Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

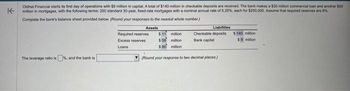

Oidhat Financial starts its first day of operations with $9 million in capital. A total of $140 million in checkable deposits are received. The bank makes a $30 milion commercial loan and another $50

milion in mortgages, with the following terms: 200 standard 30-year, foxed-rate mortgages with a nominal annual rate of 5.25%, each for $250,000. Assume that required reserves are 8%

Complete the bank's balance sheet provided below. (Round your responses to the nearest whole number)

Assets

The leverage ratio is%, and the bank is

Required reserves

Excess reserves

Loans

$11 million

$ 58 million

$ 80 million

Liabilities

Checkable deposits

Bank capital

1

(Round your response to two decimal places)

$140 million

$9 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- A bank has three assets. It has $75 million invested in consumer loans with a three-year duration, $39 million invested in T-bonds with a 16-year duration, and $39 million in six-month maturity T-bills. What is the duration of the bank's asset portfolio in years? Group of answer choices 11.51 years 7.38 years 3.95 years 5.68 yearsarrow_forwardBNP Paribas has 800 depositors. Each depositor deposits $1,000 into the bank at t=0. BNP Paribas offers its depositors an 8% interest rate. BNP then uses the deposits to make 2 year simple loans at an interest rate of 8%. Depositors of BNP Paribas can either withdraw their deposits at t=1 or t=2. At t=1, BNP can sell its loans at the initial loan values, if needed. Assume that each depositor believes that there are a total of 300 depositors who will withdraw at t=1. How much of loan payments (in $) does each depositor expects the bank to receive at t=2? Round your answer to at least 2 decimal places.arrow_forwardYou borrowed $25,000 from a bank at an interest rate of 12%, compoundedmonthly. This loan will be repaid in 48 equal monthly installments over fouryears. Immediately after your 20th payment, if you want to pay off the remainder of the loan in a single payment, the amount is close to(a) $15,723(b) $15,447(c) $15,239(d) $16,017arrow_forward

- A local finance company quotes a 17 percent interest rate on one-year loans. So, if you borrow $30,000, the interest for the year will be $5,100. Because you must repay a total of $35,100 in one year, the finance company requires you to pay $35,100/12, or $2,925.00, per month over the next 12 months. a. What rate would legally have to be quoted? b. What is the effective annual rate?arrow_forwardDo not give solution in imagearrow_forwardA client deposits 150,000 in a bank, with the bank agreeing to pay 6% annual effective for three years. The client indicates that one third of the account balance will be withdrawn at the end of the first year and half of the account balance will be withdrawn at the end of the second year. The bank can invest in either one year or three year zero coupon bonds. The one year bonds yield 7% and the three year bonds yield 10%. Develop an investment program based on immunization.arrow_forward

- A bank offers and investment account that has an annual interst rate of 9.9%, compounded quarterly. At the end of a 132 month year period you'd like to have $50,000 in the account. If your investment is made as a lump sum at the beginning how much do you need to contribute?arrow_forwardA depositor opens a new savings account with $2000 at 2% compounded semiannually. At the beginning of year 3, an additional $3000 is deposited. At the end of four years, what is the balance in the account? i Click the icon to view some finance formulas. The balance in the account at the end of 4 years is $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forwardHalep Inc. borrowed $39,070 from Davis Bank and signed a 1-year note payable stating the interest rate was 8% compounded annually. 1. Using the Present Value of an Annuity of 1 TABLE4 or Figure B2 in the textbook E, calculate the factor. 2. Next, determine the annual payment amount. 3. Then, determine the interest portion of the payment for year 1. 4. Finally, determine the principal portion of the payment for year 1. Round to the nearest penny, two decimal places.arrow_forward

- Let's assume you finance your house through Wells-Fargo Bank. Below, please find the Truth-in-Lending Disclosure (TILD). Calculate Finance Charge, i.e., the dollar amount the credit will cost you at the end of the term. Amount Financed Annual Percentage Rate Term $350,000 5.0% 30 Years Taxes and Insurance per month (Escrow account set up by Wells-Fargo.) $430 $335,321.64 $326,395.24 O $373,125.82 O $426,825.60arrow_forwardA bank deposit paying simple interest at the rate of 6%/year grew to $1300 in 8 months. Find the principal. (Round your answer to the nearest cent.) $arrow_forwardYou are told that a note has repayment terms of $1,700 per quarter for 6 years, with a stated interest rate of 8%. How much of the total payment is for principal, and how much is for interest? Calculate using (a) financial calculator or (b) Excel function PV. (Round answers to 2 decimal places, eg. 5,275.25.) Total payment for principal Total interest Determine if the total interest will be higher or lower than with an annual payment. The total interest will be than with an annual payment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education