Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:es

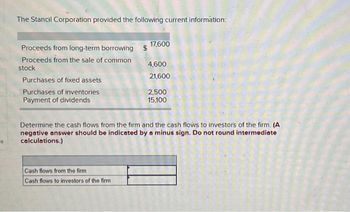

The Stancil Corporation provided the following current information:

Proceeds from long-term borrowing $ 17,600

Proceeds from the sale of common

stock

Purchases of fixed assets

Purchases of inventories

Payment of dividends

4,600

21,600

Cash flows from the firm

Cash flows to investors of the firm

2,500

15.100

Determine the cash flows from the firm and the cash flows to investors of the firm (A

negative answer should be indicated by a minus sign. Do not round intermediate

calculations.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- which of the following transactions and events would result in an improvement in Dividends per share ?A. acquiring cash proceeds from a 5-year interest-only bank loan. B. The recognition of income tax expense owing at the end of the periodC. the receipt of cash for dividends from other entities (increase financing cash flow)A and B onlyA and C onlyB and C onlyAll of the aboveNone of the abovearrow_forwardMazaya Company has the following information available: Net Income R.O. 37,500; Cash Provided by Operations R.O. 46,500; Cash Sales R.O. 97,500; Capital Expenditures R.O.16,500; Dividends Paid R.O. 4,500. What is Mazaya's free cash flow?arrow_forwardYou are evaluating the balance sheet for SophieLex’s Corporation. From the balance sheet you find the following balances: cash and marketable securities = $280,000; accounts receivable = $1,380,000; inventory = $2,280,000; accrued wages and taxes = $590,000; accounts payable = $890,000; and notes payable = $780,000. What is the quick ratio (round your answer to 2 decimal placesarrow_forward

- Do not provide image in solution and give explanation.arrow_forwardi) Central to the previous calculations of company valuations are the payment of dividends. The following terms relating to dividend payment chronology. Define each term in a single sentence • Ex-dividend date• Record date • Declaration date• Payment date • Cum-dividend period ii) Give two reasons why a company my distribute cash to shareholders via a buyback rather than a dividendarrow_forwardNutrition Inc. reissued treasury stock. How would this be shown on a statement of cash flows? decrease in cash from an investing activity increase in cash from a financing activity decrease in cash from an operating activity decrease in cash from a financing activity increase in cash from an investing activity increase in cash from an operating activity Nutrition Inc. made a payment on a past due account payable. How would this be shown on a statement of cash flows? increase in cash from a financing activity decrease in cash from an operating activity increase in cash from an operating activity decrease in cash from a financing activity increase in cash from an investing activity decrease in cash from an investing activityarrow_forward

- The Stancil Corporation provided the following current information: Proceeds from long-term borrowing $ 13,800 Proceeds from the sale of common stock 5,000 Purchases of fixed assets 27,500 Purchases of inventories 2,600 Payment of dividends 13,800 Determine the total cash flows spent on fixed assets and NWC, and determine the cash flows to investors of the firm. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations.)arrow_forward1. A company has the following balance sheet information: cash of $127,536, current assets of $350,647, current liabilities of $289,615, long-term debt of $345,000 and total assets of $1,304,165. It also has sales of $1,600,400. a. What is the company's owner's equity balance? b. What is the company's cash and current ratios? c. What is the company's total asset turnover? d. If the profit margin is 25%, what is the company's net income? e. If you were to create a common size balance sheet, what would the cash line be? What would the long-term debt line be? What is the company's ROE? f.arrow_forwardThe comparative balance sheets and income statements for Rundle Company follow: Balance Sheets As of December 31 Assets Cash Accounts receivable Inventory Equipment Accumulated depreciation-equipment Land Total assets Liabilities and equity Accounts payable (inventory) Long-term debt Common stock Retained earnings Total liabilities and equity Income Statement For the Year Ended December 31, Year 2 Sales revenue Cost of goods sold Gross margin Depreciation expense Operating income Gain on sale of equipment Loss on disposal of land Net income Additional Data $38,810 (15,383) 23,427 (3,925) 19,502 500 (50) $19,952 Year 2 $24,843 2,492 6,517 Cash flows from operating activities: 20,854 (10,472) 16,379 $60,613 $2,490 2,695 20,700 34,728 $60,613 RUNDLE COMPANY Statement of Cash Flows For the Year Ended December 31, Year 2 Year 1 $2,506 1,495 6,110 1. During Year 2, the company sold equipment for $18,357; it had originally cost $28,700. Accumulated depreciation on this equipment was $10,843…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education