EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

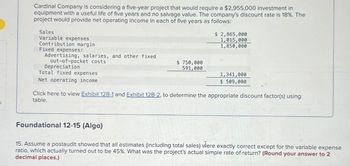

Transcribed Image Text:Cardinal Company is considering a five-year project that would require a $2,955,000 investment in

equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The

project would provide net operating income in each of five years as follows:

Sales

Variable expenses

Contribution margin

Fixed expenses:

out-of-pocket costs

Depreciation

$ 2,865,000

1,015,000

1,850,000

Advertising, salaries, and other fixed

$ 750,000

591,000

Total fixed expenses

1,341,000

$ 509,000

Net operating income

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using

table.

Foundational 12-15 (Algo)

15. Assume a postaudit showed that all estimates (including total sales) vlere exactly correct except for the variable expense

ratio, which actually turned out to be 45%. What was the project's actual simple rate of return? (Round your answer to 2

decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consolidated Aluminum is considering the purchase of a new machine that will cost $308,000 and provide the following cash flows over the next five years: $88,000, 92,000, $91,000, $72,000, and $71,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forwardPostman Company is considering two independent projects. One project involves a new product line, and the other involves the acquisition of forklifts for the Materials Handling Department. The projected annual operating revenues and expenses are as follows: Required: Compute the after-tax cash flows of each project. The tax rate is 40 percent and includes federal and state assessments.arrow_forwardRoberts Company is considering an investment in equipment that is capable of producing more efficiently than the current technology. The outlay required is 2,293,200. The equipment is expected to last five years and will have no salvage value. The expected cash flows associated with the project are as follows: Required: 1. Compute the projects payback period. 2. Compute the projects accounting rate of return. 3. Compute the projects net present value, assuming a required rate of return of 10 percent. 4. Compute the projects internal rate of return.arrow_forward

- Gardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $420,000 and will generate $95,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further Instructions on internal rate of return in Excel, see Appendix C.arrow_forwardCardinal Company is considering a five-year project that would require a $2,915,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 16%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses $ 2,863, 000 1,014,000 1,849,000 $ 781,000 583, 000 1,364, 000 $ 485,000 Net operating incone Click here to view Exhibit 148-1 ond Exhibit 148-2, to determine the appropriate discount factor(s) using table. 15. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the project's actual simple rate of return? (Round your answer to 2 decimal places.) Simple rate of returnarrow_forwardCardinal Company is considering a five-year project that would require a $2,750,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin: Fixed expenses: Advertising, salaries, and other fixed out- of-pocket costs $ 752,000 550,000 Depreciation Total fixed expenses Net operating income Click here to view Exhibit 128-1 and Exhibit 128-2. to determine the appropriate discount factor(s) using table Simple rate of return $ 2,849,000 1,122,000 1,727,000. % Foundational 12-15 (Algo) 15. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the project's actual simple rate of return? (Round your answer to 2 decimal places.) 1,302,000 $425,000arrow_forward

- Sagararrow_forwardCardinal Company is considering a project that would require a $2,782,000 investment in equipment with a useful life of five years. At the end of five years, the project would terminate and the equipment would be sold for its salvage value of $200,000. The company’s discount rate is 18%. The project would provide net operating income each year as follows: Sales $ 2,873,000 Variable expenses 1,019,000 Contribution margin 1,854,000 Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $ 754,000 Depreciation 516,400 Total fixed expenses 1,270,400 Net operating income $ 583,600 Required:If the equipment’s salvage value was $400,000 instead of $200,000, what would be the project’s simple rate of return? (Round your answer to 2 decimal places.)arrow_forwardCardinal Company is considering a project that would require a $2,810,000 investment in equipment with a useful life of five years. At the end of five years, the project would terminate and the equipment would be sold for its salvage value of $500,000. The company's discount rate is 16%. The project would provide net operating income each year as follows: $2,847,000 1,121,000 1,726,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $ 782,000 Depreciation Total fixed expenses 462,000 1,244,000 Net operating income $ 482,000 Click here to view Exhibit 10-1 and Exhibit 10-2, to determine the appropriate discount factor(s) using tables. Required: What is the present value of the project's annual net cash inflows? (Round discount factor(s) to 3 decimal places and final answer to the nearest dollar amount.) Present valuearrow_forward

- Cardinal Company is considering a project that would require a $2,765,000 investment in equipment with a useful life of five years. At the end of five years, the project would terminate and the equipment would be sold for its salvage value of $300,000. The company's discount rate is 14%. The project would provide net operating income each year as follows: $2,851,000 1,150,000 1,701,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $ 670,000 Depreciation Total fixed expenses 493,000 1,163,000 $ 538,000 Net operating income Required: What are the project's annual net cash inflows? Annual net cash inflowarrow_forwardCardinal Company is considering a project that would require a $2,805,000 investment in equipment with a useful life of five years. At the end of five years, the project would terminate and the equipment would be sold for its salvage value of $400,000. The company's discount rate is 14%. The project would provide net operating income each year as follows: $2,741,000 1,125,000 1,616,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $ 642,000 Depreciation Total fixed expenses 481,000 1,123,000 $ 493,000 Net operating income Click here to view Exhibit 10-1 and Exhibit 10-2, to determine the appropriate discount factor(s) using tables. Required: What is the present value of the equipment's salvage value at the end of five years? (Round discount factor(s) to 3 decimal places and final answer to the nearest dollar amount.) Present valuearrow_forwardVinubhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning