Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

General Accounting

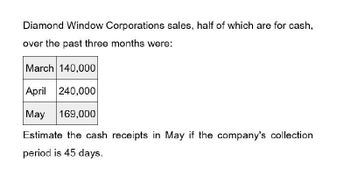

Transcribed Image Text:Diamond Window Corporations sales, half of which are for cash,

over the past three months were:

March 140,000

April 240,000

May 169,000

Estimate the cash receipts in May if the company's collection

period is 45 days.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cash collections for Renew Lights found that 65% of sales were collected in the month of sale, 25% was collected the month after the sale, and 10% was collected the second month after the sale. Given the sales shown, how much cash will be collected in March and April?arrow_forwardHalifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $75,000 in June, $65,000 in July, and $90,000 in August?arrow_forwardFitbands estimated sales are: What are the balances in accounts receivable for January, February, and March if 65% of sales is collected in the month of sale, 25% is collected the month after the sale, and 10% is second month after the sale?arrow_forward

- Earthies Shoes has 55% of its sales in cash and the remainder on credit. Of the credit sales, 70% is collected in the month of sale, 15% is collected the month after the sale, and 10% is collected the second month after the sale. How much cash will be collected in June if sales are estimated as $75,000 in April, $65,000 in May, and $90,000 in June?arrow_forwardSchedule of cash payments for service company Horizon Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: Depreciation, insurance, and property taxes represent 9,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. Seventy percent of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule of cash payments for selling and administrative expenses for March, April, and May.arrow_forwardRanger Industries has provided the following information at June 30: Other information: Average selling price, 196 Average purchase price per unit, 110 Desired ending inventory, 40% of next months unit sales Collections from customers: In month of sale20% In month after sale50% Two months after sale30% Projected cash payments: Inventory purchases are paid for in the month following acquisition. Variable cash expenses, other than inventory, are equal to 25% of each months sales and are paid in the month of sale. Fixed cash expenses are 40,000 per month and are paid in the month incurred. Depreciation on equipment is 2,000 per month. REQUIREMENT You have been asked to prepare a master budget for the upcoming quarter (July, August, and September). The components of this budget are a monthly sales budget, a monthly purchases budget, a monthly cash budget, a forecasted income statement for the quarter, and a forecasted September 30 balance sheet. The worksheet MASTER has been provided to assist you. Ranger Industries desires to maintain a minimum cash balance of 8,000 at the end of each month. If this goal cannot be met, the company borrows the exact amount needed to reach its goal. If the company has a cash balance greater than 8,000 and also has loans payable outstanding, the amount in excess of 8,000 is paid to the bank. Annual interest of 18% is paid on a monthly basis on the outstanding balance.arrow_forward

- What is the correct answer general Accountingarrow_forwardchedule of Cash Collections of Accounts Receivable OfficeMart Inc. has "cash and carry" customers and credit customers. OfficeMart estimates that 25% of monthly sales are to cash customers, while the remaining sales are to credit customers. Of the credit customers, 20% pay their accounts in the month of sale, while the remaining 80% pay their accounts in the month following the month of sale. Projected sales for the next three months are as follows: October $115,000 November 144,000 December 210,000 The Accounts Receivable balance on September 30 was $77,000. Prepare a schedule of cash collections from sales for October, November, and December. Round all calculations to the nearest whole dollar. OfficeMart Inc. Schedule of Cash Collections from Sales For the Three Months Ending December 31 October November December Receipts from cash sales: Cash sales $ $ $ September sales on account: Collected in October October sales on account:…arrow_forwardSequoia Furniture Company’s sales over the past three months, half of which are for cash, were as follows: March April May $426,000 $676,000 $546,000 a. Assume that Sequoia’s collection period is 60 days. What would be its cash receipts in May? What would be its accounts receivable balance at the end of May? b. Now assume that Sequoia’s collection period is 45 days. What would be its cash receipts in May? What would be its accounts receivable balance at the end of May?arrow_forward

- Answer? ? Financial accountingarrow_forwardSequoia Furniture Company's sales over the past three months, half of which are for cash, were as follows: March $ 420,000 April $ 670,000 May $ 540,000 1. Assume that Sequoia's collection period is 60 days. What would be its cash receipts in May? What would be its accounts receivable balance at the end of May? 2. Now assume that Sequoia's collection period is 45 days. What would be its cash receipts in May? What would be its accounts receivable balance at the end of May? 1. Collection period is 60 days Cash receipts Accounts receivable balance 2. Collection period is 45 days Cash receipts Accounts receivable balancearrow_forwardll. Subject Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning