. Per year, expected payment transactions are 61,440, year 1; 140,800, year 2; and 53,760, year 3. Required: Complete a depreciation schedule for each of the alternative methods. Straight-line. Units-of-production. Double-declining-balance.arrow_forwardSonic Corporation purchased and installed electronic payment equipment at its drive-in restaurants in San Marcos, TX, at a cost of $27,000. The equipment has an estimated residual value of$1,500. The equipment is expected to process 255,000 payments over its three-year useful life. Peryear, expected payment transactions are 61,200, year 1; 140,250, year 2; and 53,550, year 3.Required:Complete a depreciation schedule for each of the alternative methods.1. Straight-line.2. Units-of-production.3. Double-declining-balancearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT