FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

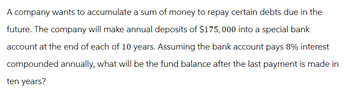

Transcribed Image Text:A company wants to accumulate a sum of money to repay certain debts due in the

future. The company will make annual deposits of $175,000 into a special bank

account at the end of each of 10 years. Assuming the bank account pays 8% interest

compounded annually, what will be the fund balance after the last payment is made in

ten years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- To provide for the automation of a production process in five years, Dominion Chemicals is starting a sinking fund to accumulate $600,000 by the end of the five years. Sinking fund payments are to be made at the beginning of every month. Round the sinking fund payments and the periodic interest earnings to the nearest dollar.a) If the sinking fund earns 7.5% compounded monthly, what monthly payments starting today should be made to the fund? b) How much interest will be earned in the fourth year? c) In what month will the fund pass the halfway point? d) How much interest will be earned in the 35th month?arrow_forwardVolvo company want to invest a lump sum amount that will provide the company with $10,000 at the beginning of every month in perpetuity to help pay for its employees' monthly salaries. How much should be invested in a fund that provides an interest rate of 10% compounded quarterly?arrow_forwardA company needs $350,000 to pay a debt four years from now. The company can place cash in a 5% compounding interest-bearing account. How much money should the company invest today in order to meet the goal? Round to the nearest whole dollar.arrow_forward

- Cline Corporation deposits $75,000 every quarter in a savings account (beginning at the end of the current quarter) for the next six years so that it can purchase a new piece of machinery at the end of six years. The interest rate is 4%. How much money will Cline Corporation have at the end of six years? (Use spreadsheet software or a financial calculator to calculate your answer. Do not round any intermediary calculations, and round your final answer to the nearest dollar.) Group of answer choices $2,043,240 $2,023,010 $2,931,195 $1,126,935arrow_forwardA company has had record profits and decided to use some of the profits to pay for manufacturing improvements. If the company can invest $1,600,000.00 in an a annuity will that will make payments at the beginning of every six months for 4 years. If the annuity pays 5.6%, compounded semi-annual. What is the size of payments that the company can expect?The payment amount will be $. (Round to 2 decimal places.)arrow_forwardHY Industries Ltd. plans to replace a warehouse in eleven years at an anticipated cost of $55,000. To pay for the replacement, a sinking fund has been established into which equal payments are made at the end of every quarter. Interest is 7.5% quarterly. (a) What is the size of the periodic payment? (b) What is the accumulated balance just after the 32th payment?arrow_forward

- Cargojet Corp. is preparing for the replacement of one of its jets in three years by making payments to a sinking fund at the beginning of every six months for the next three years. The fund earns 6% compounded semiannually, and the capital required in three years is $750,000. What is the size of the semiannual payment made to the sinking fund? __________ How much of the maturity value of the fund will be interest? __________ Construct a partial sinking fund schedule showing details of the first two and the last two payments and totals. Round the sinking fund payments, interest payments and increases in the fund to the nearest dollar.arrow_forwardI want to accumulate %500,000 in a savings account in 20 years. If the bank pays 6% compounded annually, how much chould I deposit in the account?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education