CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

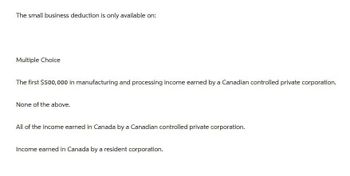

Transcribed Image Text:The small business deduction is only available on:

Multiple Choice

The first $500,000 in manufacturing and processing income earned by a Canadian controlled private corporation.

None of the above.

All of the income earned in Canada by a Canadian controlled private corporation.

Income earned in Canada by a resident corporation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- K The small business deduction (SBD) is only available on which of the following? 50 point(s) possible This question: 1 point(s) possible A. Income earned in Canada by a resident corporation. OB. The first $500,000 in manufacturing and processing profits (M&P) income earned by a CCPC. OC. The active business income of a private corporation with no more than five full-time employees devoted to earning income from property. OD. All of the income earned in Canada by a CCPC. OE. none of the above Submit testarrow_forwardYou are working with ABCD tax consultant group, new client; Leduc Corporation asks you to help them to identify there tax payables, and they provide you with the following information. Leduc co. is a Canadian Controlled Private Corporation and the Taxable Capital Invested in Canada $5,000,000. Its business activity importing consumer goods from South Africa, and distribute to different retailers in Canada. They provide you with there Income statement before taxes for the year ending Dec 31, 2023. Leduc Corp. Income Statement before Taxes Year ending Dec 31, 2023 Net Sales Cost of goods Sold $7,864,238 $6,451,133 Gross Profit $1,413,105 Selling and administration Expenses: Selling expenses Wages and Salaries $382,000 $308,000 Rent and office expenses $276,000 Amortization Expense $50,000 Other Expenses $169,660 Total Expenses Not including Income Taxes $1,185,660 Other Income Income before Taxes $167,044 $394,490 Leduc corp. did not complete there Balance Sheet but they provide you with…arrow_forwardAxtell Corporation has the following taxable income: U.S. source income $ 1,620,000 Foreign source income: Country A 550,000 Country B 2,000,000 Country C 2,900,000 Taxable income $ 7,070,000 Axtell paid $600,000 income tax to Country B and $1.3 million income tax to Country C. Country A does not have a corporate income tax. Required: Compute Axtell’s U.S. income tax, assuming the foreign source income does not qualify as FDII.arrow_forward

- Axtell Corporation has the following taxable income: U.S. source income Foreign source income: Country A Country B Country C Taxable income $ 1,620,000 550,000 2,000,000 2,900,000 $ 7,070,000 Axtell paid $600,000 income tax to Country B and $1.3 million income tax to Country C. Country A does not have a corporate income tax. Required: Compute Axtell's U.S. income tax, assuming the foreign source income does not qualify as FDII. Note: Do not round any intermediate calculations. Enter your answer in dollars and not in millions of dollars. U.S. income taxarrow_forwardU.S. International Corporation (USIC), a U.S. taxpayer, has investments in Foreign Entities A-G. Relevant Information for these entities for the current fiscal year appears in the following table: Entity Country % Owned Activity Income before tax ($ millions) Income Tax Rate Dividend Withholding tax Rate Net Amount Received by Parent ($ millions) USIC United States 35.00% Argentina Brazil Canada Hong Kong 100% Liechtenstein 100% A B C D E F G 100% 100% 100% 51% Japan New Zealand 60% Manufacturing $10.00 Manufacturing $1.00 Manufacturing $2.00 Manufacturing $3.00 Investment $2.00 Distribution $3.00 Manufacturing $2.00 $4.00 Banking 35.00% 34.00% 26.00% 16.50% 10.00% 38.00% 28.00% 0% 0% 5% 0% 4% 5% 5% $0.20 $2.50 $1.00 $1.50 S- $0.50 $1.00 Additional Information 1. USIC's $10 million income before tax is derived from the production and sale of products in the United States. 2. Each entity is legally incorporated in its host country other than Entity A, which is registered with the…arrow_forwardAssume that it is a domestic corporation using itemized deduction, compute the net taxable incomearrow_forward

- For the current year, 2022, net income for tax purposes is $264,600. Included in this amount is the following: Income from an active business carried on in Canada Taxable capital gain Eligible dividends from Canadian public companies Canadian bond interest The following is a summary of other information for Wrap Ltd. for the 2022 year: Taxable income Capital dividend paid Eligible dividend paid Non-eligible dividend paid Small business deduction Total Federal Part I tax payable $200,200 6,200 18,000 40,200 $236,200 12,200 10,200 75,200 38,038 32,120 Required: Determine the dividend refund for 2022. Would the dividend refund change if Wrap Ltd. was not a CCPC but instead was a private corporation or a public corporation? (Use 0.3067 when multiplying to represent 30% %. and 0.3833 when multiplying to represent 38 1/3%. Do not multiply by more than 4 decimal places and round your final answer to the nearest dollar. Enter subtractions as negative amounts.)arrow_forwardIf the value of its total assets do no exceed P100,000,000, compute for the income tax payable if the taxpayer is a nonresident foreign corporation.arrow_forwardKatya Corporation had the following data in 2022: Gross Income, Philippines P 600,000 500,000 300,000 Gross Income, USA Expenses, Philippines Expenses, USA Interest from time deposit 300,000 10,000 21,000 interest on money market placement, net of tax Compute the income tax due and the final taxes payable if Katya is a: 1. Domestic Corporation 2. Resident Foreign Corporation 3. Nonresident Foreign Corporationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you