Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

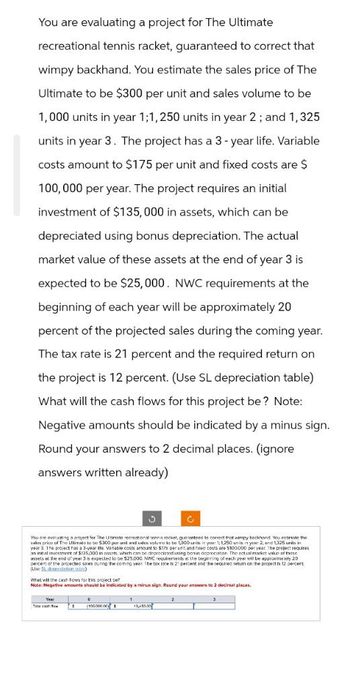

Transcribed Image Text:You are evaluating a project for The Ultimate

recreational tennis racket, guaranteed to correct that

wimpy backhand. You estimate the sales price of The

Ultimate to be $300 per unit and sales volume to be

1,000 units in year 1;1,250 units in year 2; and 1,325

units in year 3. The project has a 3-year life. Variable

costs amount to $175 per unit and fixed costs are $

100,000 per year. The project requires an initial

investment of $135,000 in assets, which can be

depreciated using bonus depreciation. The actual

market value of these assets at the end of year 3 is

expected to be $25,000. NWC requirements at the

beginning of each year will be approximately 20

percent of the projected sales during the coming year.

The tax rate is 21 percent and the required return on

the project is 12 percent. (Use SL depreciation table)

What will the cash flows for this project be? Note:

Negative amounts should be indicated by a minus sign.

Round your answers to 2 decimal places. (ignore

answers written already)

You are evaluating a project for The Unmate recreational tennis racket, guaranteed to correct that wimpy beckhand. You essmate the

sales price of The Utimato to be 5300 par unt and sudes volumes to be 1,000 units in your 1; 1,250 units in yur 2; and 1,325 units in

year 3. The project has a 3-year the variable costs amount to 5175 per unit and fixed costs are $100,000 per year. The project requires

an inntal investment of $135,000 in ass which can be depreciated using bonus deprecation. The actual market value of these

assels at the end of year 3 is expected to be $25,000. NWC requirements at the beginning of each year will be approximely 20

percent of the projected sores during the coming year. The tax rate is 21 percent and the required return on the project is 12 percent.

(Use S1 downtiation inc)

Whet will the cash tows for this project be?

Note: Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.

1

2

(1000000)

13,450.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the sales price of The Ultimate to be $440 per unit and sales volume to be 1,000 units in year 1; 1,250 units in year 2; and 1,325 units in year 3. The project has a 3-year life. Variable costs amount to $245 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $177,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $39,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 11 percent. (Use SL depreciation table) What will the cash flows for this project be?arrow_forwardYou are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the sales price of The Ultimate to be $400 per unit and the sales volume to be 1,000 units in year 1; 1,250 units in year 2; and 1,325 units in year 3. The project has a three-year life. Variable costs amount to $225 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $165,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the beginning of year 3 is expected to be $35,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. What will the cash flows for this project be? What are the NPV and IRR? Given 10 percent cost of capital would you recommend this project?arrow_forwardYou are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the sales price of The Ultimate to be $400 per unit and sales volume to be 1,000 units in year 1; 1,250 units in year 2; and 1,325 units in year 3. The project has a three-year life. Variable costs amount to $225 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $165,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $35,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. (Use SL depreciation table) What will the cash flows for this project be? Total Cash Flow Year 0: Total Cash Flow Year 1: Total Cash Flow Year 2: Total Cash Flow Year 3:arrow_forward

- You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the sales price of The Ultimate to be $400 per unit and sales volume to be 1,000 units in year 1; 1,250 units in year 2; and 1,325 units in year 3. The project has a three-year life. Variable costs amount to $225 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $165,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $35,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. What will the cash flows for this project be?arrow_forwardYou are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the sales price of The Ultimate to be $400 per unit and sales volume to be 1,000 units in year 1; 1,250 units in year 2; and 1,325 units in year 3. The project has a three-year life. Variable costs amount to $225 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $165,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $35,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. (Use SL depreciation table) What will the cash flows for this project be? Note: Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.arrow_forwardYou are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the sales price of The Ultimate to be $400 per unit and sales volume to be 1,000 units in year 1, 1,250 units in year 2, and 1,325 units in year 3. The project has a three-year life. Variable costs amount to $225 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $165,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $35,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent (Use SL depreciation table) What will the cash flows for this project be? Note: Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places. Year Total cash flow 0…arrow_forward

- You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the sales price of The Ultimate to be $300 per unit and sales volume to be 1,000 units in year 1, 1,250 units in year 2, and 1,325 units in year 3. The project has a three-year life. Variable costs amount to $200 per unit and fixed costs are $50,000 per year. The project requires an initial investment of $150,000 in assets that will be depreciated straight-line to zero over the three-year project life. The actual market value of these assets at the end of year 3 is expected to be $25,000. NWC requirements at the beginning of each year will be approximately 10 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. What will the free cash flow for this project be in year 2? Multiple Choice О $107,250 $102,450 $53,000 $49,950arrow_forwardYou are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $470 per unit and sales volume to be 1,200 units in year 1; 1,125 units in year 2; and 1,000 units in year 3. The project has a 3-year life. Variable costs amount to $260 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $144,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $28,000. NWC requirements at the beginning of each year will be approximately 30 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 12 percent. What is the operating cash flow for the project in year 2? Note: Enter your answer as a whole number. Operating cash flow Marrow_forwardYou are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $490 per unit and sales volume to be 1,200 units in year 1; 1,125 units in year 2; and 1,000 units In year 3. The project has a 3-year life. Variable costs amount to $270 per unit and fixed costs are $100,000 per year. The project requires an initial Investment of $138,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $26,000. NWC requirements at the beginning of each year will be approximately 30 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 11 percent. What change in NWC occurs at the end of year 1? (Enter a decrease as a negative amount using a minus sign.) Decrease ofarrow_forward

- You are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $450 per unit and sales volume to be 1,200 units in year 1; 1,325 units in year 2; and 1,000 units in year 3. The project has a 3-year life. Variable costs amount to $250 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $150,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $30,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent.What change in NWC occurs at the end of year 1? (Enter a decrease as a negative amount using a minus sign.)arrow_forwardYou are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $400 per unit and sales volume to be 1,000 units in year 1; 1,500 units in year 2; and 1,325 units in year 3. The project has a 3-year life. Variable costs amount to $225 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $165,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $35,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. What change in NWC occurs at the end of year 1?arrow_forwardYou are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $400 per unit and sales volume to be 1,000 units in year 1; 1,500 units in year 2; and 1,325 units in year 3. The project has a 3-year life. Variable costs amount to $225 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $165,000 in assets, which will be depreciated straight-line to zero over the three-year project life. The actual market value of these assets at the end of year 3 is expected to be $35,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. What is the operating cash flow for the project in year 2? (Enter your answer as a whole number.) Operating cash flow $ 207,735arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College