Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

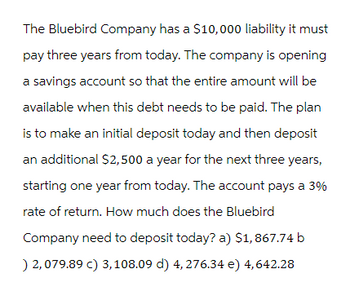

Transcribed Image Text:The Bluebird Company has a $10,000 liability it must

pay three years from today. The company is opening

a savings account so that the entire amount will be

available when this debt needs to be paid. The plan

is to make an initial deposit today and then deposit

an additional $2,500 a year for the next three years,

starting one year from today. The account pays a 3%

rate of return. How much does the Bluebird

Company need to deposit today? a) $1,867.74 b

) 2,079.89 c) 3, 108.09 d) 4,276.34 e) 4,642.28

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The problem describes a debt to be amortized. (Round your answers to the nearest cent.)A man buys a house for $330,000. He makes a $150,000 down payment and amortizes the rest of the purchase price with semiannual payments over the next 9 years. The interest rate on the debt is 10%, compounded semiannually. (a) Find the size of each payment.$ (b) Find the total amount paid for the purchase.$ (c) Find the total interest paid over the life of the loan.$arrow_forwardCline Corporation deposits $75,000 every quarter in a savings account (beginning at the end of the current quarter) for the next six years so that it can purchase a new piece of machinery at the end of six years. The interest rate is 4%. How much money will Cline Corporation have at the end of six years? (Use spreadsheet software or a financial calculator to calculate your answer. Do not round any intermediary calculations, and round your final answer to the nearest dollar.) Group of answer choices $2,043,240 $2,023,010 $2,931,195 $1,126,935arrow_forwardYou borrow $22541 to buy a car. You will have to repay this loan by making equal monthly payments for 14 years. The bank quoted an APR of 6%. How much is your monthly payment (in $ dollars)? I'm not sure how the answer is 198.6394, Can you explain that to me on the financial calculator, please? Thank you :)arrow_forward

- A company has had record profits and decided to use some of the profits to pay for manufacturing improvements. If the company can invest $1,600,000.00 in an a annuity will that will make payments at the beginning of every six months for 4 years. If the annuity pays 5.6%, compounded semi-annual. What is the size of payments that the company can expect?The payment amount will be $. (Round to 2 decimal places.)arrow_forward!arrow_forwardYou want to be able to withdraw $25,000 each year for 20 years. Your account earns 10% interest. A.How much do you need in your account at the beginning? b) How much total money will you pull out of the account? c) How much of that money is interest?arrow_forward

- You are a financial adviser, and your client wants to save $6,000 in order to make a downpayment for a car in two years. Your bank offers a savings account which pays 3.6% compounded quarterly. The client wishes to make deposits at the end of each three-month period. What is the amount of the annuity the client needs to pay in order to meet the goal? (Choose the closest number.) a) $718.44. b) $726.69 c) $734.16 d) $741.92 e) None of these. ENG 令 CMSarrow_forwardAt times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment. The company will need to do replacement analysis to determine which option is the best financial decision for the company. Price Co. is considering replacing an existing piece of equipment. The project involves the following: • The new equipment will have a cost of $9,000,000, and it is eligible for 100% bonus depreciation so it will be fully depreciated at t = 0. • The old machine was purchased before the new tax law, so it is being depreciated on a straight-line basis. It has a book value of $200,000 (at year 0) and four more years of depreciation left ($50,000 per year). • The new equipment will have a salvage value of $0 at the end of the project's life (year 6). The old machine has a current salvage value (at year 0) of $300,000. • Replacing the old machine will require an investment in net operating working capital (NOWC) of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education