Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

If the value of its total assets do no exceed P100,000,000, compute for the income tax payable if the taxpayer is a nonresident foreign corporation.

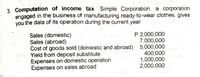

Transcribed Image Text:3. Computation of income tax. Simple Corporation, a corporation

engaged in the business of manufacturing ready-to-wear clothes, gives

you the data of its operation during the current year:

P 3,000,000

7,000,000

Sales (domestic)

Sales (abroad)

Cost of goods sold (domestic and abroad) 5,000,000

t Yield from depoșit substitute

Expenses on domestic operation

Expenses on sales abroad

400,000

1,000,000

2,000,000

CS Scanned with CamScanner

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- U.S. corporations are eligible for a foreign tax credit for withholding taxes imposed on dividends received from 100 percent owned foreign corporations, even if the dividend qualifies for the 100 percent dividends received deduction. True or Falsearrow_forwardThis term refers to an asset sold for more than its original value. Using taxable income, it is based on tax tables or tax rate schedules. During this transaction, you can exclude the first $250,000 ($500,000 for married taxpayers) of gain on sale. This term refers to passive income offset. This term essentially includes all income subject to federal tax.arrow_forwardThis is US Tax and Lawarrow_forward

- Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is an non-resident owner or lessor of vessels Qalvin Corporation, a MSME, reported the following in 2023: in 2022: Philippines Abroad Total Gross income P500,000 P200,000 P500,000 Direct Deductions 200,000 300,000 500,000 Common Expenses 150,000 Compute the income tax due if Qalvin is a resident foreign corporationarrow_forwardI'm from the Philippinesarrow_forwardA non-U.S. corporation investor held a real estate asset (a parcel of land) that that was purchased for $100,000,000 for 10 years and will sell it for $130,000,000. The investor gain on the sale of the asset is considered to in a business that is effectively connected to a U.S. trade or business (ECI). Compute the tax on the sale assuming that the investor held the asset directly (consider double tax - both ECI and branch profits tax) __________________ Compute the tax to the investor if held through US corporation (consider both entity level tax and FDAP tax on the distributions) with no treaty rates and a plan of liquidation in the year of sale _______________________arrow_forward

- Please help thanksarrow_forward2. Liang Corporation, a U.S. entity, owns 100% of ForCo, a non-U.S. corporation not engaged in a U.S. trade or business. Is Liang subject to any U.S. income tax on her dealings with ForCo? Explain.arrow_forwardDetermine the taxable income for the year. (PHILIPPINES)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education