FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

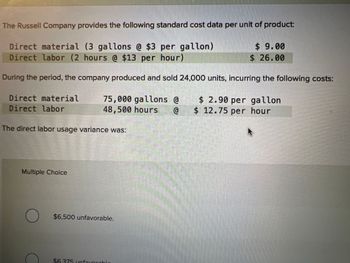

Transcribed Image Text:**The Russell Company Standard Cost Data**

The Russell Company provides the following standard cost data per unit of product:

- **Direct Material:** 3 gallons at $3 per gallon = $9.00

- **Direct Labor:** 2 hours at $13 per hour = $26.00

During the period, the company produced and sold 24,000 units, incurring the following actual costs:

- **Direct Material:** 75,000 gallons at $2.90 per gallon

- **Direct Labor:** 48,500 hours at $12.75 per hour

**The direct labor usage variance was:**

- Multiple Choice:

- $6,500 unfavorable.

- $6,375 unfavorable.

This section includes a cost variance analysis with a focus on direct labor usage, requiring a calculation of how actual costs compare to standard costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 4 pounds at $9.00 per pound Direct labor: 3 hours at $15 per hour Variable overhead: 3 hours at $6 per hour Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Advertising Sales salaries and commissions Shipping expenses Fixed Cost per Month $36.00 45.00 18.00 $99.00 $ 210,000 $ 120,000 Variable manufacturing overhead cost Variable Cost per Unit Sold $ 13.00 $ 4.00 The planning budget for March was based on producing and selling 26,000 units. However, during March the company actually produced and sold 31,000 units and incurred the following costs: a. Purchased 155,000 pounds of raw materials at a cost of $7.20 per pound. All of this material was used in production. b. Direct-laborers worked 56,000 hours at a rate of $16.00…arrow_forwardThe controller of Sheridan Industries has collected the following monthly cost data for use in analyzing the behavior of maintenance costs. Month Total Maintenance Costs Total Machine Hours January $2,930 350 February 3,230 400 March 3,830 550 April 4,730 640 May 3,430 550 June 5,730 750 Determine the unit variable costs using the high-low method for this mixed cost. (Round answer to 2 decimal places e.g. 2.25.) Variable cost per machine hour eTextbook and Media Determine the fixed costs using the high-low method for this mixed cost.arrow_forwardPreble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: $ 55.00 Direct material: 5 pounds at $11.00 per pound Direct labor: 3 hours at $12 per hour Variable overhead: 3 hours at $7 per hour 36.00 21.00 Total standard variable cost per unit $112.00 The company also established the following cost formulas for its selling expenses: Fixed Cost Variable Cost per Month $ 280,000 $ 260,000 per Unit Sold Advertising Sales salaries and commissions $ 20.00 $ 11.00 Shipping expenses The planning budget for March was based on producing and selling 21,000 units. However, during March the company actually produced and sold 26,600 units and incurred the following costs: a. Purchased 154,000 pounds of raw materials at a cost of $9.50 per pound. All of this material was used in production. b. Direct-laborers worked 63,000 hours at a rate of $13.00 per hour. c. Total variable…arrow_forward

- Rose Company has a relevant range of production between 10,000 and 25,000 units. The following cost data represents average cost per unit for 15,000 units of production. Average Cost per Unit Direct materials $12 Direct labor 10 Indirect materials 2 Fixed manufacturing overhead 4 Variable manufacturing overhead 3 Fixed selling and administrative expenses 8 Variable sales commissions 25 Using this cost data from Rose Company, answer the following questions. Cost A. If 10,000 units are produced, what is the variable cost per unit? B. If 18,000 units are produced, what is the variable cost per unit? C. If 21,000 units are produced, what are the total variable costs? D. If 11,000 units are produced, what are the total variable costs? E. If 19,000 units are produced, what are the total manufacturing overhead costs…arrow_forwardAssume that the cost formula for one of a company’s mixed expenses is $10,000 + $3.80 per unit. The company’s planned level of activity was 2,000 units and its actual level of activity was 2,200 units. The actual amount of this expense was $18,200. The activity variance for this expense is:arrow_forwardThe standard costs and actual costs for factory overhead for the manufacture of 2,800 units of actual production are as follows: Line Item DescriptionValueFixed overhead (based on 10,000 hours)3 hours per unit at $0.71 per hourVariable overhead3 hours per unit at $1.98 per hour Actual Costs Total variable cost, $18,200 Total fixed cost, $8,200 The fixed factory overhead volume variance is Group of answer choices $1,136 unfavorable $909 unfavorable $909 favorable $0arrow_forward

- The standard costs and actual costs for factory overhead for the manufacture of 2,500 units of actual production are as follows: Standard Costs 3 hours per unit at $0.71 per hour 3 hours per unit at $1.92 per hour Fixed overhead (based on 10,000 hours) Variable overhead Actual Costs Total variable cost, $18,200 Total fixed cost, $8,100 The variable factory overhead controllable variance is Oa. $3,800 unfavorable Ob. $3,800 favorable Oc. $3,040 favorable Od. Soarrow_forwardPreble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 4 pounds at $9.00 per pound $ 36.00 Direct labor: 3 hours at $12 per hour 36.00 Variable overhead: 3 hours at $8 per hour 24.00 Total standard variable cost per unit $ 96.00 The company also established the following cost formulas for its selling expenses: Fixed Cost per Month Variable Cost per Unit Sold Advertising $ 230,000 Sales salaries and commissions $ 160,000 $ 15.00 Shipping expenses $ 6.00 The planning budget for March was based on producing and selling 28,000 units. However, during March the company actually produced and sold 33,000 units and incurred the following costs: Purchased 165,000 pounds of raw materials at a cost of $7.20 per pound. All of this material was used in production. Direct-laborers worked 58,000 hours at a rate of…arrow_forwardPreble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: $40.00 Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour 12.00 Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Variable Cost, per Unit Sold Fixed Cost per Month $ 270,000 $ 240,000 Advertising $19.00 Shipping expenses The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production. b. Direct-laborers worked 62,000 hours at a rate of $1700 per hour c. Total variable manufacturing overhead for the month was $390,600. d. Total…arrow_forward

- Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 5 pounds at $8.00 per pound $ 40.00 Direct labor: 2 hours at $14 per hour 28.00 Variable overhead: 2 hours at $5 per hour 10.00 Total standard variable cost per unit $ 78.00 The company also established the following cost formulas for its selling expenses: Fixed Cost per Month Variable Cost per Unit Sold Advertising $ 200,000 Sales salaries and commissions $ 100,000 $ 12.00 Shipping expenses $ 3.00 The planning budget for March was based on producing and selling 25,000 units. However, during March the company actually produced and sold 30,000 units and incurred the following costs: Purchased 160,000 pounds of raw materials at a cost of $7.50 per pound. All of this material was used in production. Direct-laborers worked 55,000 hours at a rate of…arrow_forwardKubin Company's relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as follows: Direct materials. Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost per Unit $7.00 $ 4.00 $ 1.50 $5.00 $ 3.50 $ 2.50 $ 1.00 $0.50 Required: 1. If 18,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 22,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 18,000 units are produced and sold, what is the total variable cost related to the units produced and sold? 4. If 22,000 units are produced and sold, what is the total variable cost related to the units produced and sold? 5. If 18,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 22,000 units are produced, what is the…arrow_forwardThe standard costs and actual costs for factory overhead for the manufacture of 2,700 units of actual production are as follows: Fixed overhead (based on 10,000 hours) Variable overhead Actual Costs Total variable cost, $17,800 Total fixed cost, $8,200 The total factory overhead cost variance is Oa. $1,600 unfavorable Ob. $2,930 favorable Oc. $2,930 unfavorable Od. $4,260 favorable Standard Costs 3 hours per unit at $0.70 per hour 3 hours per unit at $2.00 per hourarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education