FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

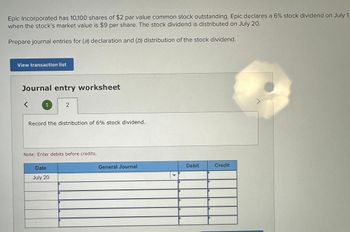

Transcribed Image Text:Epic Incorporated has 10,100 shares of $2 par value common stock outstanding. Epic declares a 6% stock dividend on July 1

when the stock's market value is $9 per share. The stock dividend is distributed on July 20.

Prepare journal entries for (a) declaration and (b) distribution of the stock dividend.

View transaction list

Journal entry worksheet

1

2

Record the distribution of 6% stock dividend.

Note: Enter debits before credits.

Date

July 20

General Journal

Debit

Credit

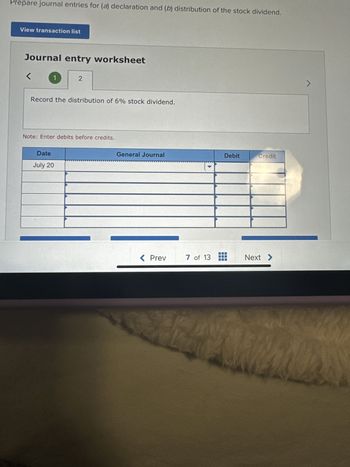

Transcribed Image Text:Prepare journal entries for (a) declaration and (b) distribution of the stock dividend.

View transaction list

Journal entry worksheet

<

1

2

Record the distribution of 6% stock dividend.

Note: Enter debits before credits.

Date

July 20

General Journal

< Prev

7 of 13

Debit

Credit

TE

Next >

>

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Italian Stallion has the following transactions during the year related to stockholders' equity. February 1 Issues 4, 200 shares of no-par common stock for $15 per share. May 15 Issues 200 shares of $10 par value, 3.5% preferred stock for $12 per share. October 1 Declares a cash dividend of $0.35 per share to all stockholders of record (both common and preferred) on October 15. October 15 Date of record. October 31 Pays the cash dividend declared on October 1. Required: Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 3 4. Record payment of the cash Note: Enter debits before credits. Date General Journal Debit Credit October 31arrow_forwardOn September 1, the board of directors of a company, declares a stock dividend on its 22,000, $13 par, common shares. The market price of the common stock is $42 on this date.Required:1. 2. & 3. Record the necessary journal entries assuming a small (10%) stock dividend, a large (100%) stock dividend, and a 2-for-1 stock split. need helparrow_forwardPlease help mearrow_forward

- 31. Closed the credit balance of the income summary account, $269,400. 2. Journalize the entries to record the transactions, and post to the eight selected Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. listed. Also prepare T accounts for the following: Paid-In Capital from Sale cf July 1. Declared a 4% stock dividend on common stock, to be capitalized at the 1. Enter the January 1 balances in T accounts for the stockholders' equity accounts FROBLEM 12-4B Btries for selected oporate transactions Objectives 4, 5, 7, 8 Shoshone Enterprises Inc. manufactures bathroom fixtures. The stockholders' equity accounts of Shoshone Enterprises Inc., with balances on January 1, 2006, are as follows: Common Stock, $20 stated value (100,000 shares authorized, 75,000 shares issued) Paid-In Capital in Excess of Stated Value Retained Earnings.. Treasury Stock (5,000 shares, at cost) $1,500,000 180,000 725,000 140,000 ADNET ASS The following selected transactions occurred…arrow_forwardPrepare the journal entry to record Zende Company's issuance of 75,000 shares of $5 par value common stock assuming the shares sell for: a. $5 cash per share. b. $6 cash per share. View transaction list Journal entry worksheet 1 > Record the issuance of 75,000 shares of $5 par value common stock assuming the shares sell for $5 cash per share. Note: Enter debits before credits. 3/ F6 F7 F8 F9 F10arrow_forwardPrepare journal entries for both of the following transactions: On Jan 1, ABC Company issued 300 $10 stocks with a $5 par value. On Dec 31st, ABC Company, declared a 3% cash dividend on each share.arrow_forward

- On January 1, Sheffield Corporation had 145000 shares of $10 par value common stock outstanding. On June 17, the company declared a 15% stock dividend to stockholders of record on June 20. Market value of the stock was $15 on June 17. The entry to record the transaction of June 17 would include a O credit to Common Stock Dividends Distributable for $326250. O credit to Cash for $326250. O credit to Common Stock Dividends Distributable for $108750. O debit to Stock Dividends for $326250.arrow_forwardPrepare the journal entry to record Jevonte Company’s issuance of 41,000 shares of its common stock assuming the shares have a: $3 par value and sell for $19 cash per share. $3 stated value and sell for $19 cash per sharearrow_forwardPlease help mearrow_forward

- The following accounts and their balances appear in the ledger of Goodale Properties Inc. on June 30 of the current year: Common Stock, $15 par $706,500 Paid-In Capital from Sale of Treasury Stock 29,000 Paid-In Capital in Excess of Par-Common Stock 18,840 Retained Earnings 1,109,000 Treasury Stock 14,630 Prepare the Stockholders' Equity section of the balance sheet as of June 30 using Method 1 of Exhibit 8. Eighty thousand shares of common stock are authorized, and 770 shares have been reacquired. Goodale Properties Inc. Stockholders' Equity June 30, 20хх Paid-In Capital: Total Paid-In Capital $4 Total Total Stockholders' Equityarrow_forwardpopatarrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education