FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is up and coming's

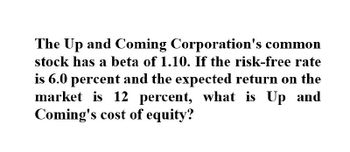

Transcribed Image Text:The Up and Coming Corporation's common

stock has a beta of 1.10. If the risk-free rate

is 6.0 percent and the expected return on the

market is 12 percent, what is Up and

Coming's cost of equity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The company has a beta of 0.85. If the risk- free rate is 3.4% and the market premium is 8.5%, what is the company's cost of equity?arrow_forwardSuppose your company has an equity beta of 0,9 and the current risk-free rate is 7,1%. if the expected market risk premium is 10%, what is your cost of equity capital?arrow_forwardThe risk free rate currently have a return of 2.5% and the market risk premium is 4.22%. If a firm has a beta of 1.42, what is its cost of equity?arrow_forward

- i need the answer quicklyarrow_forwardAssume that the Collins Company has a beta of 1.8 and that the risk-free rate of return is 2.5 percent. If the equity-risk premium is six percent, calculate the cost of equity for the Collins Company using the capital asset pricing model.arrow_forwardThe current appropriate risk-free rate is 6% and the return on the market is 13.5%.Further assume that you calculated the levered beta above as 1.29. Using the CAPM, estimate DUC’s cost of equity. Be sure to state any additional assumptions.arrow_forward

- You estimate of the market risk premium is 7%. The risk-free rate of return is 3.1% and General Motors has a beta of 1.9. According to the Capital Asset Pricing Model (CAPM), what is its expected return?arrow_forwardConsider a firm with a beta of 1.57. If the market return is 6.73% and the risk-free rate is 0.90%, what is the firm's expected return according to the capital asset pricing model? Round your answer to four decimal places, e.g., enter 12.34 for 12.34%.arrow_forwardVargo, Inc., has a beta estimated by Value Line of 1.3. The current risk-free rate (long-term) is 3.5 percent and the market risk premium is 6.4 percent. What is the cost of common equity for Vargo?arrow_forward

- I need to calculate the cost of equity with the following data: The current appropriate risk-free rate is 6% and the return on the market is 13.5%. levered beta is 1.29. Using the CAPM, estimate DE’s cost of equity. Be sure to state any additional assumptionsarrow_forwardYour estimate of the market risk premium is 5%. The risk-free rate of return is 4%, and JB Hi Fi has a beta of 1.5. According to the Capital Asset Pricing Model (CAPM), what is its expected return? Select one: 1. 10.4% 2. 11.0% 3. 11.5% 4. 11.9%arrow_forwardYour estimate of the market risk premium is 5%. The risk-free rate of return is 1% and General Motors has a beta of 1.11. What is General Motors' cost of equity capital?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education