FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

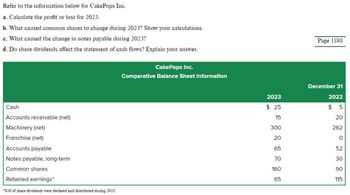

Transcribed Image Text:Refer to the information below for CakePops Inc.

a. Calculate the profit or loss for 2023.

b. What caused common shares to change during 2023? Show your calculations.

c. What caused the change in notes payable during 2023?

d. Do share dividends affect the statement of cash flows? Explain your answer.

CakePops Inc.

Comparative Balance Sheet Information

Cash

Accounts receivable (net)

Machinery (net)

Franchise (net)

Accounts payable

Notes payable, long-term

Common shares

Retained earnings*

*$10 of share dividends were declared and distributed during 2023.

Page 1180

December 31

2023

2022

$ 25

$

5

15

20

300

262

20

0

65

52

70

30

160

90

65

115

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The bookkeeper for Novak Corp. has prepared the following statement of financial position as at July 31, 2023: Cash Accounts receivable (net) Inventory Equipment (net) Patents (net) 1. Novak Corp. Statement of Financial Position As at July 31, 2023 2. $84,000 39,800 72,000 217,000 23,000 $435,800 The following additional information is provided: Notes and accounts payable Long-term liabilities Shareholders' equity $52,000 83,000 300,800 $435,800 Cash includes $1,700 in a petty cash fund and $29,000 in a bond sinking fund. The net accounts receivable balance is composed of the following three items: (a) accounts receivable debit balances =SUPPORTarrow_forwardPer US GAAP, Paying a cash dividend to its stockholders is found in which activity section A) Investing B) Operating C) Adjusting D) Financingarrow_forwardRequired information [The following information applies to the questions displayed below.] Consider the following balance sheet and income statement for Mmm Good Foods Incorporated (the company that operates Tasty Fried Chicken and Pizza Party), in condensed form, including some information from the cash flow statement: (amounts are millions) Balance Sheet Cash and short-term investments Accounts receivable Inventory Other current assets Long-lived assets Total assets Current liabilities Total liabilities Shareholders' equity Total liabilities and equity Income Statement Sales Cost of sales Gross margin Earnings before interest and taxes Interest Taxes Net income Share price Earnings per share Number of outstanding shares (millions) Cash Flows Cash flow from operations Capital expenditures Dividends Mmm Good Foods Incorporated 2019 2018 $743 623 $ 443 597 161 3,704 $ 5,231 $ 1,541 13, 247 (8,016) $ 5,231 $ 5,597 1,235 $ 4,362 $ 1,859 486 79 $ 1,294 $ 102 4.23 300 $ 1,315 196 511 167…arrow_forward

- Please interpret the numbers and compare the number, no required to explain the theory. Also answer if the business is a going concern? CKM RATIOS: 2016 2017 2018 2019 2020 2021 Current ratio 0.66 0.58 0.96 0.92 1.06 0.83 Quick ratio 0.43 0.37 0.58 0.53 0.49 0.57 Operating cash flow ratio 0.10 0.01 0.01 0.00 0.02 0.07 PWC RATIOS: 2016 $000 2017 $000 2018 $000 2019 $000 2020 $000 2021 $000 Current ratio 2.37 2.23 2.07 1.89 2.74 2.16 Quick ratio 0.93 0.95 0.81 0.80 1.36 1.01 Operating cash flow ratio 1.02 0.72 0.96 0.47 0.32 0.52arrow_forwardThe following is selected financial data from Block Industries. How much does Block Industries have in current liabilities? Cash Accounts receivable Equipment Prepaid expenses Accounts payable Unearned revenue Long-term notes payable Common stock Revenue Sales tax payable Interest expense Depreciation expense OOOO $1 $19,800 $25,800 $12,300 $20,000 13,400 10,650 5,000 12,300 7,500 10,000 18,000 11,700 6,000 4,500 1,000arrow_forwardPlease help me with all answers I will give upvote thankuarrow_forward

- Please do not give solution in image format thankuarrow_forwardPrepare balance sheets for Ebony Interiors as of March 31, 2018. Ebony InteriorsBalance SheetMarch 31, 2018 Assets $Cash Accounts receivable Supplies Total assets Liabilities $Accounts payable Stockholders' Equity $Common stock Retained earnings Total stockholders' equity fill in the blank dff07100effdffe_14 Total liabilities and stockholders' equity $fill in the blank dff07100effdffe_15arrow_forwardCreate a comparative financial statement from the following:arrow_forward

- Janzen Company recorded employee salaries earned but not yet paid. Which of the following represents the effect of this transaction on the horizontal financial statements model? A. B. C. D. Assets + Balance Sheet Liabilities + + + Multiple Choice Option B Option A Option C Option D + Stockholders' Equity Income Statement Revenue + - Expense = + + + Net income + Statement of Cash Flows -Operating Activity -Investing Activityarrow_forwardCan you explain the steps to find the answer to the red squares? Do not give answer in imagearrow_forwardQ2. From the following particulars, you are required to calculate: (c) Stock Turnover Ratio (f) Debtor's Turnover Ratio (a) Current Ratio (b) Gross Profit Ratio (d) Debt Equity Ratio (e) Proprietary Ratio Rs Rs Particulars 74,40,000 Inventories 15.00,000 Bank Overdraft 7,44,000 Sundry Debtors 6,00,000 Sundry Creditors 16,50,000 Short-Term Investments 5,00.000 Cash Balances Particulars 9,10.000 2.00.000 12,40,000 Annual Sales Paid up Capital Gross Profit Reserve & Surplus 12.00,000 1.60,000 Fixed Assets 7% Debentures 40,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education