Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

![The stockholders' equity section of Jun Company's balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 10% stock dividend. The stock's per share market value on April 2 is $10 (prior to the dividend). Prepare the

stockholders" equity section immediately after the stock dividend is distributed. \table[[JUN COMPANY,], [Stockholders' Equity,], [,April 2 (after stock dividend)], [,], [, ], [Total paid - in capital,], [Total stockholders' equity,]]](https://content.bartleby.com/qna-images/question/13dba4f9-d0e2-45b5-b336-760446f3cbc0/19ec9590-b50c-4170-9344-b57c2a12710f/iovp2r_thumbnail.png)

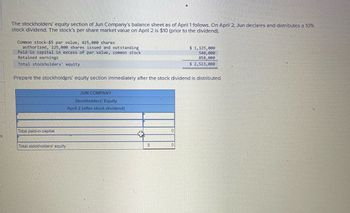

Transcribed Image Text:The stockholders' equity section of Jun Company's balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 10% stock dividend. The stock's per share market value on April 2 is $10 (prior to the dividend). Prepare the

stockholders" equity section immediately after the stock dividend is distributed. \table[[JUN COMPANY,], [Stockholders' Equity,], [,April 2 (after stock dividend)], [,], [, ], [Total paid - in capital,], [Total stockholders' equity,]]

Transcribed Image Text:The stockholders' equity section of Jun Company's balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 10%

stock dividend. The stock's per share market value on April 2 is $10 (prior to the dividend).

Common stock-$5 par value, 425,000 shares

authorized, 225,000 shares issued and outstanding

Paid-in capital in excess of par value, common stock

Retained earnings

Total stockholders' equity

$ 1,125,000

540,000

858,000

$ 2,523,000

Prepare the stockholders' equity section immediately after the stock dividend is distributed.

Total paid-in capital

JUN COMPANY

Stockholders' Equity

April 2 (after stock dividend)

Total stockholders' equity

+

09

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?arrow_forwardStockholders' Equity section of balance sheet The following accounts and their balances appear in the ledger of Goodale Properties Inc. on June 30 of the current year: Prepare the Stockholders Equity section of the balance sheet as of June 30. Eighty thousand shares of common stock are authorized, and 9,000 shares have been reacquired.arrow_forwardThe stockholders’ equity section of Jun Co.’s balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 10% stock dividend. The stock’s per share market value on April 2 is $20 (prior to the dividend). Prepare the stockholders’ equity section immediately after the stock dividend is distributed. Common stock—$5 par value, 375,000 shares authorized, 200,000 shares issued and outstanding . . . . . . . . . . $1,000,000 Paid-in capital in excess of par value, common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 600,000 Retained earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 833,000 Total stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,433,000arrow_forward

- Please help mearrow_forwardThe stockholders' equity section of Jun Co's balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 10% stock dividend. The stock's per share market value on April 2 is $20 (prior to the dividend). Common stock-$5 par value, 375,e00 shares authorized, 200,e00 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings $1,000,000 600,e00 833, еee $2,433,000 Total stockholders' equity Prepare the stockholders' equity section immediately after the stock dividend is distributed. JUN CO. Stockholders' Equity April 2 (after stock dividend) Total paid-in capital Total stockholders' eauity 8:40 PM 3/27/2022 Fn Lock Insert Prt Sc F9 F10 F11 F12 F7 F8 F4 E5 F6 + %23 %24arrow_forwardEpic Incorporated has 10,100 shares of $2 par value common stock outstanding. Epic declares a 6% stock dividend on July 1 when the stock's market value is $9 per share. The stock dividend is distributed on July 20. Prepare journal entries for (a) declaration and (b) distribution of the stock dividend. View transaction list Journal entry worksheet 1 2 Record the distribution of 6% stock dividend. Note: Enter debits before credits. Date July 20 General Journal Debit Creditarrow_forward

- Prepare a statement of stockholders' equity for Al-Can Products, Inc. Navigate to the Stockholders' Equity Statement tab in the spreadsheet. Use the following information to prepare your statement: a. January 1 balance of capital stock account of 9,000 shares issued at $6.00 per share was $54,000.00. b. No other stock was issued during the year. c. January 1 balance of retained earnings account was $29,250.00. d. Net Income was $41,106.00. e. Dividends declared during the year were $19,200.00.arrow_forwardOn June 13, the board of directors of Siewert Inc. declared a 5% stock dividend on its 40 million, $1 par, common shares, to be distributed on July 1. The market price of Siewert common stock was $15 on June 13. Complete the below table to calculate the stock dividend.Prepare a journal entry that summarizes the declaration and distribution of the stock dividend. Record the declaration and distribution of the stock dividend as journal entries.arrow_forwardConcordia Corporation has 96,900 common shares that have been issued. It declares a 4% stock dividend on December 1 to shareholders of record on December 20. The shares are issued on January 10. The share price is $15 on December 1, $14.50 on December 20, and $14.75 on January 10. b) Provide the required journal entries on the appropriate dates to record the stock dividend. Only provide account names as the dollar amount has already been calculated in part a). (If no entry is required, select "No Entry" for the account titles.) December 1 Dividends Declared Dividends Payable Stock Dividends Distributable Common Shares Preferred Shares Retained Earnings Cash No Entryarrow_forward

- The stockholders’ equity section of the balance sheet for Mann Equipment Co. at December 31, Year 2, is as follows. Note: The market value per share of the common stock is $38, and the market value per share of the preferred stock is $18. Required What is the par value per share of the preferred stock? What is the dividend per share on the preferred stock? What is the number of common stock shares outstanding? What was the average issue price per share (price for which the stock was issued) of the common stock? If Mann Equipment Company declared a 2-for-1 stock split on the common stock, how many shares would be outstanding after the split? What amount would be transferred from the Retained Earnings account because of the stock split? Theoretically, what would be the market price of the common stock immediately after the stock split? Stockholders’ Equity Paid-in capital Preferred stock, ? par value, 5% cumulative, 160,000 shares…arrow_forward(R) please answer asap.. The stockholders’ equity section of Jun Company’s balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 20% stock dividend. The stock’s per share market value on April 2 is $10 (prior to the dividend). Common stock—$5 par value, 555,000 sharesauthorized, 290,000 shares issued and outstanding$ 1,450,000Paid-in capital in excess of par value, common stock670,000Retained earnings923,000Total stockholders' equity$ 3,043,000Prepare the stockholders’ equity section immediately after the stock dividend is distributed.arrow_forwardPrepare the journal entry. Post to the T account .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,