Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Gain on disposal of property

1,165

Depreciation expense

11,620

Other items involving noncash expenses

1,355

Balance sheet data:

Increase in accounts receivable

1,710

Decrease in inventory

980

Increase in prepaid expenses

600

Decrease in accounts payable

760

Decrease in accrued and other current liabilities

1,035

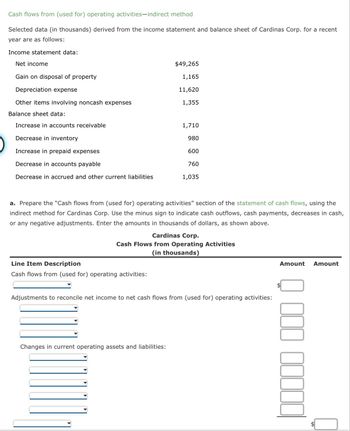

a. Prepare the "Cash flows from (used for) operating activities" section of the statement of cash flows, using the

indirect method for Cardinas Corp. Use the minus sign to indicate cash outflows, cash payments, decreases in cash,

or any negative adjustments. Enter the amounts in thousands of dollars, as shown above.

Line Item Description

Cardinas Corp.

Cash Flows from Operating Activities

(in thousands)

Cash flows from (used for) operating activities:

Adjustments to reconcile net income to net cash flows from (used for) operating activities:

Changes in current operating assets and liabilities:

b. The company has

earnings and

$

Amount Amount

net cash flows from operating

in sales. In addition, the

activities. The increase in accounts receivable indicates a(n)

company is using its cash to decrease its accounts payable balance, which indicates that the company is

Overall, National Beverage is doing

financially.

Transcribed Image Text:Cash flows from (used for) operating activities-indirect method

Selected data (in thousands) derived from the income statement and balance sheet of Cardinas Corp. for a recent

year are as follows:

Income statement data:

Net income

$49,265

Gain on disposal of property

1,165

Depreciation expense

11,620

Other items involving noncash expenses

1,355

Balance sheet data:

Increase in accounts receivable

1,710

Decrease in inventory

980

Increase in prepaid expenses

600

Decrease in accounts payable

760

Decrease in accrued and other current liabilities

1,035

a. Prepare the "Cash flows from (used for) operating activities" section of the statement of cash flows, using the

indirect method for Cardinas Corp. Use the minus sign to indicate cash outflows, cash payments, decreases in cash,

or any negative adjustments. Enter the amounts in thousands of dollars, as shown above.

Line Item Description

Cardinas Corp.

Cash Flows from Operating Activities

(in thousands)

Cash flows from (used for) operating activities:

Adjustments to reconcile net income to net cash flows from (used for) operating activities:

Changes in current operating assets and liabilities:

Amount Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Reporting changes in equipment on statement of cash flows An analysis of the general ledger accounts indicates that office equipment, which cost 245,000 and on which accumulated depreciation totaled 112,500 on the date of sale, was sold for 105,900 during the year. Using this information, indicate the items to be reported on the statement of cash flows.arrow_forwardStatement of Cash Flows The following are Mueller Companys cash flow activities: a. Net income, 68,000 b. Increase in accounts receivable, 4,400 c. Receipt from sale of common stock, 12,300 d. Depreciation expense, 11,300 e. Dividends paid, 24,500 f. Payment for purchase of building, 65,000 g. Bond discount amortization, 2,700 h. Receipt from sale of long-term investments at cost, 10,600 i. Payment for purchase of equipment, 8,000 j. Receipt from sale of preferred stock, 20,000 k. Increase in income taxes payable, 3,500 l. Payment for purchase of land, 9,700 m. Decrease in accounts payable, 2,900 n. Increase in inventories, 10,300 o. Beginning cash balance, 18,000 Required: Prepare Mueller Company's statement of cash flows.arrow_forwardCash flows from operating activitiesindirect method The net income reported on the income statement for the current year was 93,700. Depreciation recorded on store equipment for the year amounted to 31,200. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: a. Prepare the Cash flows from operating activities section of the statement of cash flows, using the indirect method. b. Briefly explain why net cash flow from operating activities is different than net income.arrow_forward

- Use the following information from Birch Companys balance sheets to determine net cash flows from operating activities (indirect method), assuming net income for 2018 of $122,000.arrow_forwardCOMPUTE CASH PROVIDED BY OPERATING ACTIVITIES Powell Companys condensed income statement for the year ended December 31, 20-2, was as follows: Additional information obtained from Powells comparative balance sheet and auxiliary records as of December 31, 20-2 and 20-1, was as follows: Depreciation expense for 20-2, included in operating expenses on the income statement, was 29,000. REQUIRED Prepare a partial statement of cash flows reporting cash provided by operating activities for the year ended December 31, 20-2.arrow_forwardPreparing a Statement of Cash Flows Volusia Company reported the following comparative balance sheets for 2019: Required: Prepare a statement of cash flows for Volusia using the indirect method to compute net cash flow from operating activities.arrow_forward

- In the current year, Harrisburg Corporation had net income of 35,000, a 9,000 decrease in accounts receivable, a 7,000 increase in inventory, an 8,000 increase in salaries payable, a 13,000 decrease in accounts payable, and 10,000 in depreciation expense. Using the indirect method, prepare the operating activities section of its statement of cash flows based on this information.arrow_forwardCOMPUTE CASH PROVIDED BY OPERATING ACTIVITIES Horn Companys condensed income statement for the year ended December 31, 20-2, was as follows: Additional information obtained from Horns comparative balance sheet and auxiliary records as of December 31, 20-2 and 20-1, was as follows: Depreciation expense for 20-2, included in operating expenses on the income statement, was 32,000. REQUIRED Prepare a partial statement of cash flows reporting cash provided by operating activities for the year ended December 31, 20-2.arrow_forwardCOMPUTE CASH PROVIDED BY OPERATING ACTIVITIES Horn Companys condensed income statement for the year ended December 31, 20-2, was as follows: Additional information obtained from Horns comparative balance sheet and auxiliary records as of December 31, 20-2 and 20-1, was as follows: Depreciation expense for 20-2, included in operating expenses on the income statement, was 32,000. REQUIRED Prepare a partial statement of cash flows reporting cash provided by operating activities for the year ended December 31, 20-2. SCHEDULE FOR CALCULATION OF CASH GENERATED FROM OPERATING ACTIVITIES Using the information provided in Problem 23-9A for Horn Company, prepare the following: 1. A schedule for the calculation of cash generated from operating activities for Horn Company for the year ended December 31, 20-2. 2. A partial statement of cash flows for Horn Company reporting cash from operating activities under the direct method for the year ended December 31, 20-2.arrow_forward

- Statement of cash flowsindirect method The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. Net income, 250,000. b. Depreciation reported on the income statement, 135,000. c. Equipment was purchased at a cost of 420,000 and fully depreciated equipment costing 90,000 was discarded, with no salvage realized. d. The mortgage note payable was not due for six years, but the terms permitted earlier payment without penalty. e. 30,000 shares of common stock were issued at 20 for cash. f. Cash dividends declared and paid, 45,000. Instructions Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.arrow_forwardWhich item is added to net income when computing cash flows from operating activities? a. Gain on the disposal of property, plant, and equipment b. Increase in wages payable c. Increase in inventory d. Increase in prepaid rent Use the following information for Multiple-Choice Questions 11-9 and 11-10: Cornett Company reported the following information: cash received from the issuance of common stock, $150,000; cash received from the sale of equipment, $14,800; cash paid to purchase an investment, $20,000; cash paid to retire a note payable, $50,000; and cash collected from sales to customers, $225,000.arrow_forwardRoberts Company provided the following partial comparative balance sheets and the income statement for 20X2. Required: Compute operating cash flows using the indirect method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College