Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Accounting

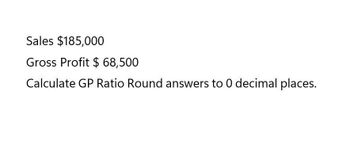

Transcribed Image Text:Sales $185,000

Gross Profit $ 68,500

Calculate GP Ratio Round answers to 0 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Forecast the ATO based on the following data. Sales 1 $66.170B Sales 2 $66.463B NOA 1 $107.760B NOA 2 $109.727B PM average is 14.5% Post you answer with 2 decimal. 0.88 for examplearrow_forwardcalculate this account questions profit ratioarrow_forwardHi expart give correct answer the general accounting questionarrow_forward

- PLZZ EXPLAINarrow_forwardAssume the following sales data for a company: Year 2 $562,500 Year 1 $450,000 What is the percentage increase in sales from Year 1 to Year 2 (to the nearest whole percent)? O a. 20% O b. 125% О с. 25% O d. 80%arrow_forwardHelp Save & Exit Submit Martinez Corporation reported net sales of $769,000, net income of $138,000, and total assets of $7,674,336. The profit margin is: Multiple Choice 557.0%. 5.57%. 82.05%. 6:35 PM 3/28/2022 Insert Prt Sc F12 Del F8 F9 F10 F7 ockarrow_forward

- Year 1 Year 2 YR 1 YR2Sales (S) $ 614,405.00 $ 600,343.00 Cost of Good Sold (COGS) $ 385,101.00 $ 473,396.00 Gross Profit (GP) $ 229,304.00 $ 226,947.00 Calculate the following: (round to nearest percent) Answer Answer(a) Mark-up percent for year 1 (b) Mark-up percent for year 2 (c) Gross Profit for year 1 (d) Gross Profit for year 2arrow_forward+ Question:8 Sales COGS Gross profit G&A expenses Sales & Marketing expenses Depreciation Operating income Interest $575,000 $ 1,600,000 $200,000 $ 50,000 $ 100,000 Income Before taxes Income taxes Net income 1: Calculate Sales. 30% $ 700,000 2. Calculate Income before taxes. Taxes are 30%, so you know the Net Income (Y) is a percent of "Income before taxes" (X). 3. Calculate the Income tax figure. 4. Calculate Operating Income.arrow_forward20.1 A business has compiled the following information for the year ended 31 October 20X2: 38 mins $ 386,200 989,000 422,700 Opening inventory Purchases Closing inventory The gross profit as a percentage of sales is always 40% Based on these figures, what is the sales revenue for the year? $952,500 $1,333,500 $1,587,500 A C $1.524.000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning