Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

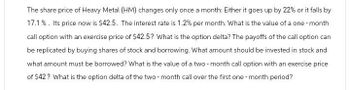

Transcribed Image Text:The share price of Heavy Metal (HM) changes only once a month: Either it goes up by 22% or it falls by

17.1%. Its price now is $42.5. The interest rate is 1.2% per month. What is the value of a one-month

call option with an exercise price of $42.5? What is the option delta? The payoffs of the call option can

be replicated by buying shares of stock and borrowing. What amount should be invested in stock and

what amount must be borrowed? What is the value of a two-month call option with an exercise price

of $42? What is the option delta of the two-month call over the first one-month period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The stock price of Heavy Metal (HM) changes only once a month: either it goes up by 26% or it falls by 19.3%. Its price now is $43. The interest rate is 0.5% per month. a. What is the value of a one-month call option with an exercise price of $43? b. What is the option delta? c. The payoffs of the call option can be replicated by buying shares of stock and borrowing. What amount should be invested in stock and what amount must be borrowed? d. What is the value of a two-month call option with an exercise price of $42? e. What is the option delta of the two-month call over the first one-month period? Complete this question by entering your answers in the tabs below. Req A and B Req C Req D and E d. What is the value of a two-month call option with an exercise price of $42? (Do not round intermediate calculations. Round your answer to 1 decimal place.) e. What is the option delta of the two-month call over the first one-month period? (Do not round intermediate calculations. Round your…arrow_forwardThe stock price of ABC changes only once a month: either it goes up by 20% or it falls by 16.7%. Its price now is £40. The interest rate is 12.7% per year, or about 1% per month. Required: i Suppose a one-month call option on this stock has an exercise price of £40, what is the option delta? ii Show how the payoffs of this call option can be replicated by buying ABC’s stock and borrowing. iii Using the risk-neutral method to calculate the value of a one-month call option with an exercise price of £40. iv Construct a two-month binomial tree. What is the value of a two-month call option with an exercise price of £40? v Use put-call parity, what is the price for a one-month put with the same exercise price? And a two-month put with the same exercise price?arrow_forward1. The stock price of Heavy Metal (HM) changes only once a month: either it goes up by 20% or it falls by 16.7%. Its price now is $40. The interest rate is 12.7% per year, or about 1% per month. a. What is the value of a one-month call option with an exercise price of $40? b. What is the option delta? c. What is the option delta of the two-month call over the first one-month period? d. Show how the payoffs of this call option can be replicated by buying HM’s stock andborrowing. e. What is the value of a two-month call option with an exercise price of $40?arrow_forward

- TreeOlivia's stock price is $180 and could halve or double in each six-month period. The interest rate is 12% a year. What is the value of a six-month call option on TreeOlivia with an exercise price of $120? What is the option delta for the six-month call with an exercise of $120? The payoffs of the six-month call option can be replicated by buying shares of stock and borrowing. What amount should be invested in stock and what amount must be borrowed? Assume the exercise price is $120. What is the value of the one-year call option on TreeOlivia with an exercise of $150? (Hint: use the two-step binominal tree) What is the value of the one-year put option on TreeOlivia with an exercise of $150?arrow_forwardThe share price of your favourite company is currently traded at a price of £40 and interest is compounded continuously at rate 3.7% per year. Assume that the share evolves according to a discrete time LogNormal process with time measured in years, drift ?=0.15 and volatility ?=0.24. You decide to buy a European call option with a strike price of £42 and an expiration date of two years from now. What is the no-arbitrage price for this option?arrow_forwardThe share price of your favourite company is currently traded at a price of £60 and interest is compounded continuously at rate 3.7% per year. Assume that the share evolves according to a discrete time LogNormal process with time measured in years, drift µ = 0.15 and volatility o = 0.24. You decide to buy a European call option with a strike price of £63 and an expiration date of two years from now. What is the no-arbitrage price for this option? State your answer to the nearest pence. Do not enter the pound sign.arrow_forward

- The share price of your favourite company is currently traded at a price of £60 and interest is compounded continuously at rate 3.7% per year. Assume that the share evolves according to a discrete time LogNormal process with time measured in years, drift μ= 0.15 and volatility o = 0.24. You decide to buy a European call option with a strike price of £63 and an expiration date of two years from now. What is the no- arbitrage price for this option? State your answer to the nearest pence. Do not enter the pound sign.arrow_forwardSuppose that shares of FC Inc. are trading at $100. Consider an American put option withstrike price 110. The option matures two periods from now and it pays no dividends. The price can go upby 15% or down by 10% in each period. What is the price of the option today? The risk-free rate is 7%.arrow_forwardThe share price of Heavy Metal (HM) changes only once a month: Either it goes up by 22% or it falls by 18.5%. Its price now is $48.7. The interest rate is 0.9% per month. What is the value of a one-month call option with an exercise price of $48.7?arrow_forward

- The share price of your favourite company is currently traded at a price of £80 and interest is compounded continuously at rate 3.7% per year. Assume that the share evolves according to a discrete time LogNormal process with time measured in years, 0.15 and volatility o = 0.24 drift µ . You decide to buy a European call option with a strike price of £84 and an expiration date of two years from now. What is the no-arbitrage price for this option? State your answer to the nearest pence. Do not enter the pound sign. =arrow_forwardSuppose that a stock price is currently 35 dollars, and it is known that four months from now, the price will be either 51 dollars or 29 dollars. Find the value of a European call option on the stock that expires four months from now, and has a strike price of 39 dollars. Assume that no arbitrage opportunities exist and a risk-free interest rate of 10 percent.Answer =dollars.arrow_forwardXYZ Corporation will pay a $2 per share dividend in two months. Its stock price currently is $80 per share. A European call option on XYZ has an exercise price of $75 and 3-month time to expiration. The risk-free interest rate is 0.95% per month, and the stock's volatility (standard deviation) - 18 % per month. Find the Black-Scholes value of the option. (Hint: Try defining one "period" as a month, rather than as a year, and think about the net-of-dividend value of each share.) Note: Round your answer to 2 decimal places. Black-Scholes value of the optionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education